As we all know, change management strategies are critical to the success of finance transformations. But what happens when you experience pushback against the idea of introducing new technology to the finance function?

It’s a tricky one because resistance to change can quickly undermine even the most thought-out plans. But with the right approach, you can effectively manage this resistance and bring your finance team into the modern age of digitalization and in this blog post, we’ll show you how.

Topics covered:

- Understanding the resistance to change

- Building a case for change

- Change management strategies

- Change management quotes

Understanding the resistance to change: Why change management strategies are so important

Resistance to change is a natural reaction to any major change and can come in many forms, including fear of the unknown, loss of control, or lack of trust in leadership.

Understanding the reasons behind the resistance and developing effective change management strategies is key to overcoming these obstacles and achieving the desired outcome.

So, let’s get into why so many are resistant to change, even if that change can have a positive impact.

Fear of the unknown

At the root of most resistance is a fear of the unknown. Not many people want to admit it, but stepping into the unknown can be terrifying. When you introduce new technologies that completely rewire traditional processes and systems, you should prepare and even expect some backlash from your team.

Try to be empathetic and understanding about where this backlash is coming from. People on your team may be worrying about how these new tools and software will impact their job security, their workload, and/or their daily routines. This fear can lead to feelings of anxiety and uncertainty, which can quickly turn into resistance.

Loss of control

Another common reason people resist change is a loss of control. When finance transformations change processes, systems, or technology, it can leave employees feeling like they no longer have control over their work. This can lead to a lack of motivation, low morale, and, ultimately, resistance to the new change you’re trying to implement.

Lack of trust in leadership

Don’t take it personally, but one of the most common reasons for resistance to change in the workplace often links to a lack of trust in leadership.

When employees don't believe that leadership has their best interests at heart or is transparent about the reasons for change, it can create a sense of distrust that can lead to resistance.

As a CFO, it's your responsibility to understand these reasons for resistance and to develop strategies to address them. By tackling the underlying concerns and fears of stakeholders, you can minimize resistance and promote a positive attitude toward change.

Building a case for change

Building a compelling case for change is one of the most critical steps in managing resistance to finance transformation. By addressing the concerns of stakeholders and clearly articulating the benefits of the transformation, you can create buy-in and minimize resistance.

So, how do we build a case for change that resonates with stakeholders and drives the finance transformation forward?

Here are a few key steps:

1. Clearly articulate the problem

Start by clearly defining the problem you want to solve. For your organization, this could be anything from dealing with inefficiencies in the current processes to improving financial reporting and overall transparency.

By articulating the problem you’re trying to solve with new tools and software, you’ll help stakeholders understand the need for change.

2. Highlight the benefits

“Be a vocal leader and supporter and emphasize the benefits of the changes.”

Next, focus on the benefits of the finance transformation. Be specific about how the transformation will improve existing processes, maximize efficiency, drive innovation, etc.

Make sure to highlight how these benefits will positively impact stakeholders, both individually and as a team.

3. Address concerns

At this stage, you’ll likely get some feedback from your team and/or other members of the organization. This could include concerns about job security, increased workload, or the need for additional training.

Make sure that you listen to feedback and don’t brush it under the rug. Instead, address these concerns head-on and help others see the positive aspects of the change.

4. Get buy-in from key stakeholders

“Use a strategic and collaborative approach and include all stakeholders in the decisions.”

Involve key stakeholders in the process of building the case for change. By including their insights and perspectives, you can increase their investment in the transformation and minimize resistance.

5 strategies for successful change management during finance transformation

To effectively manage resistance and drive positive change within the organization, CFOs must adopt a strategic approach that considers the needs of stakeholders and the business.

So, here are some of the best change management strategies to help you ensure the success of your finance transformation:

1. Make communication your top priority

Developing a clear and effective communication strategy that takes the needs and concerns of all stakeholders into consideration is so important.

So, make sure to involve the right people early in the change management process as this will help build buy-in and reduce overall resistance.

It’s also vital to keep stakeholders informed about the status of the finance transformation and always be open to their feedback.

2. Provide sufficient training and development

Providing training and development opportunities to help your team learn how to use new processes, technology, and/or systems is vital to the overall success of the transformation.

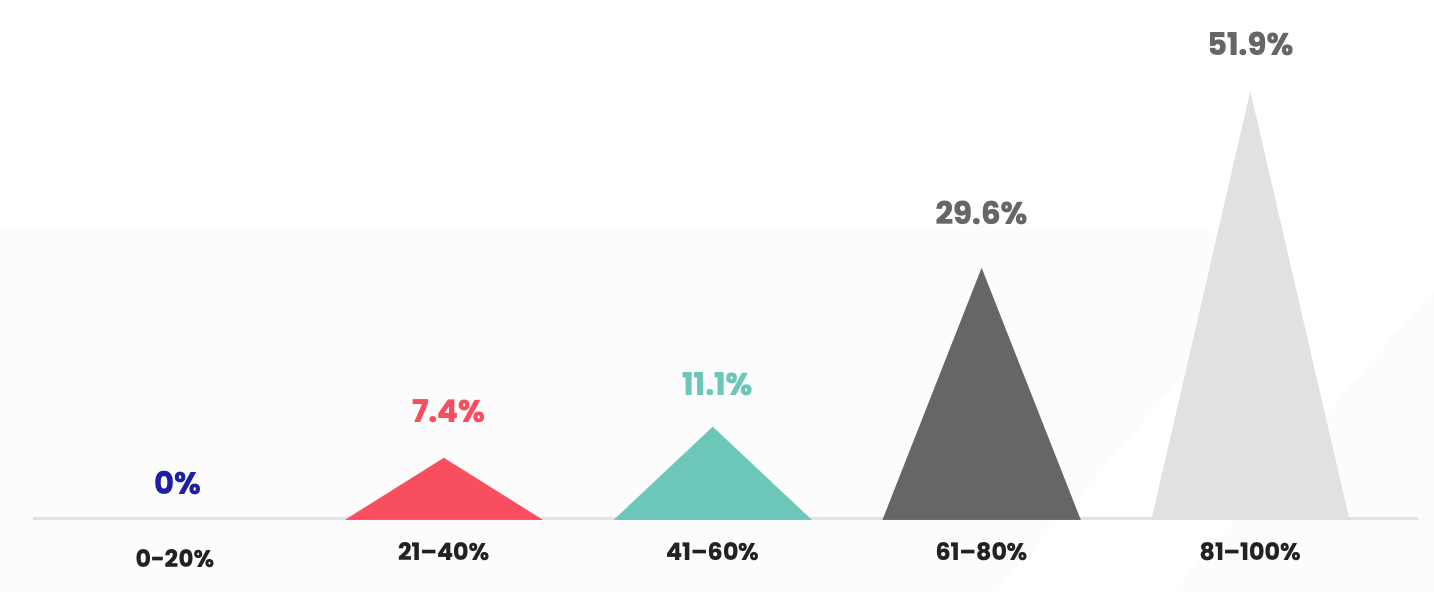

When we asked finance professionals to rate their confidence in their ability to adapt to new technologies as part of our State of Finance Transformation Report, 51.9% of respondents said they were between 81% to 100% confident.

On the other hand, 29.6% of respondents stating they were slightly less confident, rating their ability to adapt to new technologies as somewhere between 61% to 80%.

These insights tell us that finance professionals absolutely need sufficient training and development to help them adapt to change. So, make sure that you’ve provided both, and don’t expect everyone to just ‘get it’ straight off the bat.

3. Lead by example

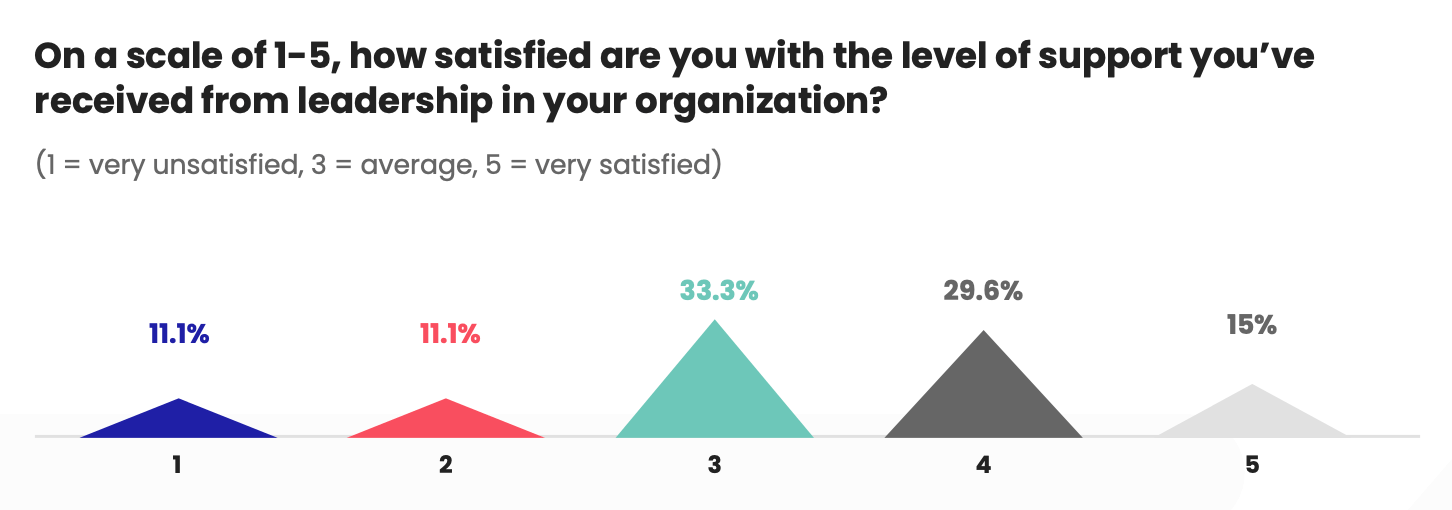

According to our finance transformation survey, 74.1% of respondents said that strong leadership is very important when delivering transformation successfully. Unfortunately, not everyone received the level of support from their leadership that they required to succeed.

In fact, 33.3% rated their level of leadership support as just average and a total of 44.6% said they were unsatisfied or very unsatisfied.

As a CFO, you must lead by example and demonstrate a positive attitude toward change. Your actions and attitudes will set the tone for the rest of the organization. Remember to set a positive example, demonstrate empathy, and encourage open and honest communication.

4. Engage your team and offer incentives

Offering incentives and recognition can be an effective way to manage resistance and promote positive attitudes toward change. This could include bonuses, promotions, or public recognition.

It’s also worth making a conscious effort to engage the finance team in the change process and involve them in decision-making to increase buy-in and reduce resistance.

5. Evaluate and adjust

One of the most important change management strategies comes into effect after the initial financial transformation has occurred.

Once new technologies are implemented, you’ve got to evaluate the progress of the finance transformation and adjust as needed. This will help ensure that the transformation stays on track and that resistance is managed effectively.

Change management quotes: Tips from finance leaders

Finance transformation impacts more than just an organization’s processes and systems, it also impacts the team. When plans for transformation fall apart, it’s often not because of the new technologies that were introduced, but because of the ways those changes were implemented.

Therefore, you must build an effective culture of change to help manage resistance and deliver change successfully.... but how?

Here are some change management quotes, including tips from respondents of our survey to help manage resistance and deliver change effectively:

“Change is inevitable and for the greater good. As a CFO, you must make continuous dialogue with teams to come up with ideas for digitalization, process automation, and risk control measures, etc., along with the benefits of adopting these changes. Engage the momentum by using the ‘‘walk the talk’ approach in implementing discussed changes and provide needful support to the team in adverse situations.” – anonymous respondent of the State of Finance Transformation Survey

“CFOs must lead this strategic imperative. Most employee surveys complain of inefficient processes and competing priorities. Finance transformation can address this and improve morale and support retention.

CFOs have the power to allocate resources to make this happen. A dedicated, expert team is key.” – anonymous respondent of the State of Finance Transformation Survey

“Change is difficult to implement because, inherently, human beings find it more comfortable not to change. We like control and change brings with it uncertainty which we don’t like.

“Finance teams often struggle with change as they try to tell people what is needed from the perspective of finance or what is “right”, and do not spend a lot of time answering the question the other person who is being impacted by the change is asking themselves....what’s in it for me? - Andrew Jepson, Partner (APAC) at The Finance Business Partner

“Showing the benefits that this transformation will bring to everyone, encouraging employees to specialize (which will develop their career), and proposing a growth perspective to employees who adhere to the changes.” - Paula Mota, FP&A Analyst at BRZ Insurance

a) Identify your key stakeholders

b) Identify their needs and requirements

c) Engage their “head, heart, and hands”

d) Track and measure progress

e) Have well-planned, consistent communications that go both ways - Brian Kalish, Principal, and Founder at Kalish Consulting

In conclusion, managing resistance to finance transformation requires a strategic approach that considers the needs of stakeholders and the business as a whole.

By following these strategies, CFOs can effectively manage resistance and drive change, ensuring the success of finance transformations.

Follow us on LinkedIn

Follow us on LinkedIn