Want to choose the best FP&A tools for your business but don’t know where to start? This guide breaks down the top tools tailored to your needs.

We’ve carefully curated a list of the top FP&A software tools featured in our Finance Tools of Choice report, each scrutinized for its features, usability, and impact.

So, whether you're a start-up on the brink of expansion or a well-established corporation refining its financial strategies, our guide aims to direct you to the FP&A solution that resonates with your business narrative.

Read on to discover the best FP&A tools to empower your financial planning.

Table of contents

- What is an FP&A tool?

- What is the market size of FP&A software?

- What should I look for in FP&A software?

- Best FP&A tools

- Best FP&A software for startups

- Best FP&A AI tools

What is FP&A software?

An FP&A tool is a software solution to optimize financial planning, forecasting, and budgeting processes.

FP&A software vendors often provide vital insights into financial performance, helping companies plan future actions, allocate resources efficiently, and make informed strategic decisions.

These tools typically offer data visualization, scenario modeling, real-time analytics, and integration with other business systems, enabling a comprehensive view of a company's financial health.

What is the market size of FP&A software?

The global market size for FP&A software is experiencing steady growth, driven by increasing demand for more sophisticated financial analysis tools and the adoption of cloud-based solutions.

The exact market size can vary based on different market research reports, but there's a consensus on its continuous expansion. For reference, the global financial management software market is expected to be valued at $24.4 billion by 2026, according to Gartner's forecast.

This growth is fueled by factors like digital transformation in finance, the need for more agile and accurate forecasting in a volatile business environment, and the growing complexity of financial operations in companies of all sizes.

In 2023, the Financial Planning Software market was predominantly led by cloud-based and on-premise product types, that together held the largest market share in this sector.

What should I look for in FP&A software?

When selecting FP&A tools and software, consider the following key factors:

- Functionality: Ensure the tool meets your specific financial planning, analysis, and reporting needs. Look for features like budgeting, forecasting, financial modeling, and scenario analysis.

- Integration: The software should seamlessly integrate with your existing systems (like ERP, CRM, etc.) to ensure smooth data flow and unified operations.

- Usability: User-friendly interface and ease of use are crucial for efficient operation and adoption by your team.

- Scalability: Choose a tool that can grow with your business, accommodating increased data volume and more complex operations.

- Customization: The ability to customize reports, dashboards, and models to fit your unique business requirements.

- Security: Robust security features are essential to protect sensitive financial data.

- Support and training: Look for vendors that offer reliable customer support and training resources to help your team make the most of the software.

- Cost-effectiveness: Consider the total cost of ownership, including licensing, implementation, and maintenance fees, against the expected ROI.

- Compliance: Ensure the tool complies with relevant financial regulations and reporting standards.

- Cloud vs. on-premise: Decide whether a cloud-based solution (with its accessibility and lower upfront costs) or an on-premise solution (offering more control) is more suitable for your needs.

Best FP&A tools

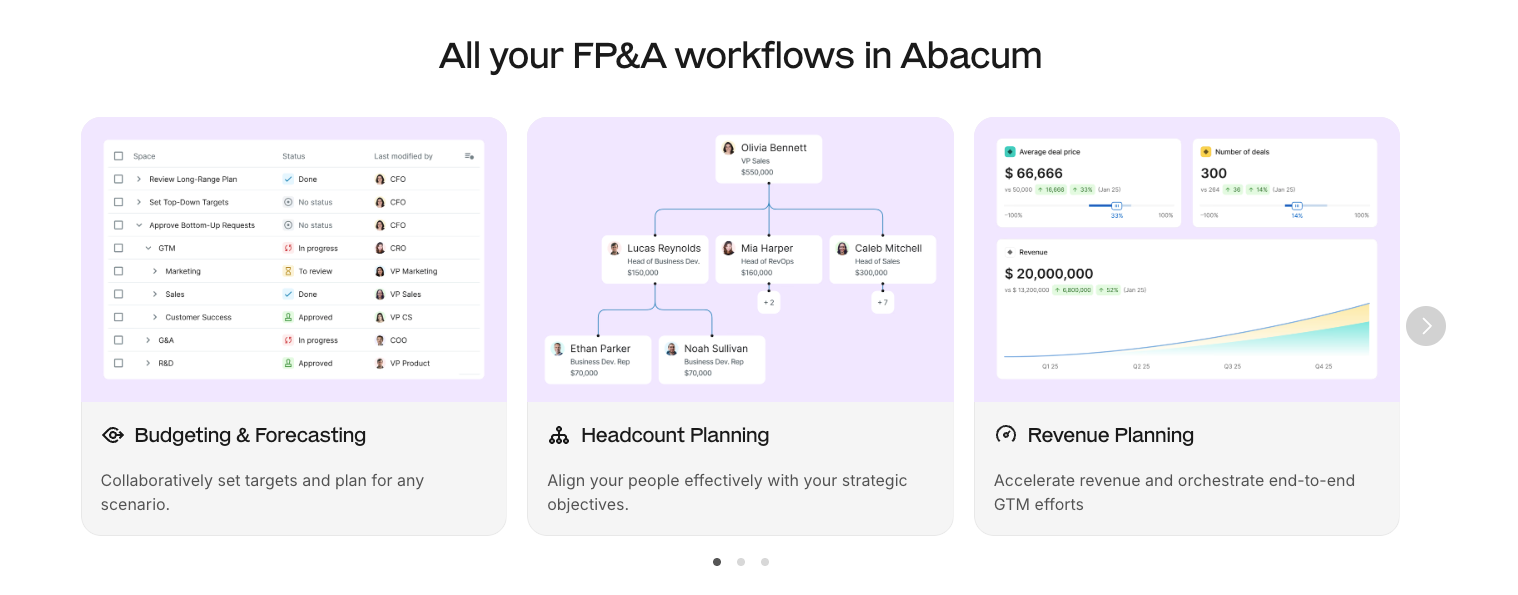

Abacum

Abacum is the AI-native FP&A platform that helps finance teams plan smarter, move faster, and make confident decisions.

By embedding intelligence directly into core workflows, like data consolidation, forecasting, scenario planning and reporting, Abacum transforms financial planning from a manual, time-consuming process into a strategic advantage.

OneStream

This intelligent performance management platform, recognized for its integration of FP&A systems and processes, was highly appraised by our respondents for its ability to unify finance processes and streamline financial reporting.

With OneStream, you can plan and report faster by unifying finance processes to help deliver actionable financial signals, forecasts, and analytics across the enterprise.

SAP ERP

Efficiency in business operations is only as good as the integrative software supporting it. SAP ERP stands tall in this regard, offering end-to-end solutions for logistics, financials, and human resources.

Renowned globally, it's an enterprise-centric solution that emphasizes process efficiency, data- driven insights, and scalable operations.

Embracing SAP ERP translates to a synchronized business environment, where every function moves in harmony, powered by real-time data and analytics. You can also integrate this software with other products including SAP Analytics Cloud.

Anaplan

With its Connected Planning Platform, Anaplan empowers businesses to develop robust financial forecasts in real-time. Its model-building capabilities, combined with granular data analysis, allow for in-depth scenario planning.

The platform is designed to adapt quickly, helping finance teams respond proactively to ever-changing business conditions.

Planful

Planful offers a continuous planning platform that merges financial forecasting, budgeting, and reporting, positioning it as a leading provider of FP&A solutions.

Its cloud-based design ensures finance teams always have access to up-to-date data, enabling more agile and accurate forecasting. With its scenario modeling, businesses can better navigate uncertainties and stay ahead of market shifts.

Jedox

Jedox provides an integrated solution for FP&A planning tools, encompassing planning, analytics, forecasting, and reporting. Its unified platform creates financial forecasts that are built on consistent and accurate data.

Jedox is one of the most adaptable planning and performance management platforms available, allowing you to integrate data from any source, model any attribute, and create any set of business logic rules to create accurate financial forecasts for your business.

Sage Intacct

One of the most popular choices for financial reporting is Sage Intacct.

Our participants noted its seamless integration with other tools, making it ideal for things like billing, general ledgers, cash management, order management, and of course, financial reporting.

With its modular design, businesses can easily scale and adapt the software to their evolving needs. Its multidimensional data model allows for intricate financial analyses, making reporting more granular and insightful.

Oracle NetSuite

Oracle NetSuite offers seamless integration of accounting, financial planning, and complex reporting functionalities.

Its intuitive interface, real-time data analytics, and customizable dashboards provide finance teams with the tools necessary to draw actionable insights, ensuring accurate and timely decision-making.

As a part of Oracle's suite of products, NetSuite promises reliability, scalability, and a commitment to keeping pace with the ever-evolving demands of modern finance.

Best FP&A software for startups

Float

Float is one of the best FP&A tools for startups, focusing on cash flow forecasting and management. Its user-friendly interface allows for easy tracking and forecasting of cash flow, giving startups a clear view of their financial health.

The tool integrates with popular accounting software like QuickBooks and Xero, ensuring real-time financial data synchronization.

Float's strength lies in its ability to provide straightforward yet detailed cash flow insights, which are crucial for startups managing their financial growth strategically.

Fathom

If you're looking for FP&A software for small businesses or startups, Fathom is an excellent choice. It's an intuitive and comprehensive financial analysis and reporting tool.

It offers an array of features like profitability analysis, trend tracking, and KPI monitoring.

Fathom stands out for its ability to translate complex financial data into visual reports and dashboards, making it easier for startups to make data-driven decisions.

Its seamless integration with accounting software simplifies the process of financial reporting, ideal for startups needing to maintain focus on their core business activities.

Spotlight Reporting

Spotlight Reporting is tailored for startups that require versatile financial planning and analysis software for reporting, forecasting, and budgeting.

The platform offers in-depth financial reports, full-spectrum forecasting, and interactive dashboards, making it a comprehensive solution for startups aiming to keep a close eye on their financial performance.

One of its key features is the ability to create custom reports, which can be tailored to a startup’s specific needs, allowing for more focused financial insights and strategic planning.

Best FP&A AI tools

Microsoft Dynamics

Diving deep into business analytics and insights becomes seamless with Microsoft Dynamics. More than just an ERP, it integrates CRM capabilities with multi-currency financial management, supply chain, and analytics modules.

Its strength lies in the deep integration with other Microsoft tools and a cloud-centric approach, catering to businesses aiming for agility, foresight, and integrative growth.

For finance, Microsoft Dynamics allows you to adopt faster to avoid disruptions, work smarter, and drive better performance with automation.

OpenAI ChatGPT

OpenAI's ChatGPT has proved to be one of the best FP&A AI tools. Beyond just answering queries, it can assist in data extraction, summarizing financial reports, and providing insights into data and complex financial terminologies.

With ChatGPT, finance teams can streamline communications, get instant clarifications on financial matters, and even enhance customer-facing interactions, offering real-time responses to financial queries.

Microsoft Copilot

Finance isn't just about numbers; it's about making informed decisions based on those numbers.

Microsoft Copilot combines the power of large language models (LLMs) with your data and is designed to alleviate the burden of mundane tasks, enabling users to focus on more fulfilling and creative aspects of their work.

This tool can be integrated seamlessly into Microsoft applications such as Word, Excel, PowerPoint, Outlook, and Teams.

Domo

Domo stands out as a business intelligence tool that amplifies the power of data across an organization. It promises to help you move from basic charts and graphs to data experiences that fuel real insights and action when it matters most.

With intuitive dashboards and robust integration capabilities, Domo ensures that professionals from various departments, including finance, can seamlessly connect and interpret vast datasets.

As a result, businesses can harness the potential of their data, identify trends, and optimize strategies for growth.

Common FAQs: FP&A tools

What is FP&A technology?

FP&A technology refers to the software and tools used in financial planning and analysis. These technologies automate and streamline various FP&A processes, such as budgeting, forecasting, reporting, and financial modeling. They often incorporate data analytics, visualization tools, and integration capabilities, enabling FP&A teams to derive insightful, data-driven decisions efficiently.

How big is the FP&A software market?

The FP&A software market is experiencing significant growth, driven by an increasing demand for sophisticated financial planning tools and cloud-based solutions. The exact market size can vary according to different market research reports, but the consensus is on its continuous expansion, reflecting the rising importance of agile and accurate financial planning in diverse business environments.

What does FP&A software do?

FP&A software facilitates a range of financial planning and analysis activities for businesses. Key functions include:

- Budgeting and forecasting: Assisting in the creation of detailed budgets and financial forecasts.

- Financial reporting: Generating comprehensive financial reports for internal and external stakeholders.

- Data analysis and visualization: Providing insights through data analysis and presenting them in an easily understandable format.

- Scenario planning: Allowing companies to evaluate different financial scenarios and their potential impacts.

- Integration with other systems: Seamlessly connecting with other business systems (like ERP and CRM) for real-time data synchronization and holistic analysis.

- Automating routine tasks: Reducing manual efforts in data entry and calculations, thereby increasing efficiency and accuracy.

Download our Finance Tools of Choice Report

The right FP&A tool is pivotal for your business’s financial health and growth. Whether you're a startup navigating the complexities of financial planning or an established enterprise looking to refine your strategies, the right FP&A software can make all the difference.

However, with so many options available, the decision-making process can be overwhelming. That's why we've compiled a comprehensive Finance Tools of Choice report.

By downloading our report, you'll gain access to an invaluable resource that breaks down the strengths and capabilities of various finance tools, tailored to meet different business needs and scales.

Let this report be your guide in selecting a tool that not only aligns with your business objectives but also empowers your financial planning and analysis processes.

Follow us on LinkedIn

Follow us on LinkedIn