Do you have what it takes to be a CEO?

In today’s VUCA (Volatility, Uncertainty, Complexity, and Ambiguity) world, the CFO role has evolved from a financial steward and architect to a strategic business advisor to the CEO and the C-Suite.

The CFO is typically the right hand of the CEO. The CFO partners with the CEO in navigating the business for concerted profitable growth achievements and shaping the company’s strategy to create and maximize the value of the organization.

Every business activity and transaction eventually flows into the financial information systems. By having the ability to oversee and manage the impact of the financial side of the company, the CFO is in the best position to understand the financial implication of any decisions made.

In addition to being the financial steward and architect, today’s CFO is expected to provide direction on everything from raising capital to driving mergers and acquisitions, communicating to the investors, managing business performance, driving innovation through new business models, leading digital transformation, and deploying ESG (Environment, Social, and Governance) framework and initiatives, etc.

At the same time, the CFO must continue to maintain the appropriate level of independence to deliver a fine balance of risk and opportunity. The CFO needs to strike the balance as a business-oriented strategic advisor without scarifying the financial oversight.

What does it take for a CFO to be a CEO?

CFOs, who believe that the CEO position will be their logical path for the next career progression, will be greatly disappointed. Even those CFOs who have earned recognition as the best-in-class CFOs shouldn't get their hopes up.

Why?

Well, only 15% of CEOs in Fortune 500 companies come from CFO backgrounds.

"What brought you here might not take you there."

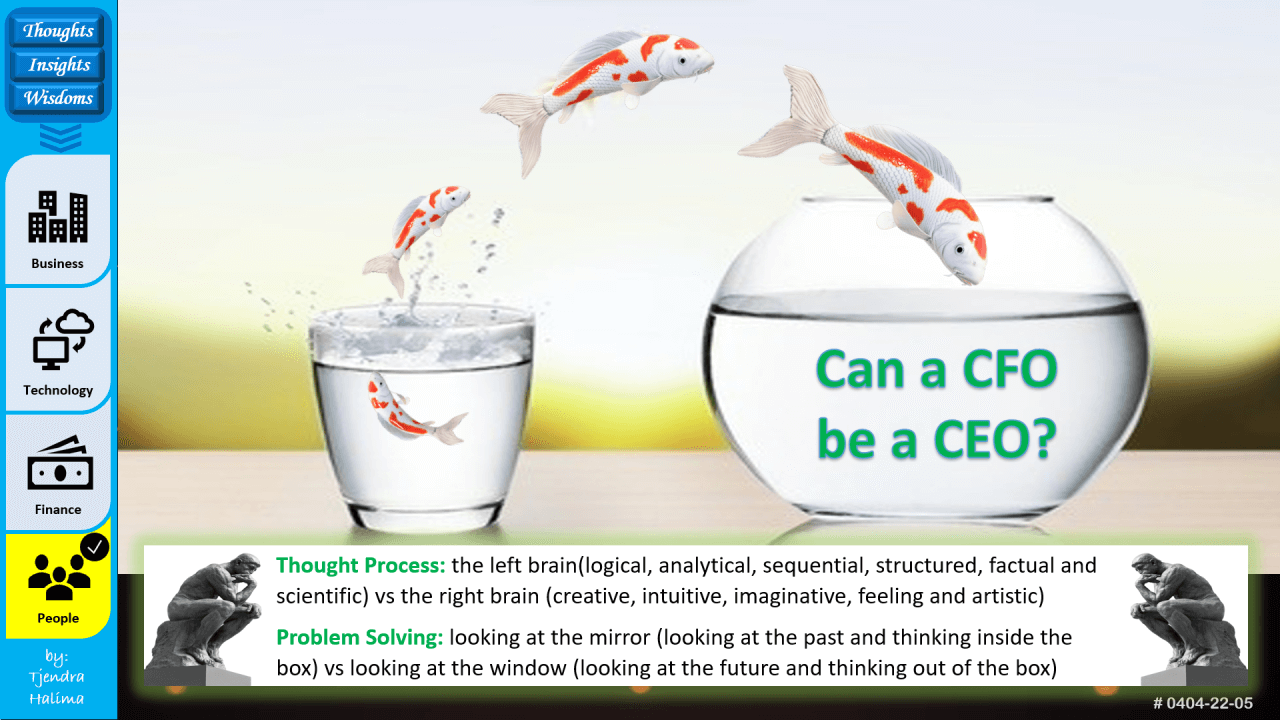

Left-brain vs right-brain competencies

A person in a finance leadership role, such as CFO, often uses the left side of the brain. Biologically, this person possesses these characteristics: logical, analytical, sequential, structured, factual, and scientific. While CFO tends to use the left side of the brain, the CEO often relies more on the right side of the brain. The right-brain person possesses these characteristics: creative, intuitive, imaginative, feeling, and artistic.

The best-in-class CEOs normally have a balance of left-brain and right-brain competencies. These CEOs possess both left-brain competencies (such as financial acumen and strategic mindset) and right-brain competencies (such as social leadership and communication skill).

Looking at the mirror vs looking at the window

Problem-solving is crucial in every C-Suite role. Both CFOs and CEOs solve problems every day. Yet, there are fundamental differences in the problem-solving and decision-making process between the two.

A CFO tends to solve problems by looking at the mirror (looking at the past and thinking inside the box). However, a CEO tends to solve problems by looking at the window (looking at the future and thinking out of the box).

When we solve problems by only looking at the mirror, we constrain ourselves and focus only on internal controllable variables. For example: when we are under pressure to deliver the bottom line, we'll likely take these unpopular actions by cutting costs and/or increasing selling price, which might in the short term save the bottom line but sometime could also damage further the bottom line.

However, if we try to solve problems by looking out the window, we might see some external variables out there that ignite our right brain competencies: creativity and imagination. Therefore, when we are under pressure to deliver the bottom line, we should first look at the external variables: our customers, our competitors, the industry, the market, and the economy.

Ask questions like...

- Do we provide our customers with the right expected level of experience?

- Why our competitors are ahead of the curve?

- Are we addressing the market with the right products or solutions?

- Do we have the right business model in the current business environment?

Maximize profit vs maximize value

There is a paradigm shift needed for a CFO in transition to the CEO role. Instead of focusing on cost control and profit maximization to preserve value, the CFO needs to focus more holistically on value creation and value maximization.

Presentation skill vs communication skill

Communication is crucial in every C-Suite role. Both the CFO and CEO need to be good communicators. The CFO generally has the right level of communication skills as they must communicate financial results and business priorities to the C-suites, the investors, and the whole organization.

However, communication by presentation with PowerPoint and Dashboard might not be necessary inspiring to the audience. Therefore, to be a CEO, there's another level of communication skill needed.

The CEO needs to be able to communicate with the right tone, energy, attitude, optimism, and courage that'll motivate and inspire the whole organization.

Risk management vs opportunity management

CFOs generally excel in Risk Management whereas CEOs generally excel in Opportunity Management.

During the course of their careers, CEOs are always facing many challenges. They've to make difficult decisions in adverse business situations. These include things such as crisis management, economic downturn, business transformation, critical negotiation, restructuring, etc. These experiences have made most CEOs far more confident and comfortable in making decisions in a risky environment.

On the other hand, CFOs and finance leaders are typically risk-averse. They're not comfortable deciding without knowing all the information and the potential consequences, which is sometimes not realistic to expect. The CFO cannot be “Dr. No” all the time.

A CFO is usually good in logic, analytics, and calculation. So, they must make the transition into taking calculated risks. While still exercising financial judgment, the CFO must be comfortable taking some level of risks to facilitate value creation.

If a business case or an opportunity is too risky, saying no without providing any alternatives is not enough. Every stakeholder expects an explanation and transparent business cases to support such a decision.

...From CFNO to CFGO

To transition into the CEO role, the CFO needs to change his/her image from being CFNO to CFGO.

The CFO should not always be the one who comes to stop the party by taking away the drinks and stopping the music. Sometimes, the CFO needs to stop the traffic and block the street for the party to go on all night long.

Sign up to our free Finance Alliance Slack community and start networking with other CFOs and finance leaders today!