Artificial intelligence (AI) is transforming the way we approach financial planning and analysis (FP&A).

Now, before you envision robots taking over your job, relax. That’s not happening! AI in FP&A won’t make you or your role obsolete. But it will help automate routine tasks and give you more time for strategic initiatives.

Keep reading to find out how.

Table of contents

- What is AI in FP&A?

- Benefits of embracing AI

- Common challenges

- Types of AI

- Best AI tools for finance

- Steps to implement AI in FP&A

- Why FP&A needs to embrace AI

- FAQs

What is AI in FP&A?

AI in FP&A involves using artificial intelligence to help better plan and analyze your company's finances.

AI can take over repetitive and mundane tasks, letting FP&A teams focus on providing key insights to help make smarter business decisions. Sure, automated software isn't exactly ground-breaking. But the latest AI can tackle those tasks even faster and with fewer errors than before.

The rise of user-friendly AI chatbots like ChatGPT, Google’s Gemini, and Microsoft’s Copilot have made AI easily accessible to pretty much anyone - including FP&A professionals. These chatbots can perform routine tasks like data retrieval and analysis very well. Not only that, but companies are even building specialized chatbots that are designed to aid finance teams with a multitude of tasks.

So, if you’ve been waiting to give AI a try, now might be a good time to reconsider.

On another note, Gartner’s research found that 64% of finance organizations using AI said it either ‘met or exceeded their expectations’. Some might say that’s strong evidence of AI’s potential to transform FP&A for the better!

Benefits of embracing AI for FP&A

1. Data-driven decisions, not guesses

AI unlocks hidden trends and relationships within financial data, providing valuable insights that would otherwise remain buried. These insights help companies make better-informed decisions backed by data, not just intuition.

2. Risk management on autopilot

AI can constantly scan your data for potential problems like risks or anomalies. This proactive approach helps you catch risks early and avoid big losses before they happen. Think of it as putting risk management on autopilot (kind of)!

3. Real-time scenario planning

AI in FP&A allows for dynamic scenario modeling, which means you can explore various possibilities and make informed choices based on simulated outcomes. This lets teams make faster decisions, uncover hidden opportunities, and avoid risks before they become problems.

4. Reduced human error

Manual data entry and calculations are prone to human error. AI in FP&A automates these processes and reduces the risk of errors that can skew financial analysis. This means your financial data is more accurate and you can trust it to make good decisions.

5. Efficient workflows

Statista’s 2024 survey found that nearly half (43%) of companies using AI in financial services saw a big boost in operational efficiencies. This isn’t surprising if you consider how AI tackles repetitive tasks like data entry with incredible speed.

Common AI challenges in FP&A

Thinking about using AI for your company's finances? There are some bumps you might encounter along the way, so it's good to be aware of them beforehand.

According to the Global AI Adoption Index, the top three barriers to AI adoption back in 2021 were:

- Limited AI expertise or knowledge (39%)

- Increasing data complexity and data silos (32%)

- Lack of tools or platforms for developing AI models (28%)

Some of these barriers remain true today. However, the most pressing challenge nowadays is related to concerns over data integrity and security.

FP&A teams deal with a lot of sensitive financial data and the last thing they want is a data breach. When FP&A uses AI to make forecasts and analyses, this data needs to be shared.

However, sharing data like this can make it a target for hackers or lead to accidental leaks. Companies need to be very careful about how they protect this data while still using AI.

Data integrity is another major concern when it comes to AI in FP&A. Data must be accurate and reliable but as the saying goes, ‘garbage in, garbage out’ and AI is only as good as the data it's fed.

Types of AI technologies & use cases in finance

There are lots of different types of AI technology specially designed for finance, each bringing something unique to the table.

Below, you'll find some more information about different forms of AI (as included in our AI in Finance eBook), along with some examples of how each technology is used in finance.

Best AI tools for finance and FP&A

The fusion of AI in FP&A and finance has been nothing short of transformative. AI is reshaping how financial professionals analyze data, identify patterns, and make predictions.

But what are the best AI tools for finance and FP&A?

Here are just a few options on offer:

OpenAI ChatGPT

OpenAI's ChatGPT, a conversational AI, can be a robust tool for finance professionals. Beyond just answering queries, it can assist in data extraction, summarizing financial reports, and providing insights into data and complex financial terminologies.

With ChatGPT, finance teams can streamline communications, get instant clarifications on financial matters, and even enhance customer-facing interactions, offering real-time responses to financial queries.

Microsoft Copilot

Finance isn't just about numbers; it's about making informed decisions based on those numbers. Microsoft Copilot combines the power of large language models (LLMs) with your data and is designed to alleviate the burden of mundane tasks, enabling users to focus on more fulfilling and creative aspects of their work. This tool can be integrated seamlessly into Microsoft applications such as Word, Excel, PowerPoint, Outlook, and Teams.

Booke.ai

Automation in bookkeeping is the future, and Booke.ai is leading the charge. This AI-driven platform simplifies the tedious task of financial record-keeping. This means reduced manual entry errors, faster reconciliation processes, and seamless integration with existing financial systems. By adopting Booke.ai, financial departments can ensure accuracy, save time, and focus on more strategic financial planning and analysis.

Nanonets

If you’d like to put a variety of finance and business processes on autopilot, Nanonet might be the ideal tool for you. Nanonets is an AI-driven platform specialized in automating data extraction from various document types.

Its machine-learning capabilities enable it to recognize and process patterns, making it invaluable for businesses inundated with paperwork. It simplifies tasks like invoice processing, receipt tracking, and financial document management. By leveraging this tool, you can accelerate your workflows, reduce manual errors, and ensure consistent data accuracy.

Domo

Domo stands out as a business intelligence tool that amplifies the power of data across an organization. It promises to help you move from basic charts and graphs to data experiences that fuel real insights and action when it matters most.

With intuitive dashboards and robust integration capabilities, Domo ensures that professionals from various departments, including finance, can seamlessly connect and interpret vast datasets. As a result, businesses can harness the potential of their data, identify trends, and optimize strategies for growth.

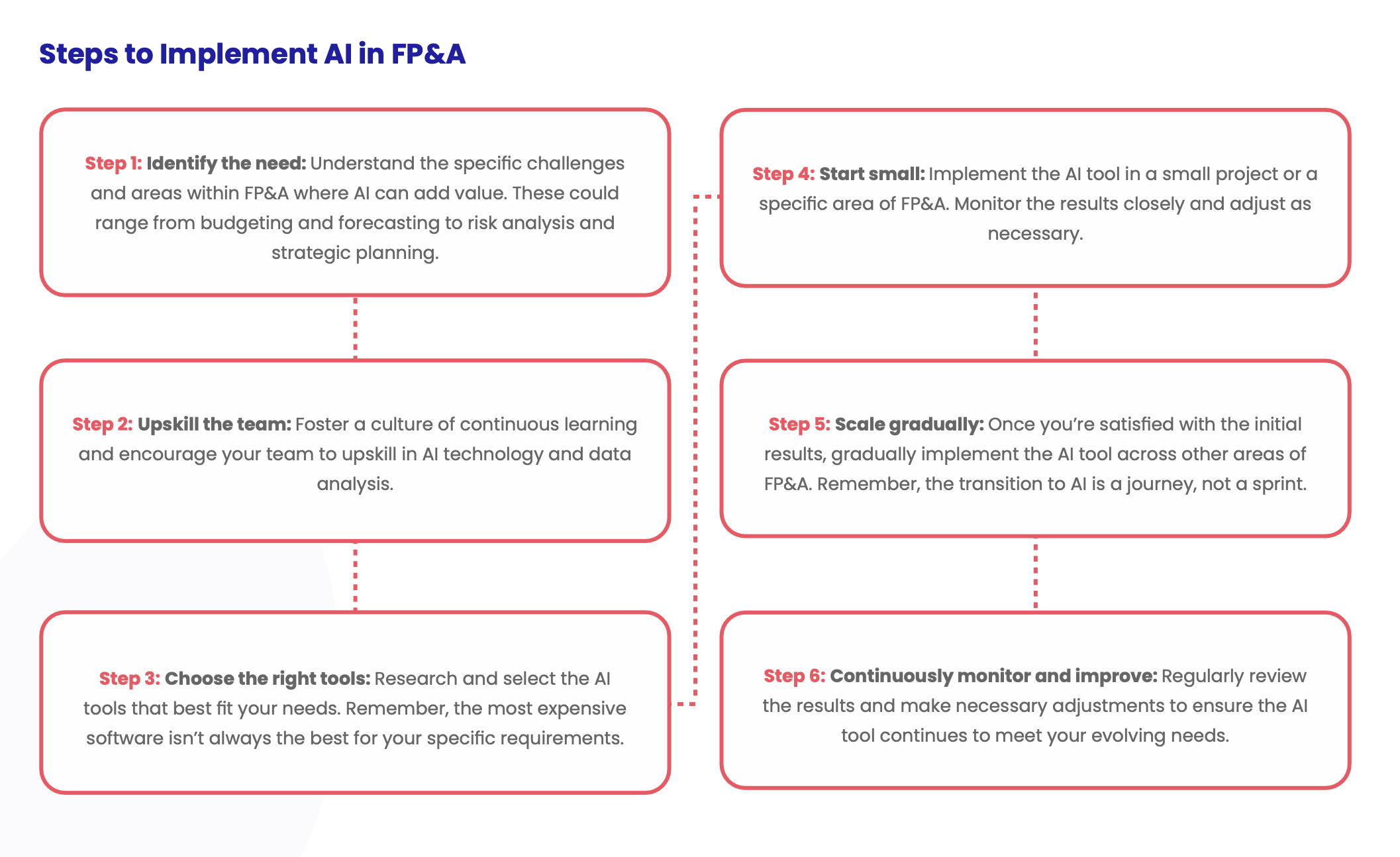

Steps to implement AI in FP&A: A visual

Why FP&A needs to embrace AI

A massive 61% of finance leaders haven't yet adopted AI, according to a recent survey from Gartner.

“Despite AI’s potential, most finance functions’ AI implementations have remained limited...

“As they begin to chart out a plan for how best to prioritize that additional investment, CFOs should partner with their finance leadership teams to compare their current progress against their peers’ and identify concrete recommendations from early adopters on how best to accelerate AI use in their function.” - Marco Steecker, Senior Principal in the Gartner Finance Practice.

While other departments like HR, IT, and legal, are embracing AI and reaping its benefits, FP&A teams seem to be lagging behind. But here's the good news: this presents a huge opportunity if you want to get ahead.

By embracing AI, you can transform your role and reduce time spent on mundane tasks. More importantly, AI in FP&A can help you become a strategic partner to the business, with the time and tools to unlock deeper insights and guide your company towards a profitable future.

FAQs

Will FP&A be replaced by AI?

No, AI is unlikely to completely replace FP&A. Instead, it will automate many of the routine and time-consuming tasks currently handled by FP&A professionals. This will free them up to focus on more strategic aspects of financial planning, like analysis, interpretation, and providing insights to leadership.

Will FP&A be automated?

Yes, a significant portion of FP&A tasks involving data collection, consolidation, and basic forecasting are being automated by AI. This will allow FP&A professionals to dedicate their time and expertise to higher-level activities.

How is AI used in financial planning?

AI is used in financial planning in several ways including automating tasks, advanced forecasting, risk management, and scenario planning.

Is AI coming for financial advisors?

Don’t worry, AI won't replace financial advisors, but it can augment their capabilities. AI-powered tools can help financial advisors personalize investment strategies, manage portfolios more efficiently, and provide clients with 24/7 access to basic information. However, the human touch will still be crucial for tasks requiring empathy, complex financial planning, and building trust with clients.

What skills do I need to succeed in an AI-powered FP&A world?

While technical skills related to AI tools are helpful, the soft skills remain essential. Critical thinking, communication, and the ability to translate complex data into actionable insights will be highly valued as AI handles the routine tasks.

FP&A Certified Core course

Join the ranks of elite financial professionals with our FP&A Certified Core course.

Designed for those aspiring to make a significant impact in their organizations, this course offers deep dives into financial modeling, forecasting, budgeting, reporting, and more.

As you progress, you’ll unlock the secrets to crafting compelling financial narratives that influence decision-making at the highest levels.

Start your journey to becoming a certified FP&A expert today and build the career you've always wanted.

Follow us on LinkedIn

Follow us on LinkedIn