Promoting financial accountability across the company is a smart move for a few reasons.

💰 Firstly, it’s about protecting the bottom line.

When everyone understands their role in managing finances responsibly, it helps avoid costly mistakes, careless spending, and possible legal or compliance disputes down the road.

Money saved is money earned, right?

🤝🏻 Secondly, it builds trust and transparency.

When everyone takes ownership of finances, it shows a combined investment in the company’s success. It also opens the door for better communication between other departments and finance, which helps improve collaboration too.

🛡️ Thirdly, it improves risk management.

Identifying financial issues early can stop them from snowballing into much larger problems. By encouraging accountability in finance, you’re also inspiring responsible spending, which helps everyone stay within budget.

Looking after the company’s money is a shared responsibility that needs diligence, transparency, and accountability from all levels of the organization.

Failure to maintain financial responsibility can lead to:

- Wasted resources

- Missed opportunities

- Compliance issues

- Financial blind spots

- Damaged reputation

The good news is that there are steps you can take to help build collective financial accountability across the company.

So, keep reading if you want to find out what they are and learn more about the importance of financial accountability.👇🏼

Read all about:

- What is financial accountability?

- Types of accountability

- Key principles to keep top of mind

- Tips to promote financial responsibility in business

What is meant by financial accountability?

Financial accountability is when everyone in the company takes responsibility for the money. It means using it wisely, following clear spending rules, and being open about how finances are managed. This builds trust, helps management make smart decisions, and keeps the company on track for long-term success.

However, accountability in finance goes beyond the people in the company itself. For example, Investopedia states that financial accountability, particularly in the U.S. includes:

"...a requirement that public corporations make accurate financial records available to all stakeholders".

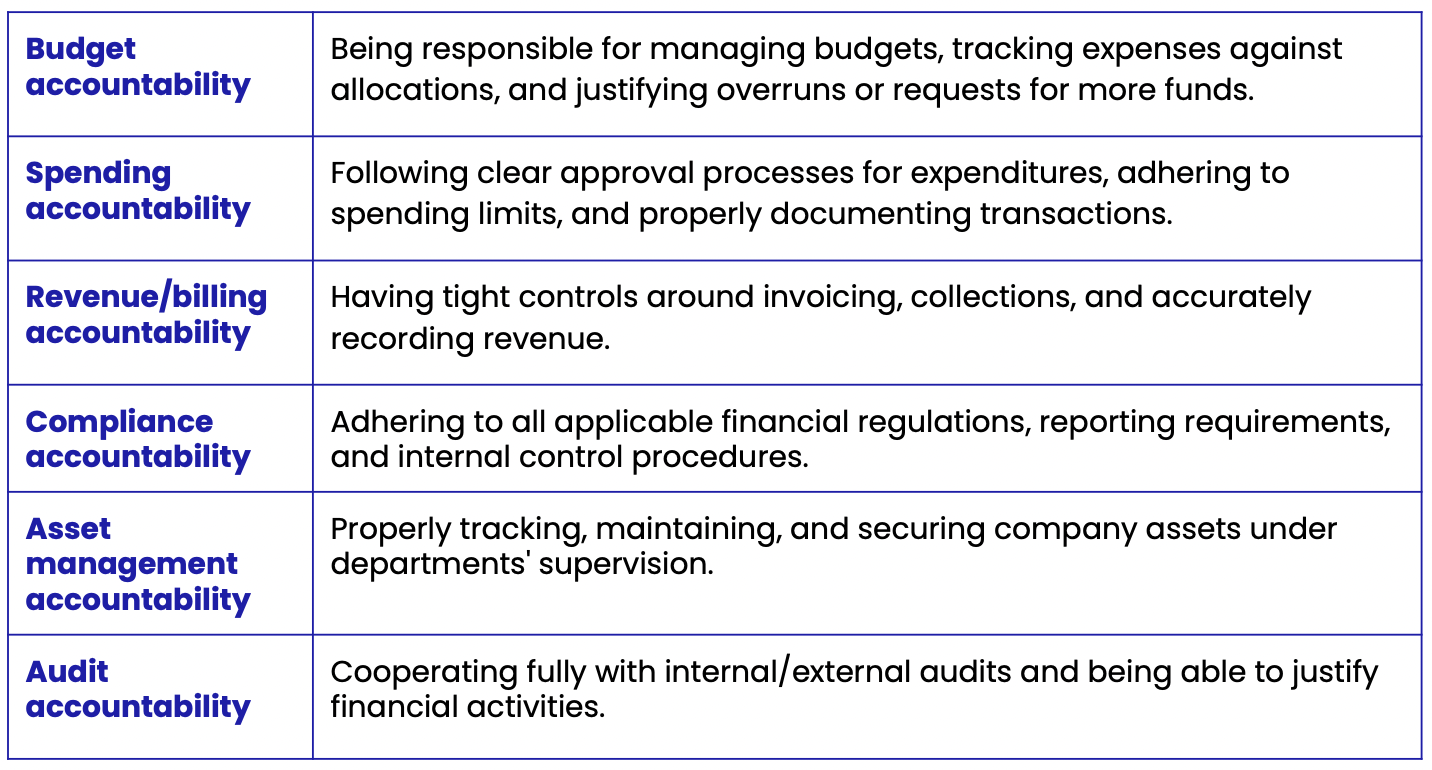

Types of accountability

While not always directly related to finance, here are the main 'types of accountability' when talking about the topic with a wider lens:

🏢 Corporate accountability: Companies are responsible to shareholders, workers, customers, and communities through ethical practices and proper financial management.

✊🏼 Political accountability: Politicians are answerable to the public for their decisions, spending, and conduct while in office.

⚖️ Government accountability: Government bodies operate with integrity, following rules, and acting in the best interests of citizens.

📱Media accountability: News outlets and journalists ensure accurate, fair, and ethical reporting that is fact-checked and independent.

When you zone in on types of accountability in finance in particular, you have to look at it in connection to areas like financial controls, audits, compliance, and more.

Let’s go over some of these financial accountability types (and what they involve) in more detail:

What are the principles of financial accountability?

1. Transparency

One of the most important principles of financial accountability is transparency, which means being open and making sure financial information (like activities, decisions, and performance) is visible and accessible.

2. Diligence

When you’re trying to build financial accountability in your company, you need to make sure you’ve clearly defined roles, policies, and processes that align financial duties and decision-making. To ensure resources are used properly, make sure everyone knows what they’re responsible for.

3. Accountability

Everyone, from individual employees to department heads and leadership, must be held responsible for their financial decisions and adherence to established policies.

4. Compliance

To guarantee accurate and legally compliant financial reporting, you need to make sure the company (and departments within it) follow all relevant financial regulations and accounting standards set for their region/location.

5. Risk management

Staying ahead of financial risks is key. So, keep a close eye on spending patterns and watch out for any areas of wasteful spending. It’s also a good idea to have backup plans ready for unexpected bumps in the road.

6. Performance measurement

Keeping tabs on important money numbers like profitability, growth, and how resources are being spent allows the company to see how it's progressing toward its financial goals and where it needs to make improvements.

5 ways to build a culture of financial accountability

1. Establish clear policies and procedures

The first of the accountability steps is to develop clear policies that outline things like expense management, procurement, and approval processes. Make sure the policies clearly define the where, how, and who:

- Where we can spend

- How we get what we want

- Who needs to approve

Create accessible procedures that are clear and transparent. The point is to reduce confusion and any ambiguity that might arise. By doing so, the rest of the company will have a much easier time following the guidelines properly (and avoid making financial mistakes).

2. Define your budget and budget ownership

Involve departments in setting realistic budgets and give them ownership over managing those budgets.

Budget ownership is a key strategy for promoting accountable finance and here’s why it works:

Shared responsibility = shared success.

When different departments (besides finance) are involved in defining realistic budgets, they take ownership of their financial performance. This creates a stronger sense of responsibility and even encourages cost-consciousness.

To do this right, you need to involve department heads and key personnel in the budgeting process. And take the bottom-up approach if you can. This way, departments will build their budgets from the ground up, detailing expenses and spotting possible cost-saving moves.

3. Build strong internal controls

It’s usually not a great idea to have one person in control of an entire process from start to finish. So, segregate duties to help prevent errors or even misuse of funds. Doing this will help improve internal controls and create a center for financial accountability.

Just like balancing your checkbook, regular reconciliations compare financial records with external statements (bank accounts, credit card statements, etc.). This is a great way to identify discrepancies sooner rather than later.

Another way to help implement strong internal controls is by building systematic review processes. These types of processes will be useful for things like requiring high-level approvals for large expenses.

Let’s look at an example of how this all might work in real life.

Say you want to build stronger controls after an incident of unauthorized spending led to a very expensive mistake. How would you tackle this situation and use it to improve existing internal controls?

Well, one way is to segregate who can create purchase orders from those who can receive inventory and approve invoices.

You could also think about reconciling open POs to receipts weekly, which would surface any discrepancies.

Finally, a spend management system that enforces approval rules and coding requirements would prevent future policy violations.

The key is implementing overlapping preventive and detective controls, while strategically automating aspects with technology. This embeds financial accountability into core processes.

4. Training and education

Not everyone ‘speaks finance.’ And, if you’ve been in finance for some time, you’ll know the truth of that statement more than anyone. So, a seemingly obvious but often overlooked strategy to build financial accountability is through training and education.

How’s how you can approach this:

First, identify any knowledge gaps within departments. Do marketing teams need a better understanding of cost analysis? Do sales understand the impact of discounts on profitability? Tailored training addresses specific needs and maximizes impact.

Next, you’ll need to take time to break down complex financial concepts into clear and understandable language. So, leave the jargon and niche finance terms out in the cold for now and try to make everything as accessible and relevant as possible.

Remember, everyone learns differently. A long, in-depth lecture might work for some people in your company but it might send others into a sleep-like state.

Don’t be afraid to mix things up and leverage things like workshops, online courses, and simulations to help engage employees better. Lastly, it’s important to understand that this will be an ongoing thing. Continuous learning is key for building fiscal accountability and making it stick.

5. Align goals and reward success

Let’s end on a positive note and talk about how you can motivate the team into action with reward-based incentives.🥇

By aligning performance metrics with incentives, you can create a powerful system that motivates departments to actively participate in accountable finance.

When achieving financial goals becomes a shared objective with tangible rewards, it strengthens teamwork, drives performance, and fuels the company's success.

Here’s how it works:

- Define key performance indicators (KPIs) that are specific, measurable, achievable, relevant, and time-bound (SMART).

- Don't create departmental silos. Make sure that each department's KPIs directly tie back to and support the company's broader financial goals.

- Develop incentive programs that reward teams and individuals for achieving financial targets while maintaining compliance.

FAQs: Financial accountability in business

What is an example of accountability in finance?

An example of accountability in finance is having a clear approval process for expenditures, where team members are responsible for making purchases have defined spending limits and must provide proper documentation for each transaction.

How to ensure financial accountability?

To ensure financial accountability, companies should implement strong internal controls, performance metrics aligned with incentives, segregation of duties, regular audits, and mechanisms for reporting and addressing issues.

What are four types of accountability?

Four types of accountability are corporate accountability, political accountability, government accountability, and media accountability.

What is the first stage of financial accountability?

The first stage of financial accountability is establishing clear policies, processes, and guidelines that define financial roles, responsibilities, and appropriate practices within the organization.

What are the benefits of financial responsibility across a company?

Benefits include protecting the organization's assets, mitigating risks, eliminating wasteful spending, driving performance through disciplined planning, and promoting ethical financial management.

Who is responsible for financial accountability?

Financial accountability is a shared responsibility across all levels of an organization, from individual contributors to department heads to executive leadership and the board of directors.

What are the consequences of lacking accountability for finances within a company?

Lack of financial accountability can lead to consequences such as misuse of funds, compliance violations, financial losses, erosion of stakeholder trust, legal risks, and potential reputational damage to the organization.

Want to optimize your processes even further?

Our Pro Membership offers a unified source of trustworthy value for finance professionals to gain new knowledge and access templates and tools to help you optimise your daily activities and skyrocket your finance career to new heights.

This membership plan helps you to gain access to the most recent resources, and a supportive community of peers who share your passion for achievement.

Learn more about our Pro Membership here.