Do you know what the biggest challenge is when it comes to budget timelines?

It’s that departments tend to wait right before the final deadline to share their inputs with the finance team. Usually, they do this because they prioritize their own tasks and budgeting can often get sidelined until the deadline looms closer.

But that leaves us in finance scrambling. We don’t have time to properly review or challenge their numbers, and it ends up squeezing the timeline for consolidating financials and tax work.

So, let’s talk about how to avoid this chaos. In this article, I’m going to walk you through the three key principles I’ve found invaluable when setting up budget timelines to prevent this and other issues.👇

1. Start early and plan ahead

First, you want to make sure to start early and plan ahead. You’ve got to give yourself (and everyone else) enough time for thorough planning and consideration. Ideally, start three to six months before the start of the next fiscal year. Of course, how early you need to start depends on the complexity of your business.

Large multinational companies tend to start in August and September, and the fiscal year ends by the end of December. But smaller companies can get the entire budgeting process done within one or two months as well.

The most important thing to remember is to plan early and make sure you have everything lined up so the process runs as smoothly as possible.

2. Set clear deadlines and milestones

Deadlines need to be firm—no wiggle room. Make sure everyone understands why they’re in place and gets onboard with sticking to them.

It’s a good idea to separate between initial submissions, revisions, and final approvals. Each of these should have a buffer because delays happen. Things can end up taking longer than you plan, no matter how well organized you are. So, adding a day or two here and there can save you from major stress down the road.

3. Involve key stakeholders early

Another crucial piece?

Involving key stakeholders early.

Their leadership is critical for setting realistic and achievable budget timelines. Ideally, ask people before you share it what they think about it and get their input before you share the budget timeline. Doing this helps to make the process more collaborative from the start.

Budget timeline: Getting inputs sooner

A common issue when it comes to budget timelines is that department heads share their inputs at the very last moment. Here's a way that I found helps significantly with addressing that issue and getting budget inputs sooner:

Implement a staggered timeline

Urgency drives prioritization. When people have a lot on their plate, they struggle with prioritizing the budget tasks so instead, they prioritize things according to the deadline.

It’s not a surprise, really, since deadlines create urgency and urgency is an important driver for prioritization. So, this is why I advise that you implement a staggered budget timeline.

A staggered budget timeline has multiple checkpoints. In other words, there are multiple times when you're asking for input rather than waiting until the very last moment. This makes the work more manageable because it's being completed progressively, rather than all at once.

Provide training and support

Sometimes, delays occur simply because people don't understand a part of the process, or they don't understand where to get their input from, etc., and you must clarify that information upfront.

The best process is to ask people to explain how they understood the process and the deadlines back to you. This will help you quickly identify where the gaps are in the understanding.

Regular reminders and check-ins

Regular reminders and check-ins are important throughout the budgeting timeline, especially as deadlines get closer.

Sometimes, people are concerned that sending a reminder a day before the deadline can be taken as annoying or too intrusive. But trust me - even senior leaders appreciate a nudge as a deadline approaches.

Use incentives and consequences

Incentives and consequences can help improve early or on-time submissions. On the other hand, it can also help to establish consequences for late submissions. However, consequences should be used sparingly because you risk damaging the relationship between two colleagues or departments.

An example of an appropriate consequence would be sharing what happens when you receive a late submission and what that means for the business as a whole. For example, one late submission could bring the entire budget process to a halt and lead to further delays down the road.

Leverage technology

Technology can be a lifesaver here. Budgeting software eliminates the hassle of emailing spreadsheets back and forth. With a centralized dashboard, people can enter their data, and you can see updates in real-time. That’s a huge time-saver and helps avoid errors and identify bottlenecks early in the process.

Involve senior management

As a last resort, if people are just completely ignoring your deadlines and missing them consistently, it might be time to involve senior management. With them involved, it can help reinforce the importance of adhering to the timeline.

Facilitate collaboration

There are also ways you can facilitate communication and make it easier for people to communicate. One specific way that you can do this is to set aside a specific time each week when people can drop in (or hop on a Zoom call) with questions. It’s amazing how much smoother things go when people feel they have an open line to you.

Build good relationships

At the end of the day, budget timelines run on trust. When people believe you have their best interests at heart and see that you’re an expert who knows what you’re doing, they’re more likely to invest their time and effort into the process.

Budget timeline: A real-world example

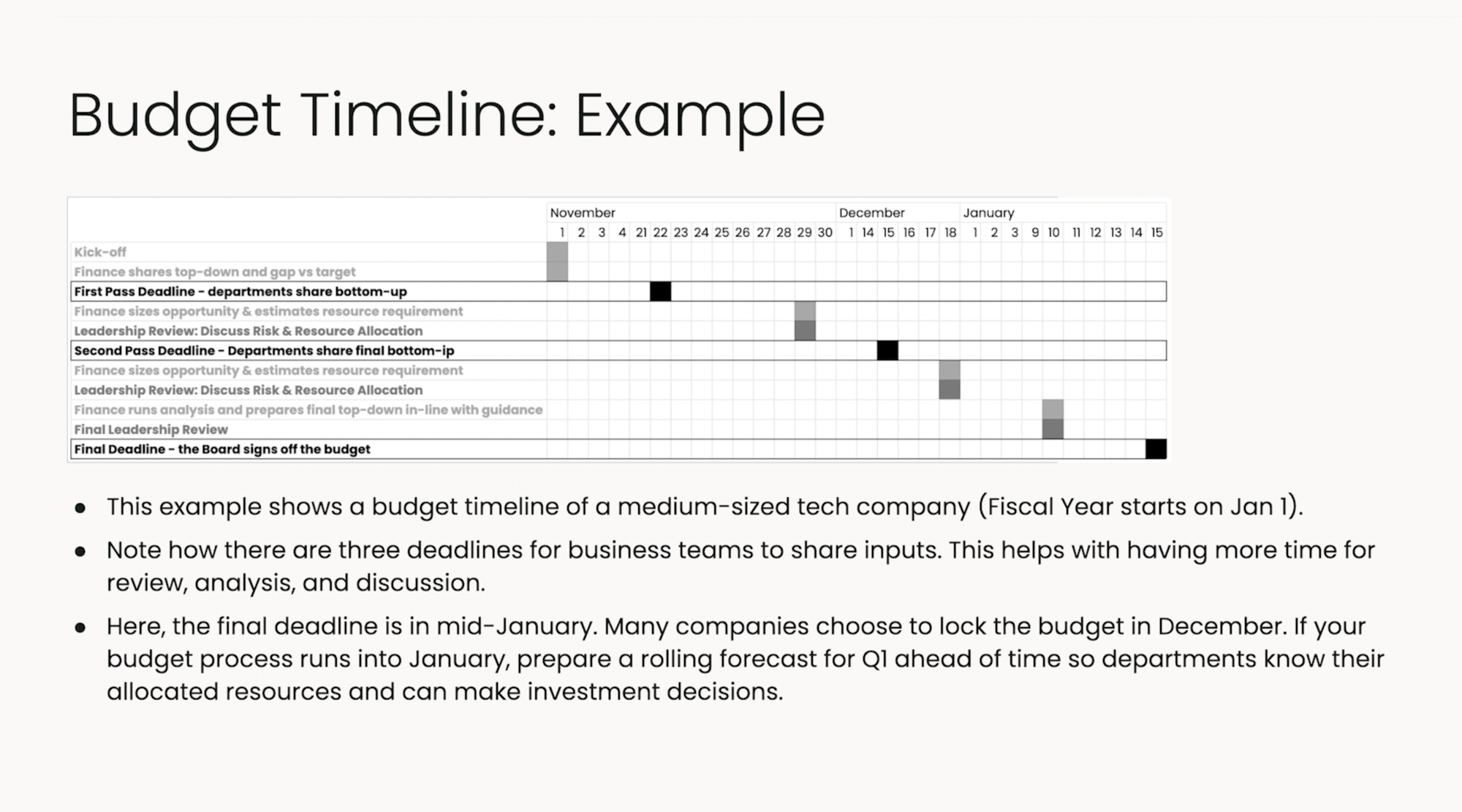

Let me show you what a budget timeline might look like for a medium-sized company:

As you can see, the schedule starts on November 1 and ends in mid-January. While it’s not ideal for the budget process to extend into January - especially if the fiscal year begins on January 1, as it does here - it’s a reality for many smaller and medium-sized companies. This example illustrates how such a timeline can work.

Now, let’s break down how the deadlines are structured. Here is a short video explanation taken from one of the modules of the Budgeting and Forecasting: Certified course:

In this example, tasks led by the finance team are marked in blue, submission deadlines are in black, and review stages are in red. The first thing you’ll notice is that there isn’t just one big deadline at the very end. Instead, there’s a first-pass deadline and a second-pass deadline. This staggered approach helps encourage earlier prioritization and provides enough time for iteration.

The first deadline is about three weeks after the budget process kicks off - on November 22. This gives teams enough time to compile their initial “bottom-up” inputs.

Once those are submitted, the finance team has about a week to analyze the data before the next leadership review. During this review, the team will likely discuss any gaps between the bottom-up inputs and the “top-down” targets, which represent the company’s overall financial goals. From there, the business needs to address how to close those gaps, as the bottom-up figures often lean too conservative.

Two to three weeks later, you have the second-pass deadline. By this point, the hope is that the inputs are closer to aligning with the top-down targets, and the differences can be bridged more easily. Another leadership review follows, where adjustments may be made to finalize the numbers.

Depending on the situation, there could be additional passes or iterations, but ideally, the final analysis happens during this phase. Leadership may provide top-down adjustments at this stage, which override earlier inputs. After this final leadership review, the CFO can lock the plan shortly afterward.

This timeline highlights the importance of staggered deadlines, as they ensure budgeting starts early, progresses iteratively, and allow enough time for meaningful reviews and adjustments.

Budgeting and Forecasting Certified Masters course

Mastering budget timelines is just one part of the bigger picture in budgeting and forecasting. If you’ve ever felt the stress of last-minute submissions, the frustration of misaligned inputs, or the pressure to deliver perfect results with limited time, you’re not alone. And I’ve been there too.

That’s why I worked with Finance Alliance to create the Budgeting and Forecasting Certified Masters course—to give you the tools, strategies, and confidence to navigate these challenges like a pro. This isn’t just theory; it’s practical, battle-tested advice from someone who’s been in the trenches.

In this course, we cover everything from building timelines that actually work to crafting forecasts that lead to smarter business decisions. It’s designed for professionals who want to move beyond the basics and truly excel in FP&A.

If you’re ready to take control of your budgeting process and make a real impact in your organization, I’d love for you to join me.

Check out the course here, and let’s get started!

Follow us on LinkedIn

Follow us on LinkedIn