Is your calendar marked for a Chief Financial Officer (CFO) interview soon? Feeling those jitters?

We've all been there. That moment when your dream job is finally within reach and the only thing standing between you and that executive position is the interview.

As the potential CFO, you're not just the head money person; you're a strategic partner, a leader, and the one who'll steer the financial future of the company. That's a big deal. The interviewer knows it, and you certainly do too. That's why they’ll ask a diverse set of CFO interview questions to test you and your suitability for the role. So, the more prepared you are for those questions, the higher your odds of securing the job.

In this guide, we’ll help you prepare so that when you walk into that interview room (virtual or in-person), you’ll be ready to show them exactly why you're the best person for the role.

Table of contents:

- Your pre-interview checklist

- CFO interview questions and answers (examples)

- Presentation of financial analysis and strategic vision

- Performance tips for your interview

- The importance of reciprocal questions

- After the interview (follow-up tips)

Your pre-interview checklist

According to IBM, CEOs view the CFO as playing the most crucial role in their organizations over the next two to three years. So, landing a CFO interview is worth celebrating... but it’s also the point where the real challenge begins.

To succeed in your interview, you must be prepared to answer a variety of common, behavioral, and strategic questions for a CFO.

Here are some pre-interview preparation tips to help you prepare:

1. Company research

- Understand the company’s business model: What do they do? Who are their customers? What is their value proposition?

- Financial health and performance: Review financial reports, recent earnings calls, and any available analyst reports.

- Company culture and values: What do they stand for? What is their mission and vision?

- Key leadership and board members: Who are the current executives and what are their backgrounds?

- Recent news and developments: Has the company been in the news recently? Any new product launches or partnerships?

2. Industry analysis

- Understand the industry dynamics: Who are the major players? What are the key trends and challenges?

- Regulatory environment: What are the key regulations affecting the company and industry?

- Competitive landscape: Who are the company's main competitors, and how do they compare in terms of product, market share, and financial performance?

3. Financial landscape

- Company's financial strategy: Is the company growth-focused or profit-focused? Is it investing in new products or focusing on cash flow?

- Financial KPIs: Understand the company's key financial metrics and how they have been performing in these areas.

- Risk factors: Based on the company and industry analysis, what are potential financial risks the company may face?

4. Role-specific preparation

- Revisit your successes and challenges: Be ready to discuss your key achievements, learning moments, and how you've driven financial strategy in the past.

- Alignment with the role: Identify specific examples from your experience that align with the CFO role and responsibilities.

- Understand their needs: From the job description and your research, identify the key needs of the company and how you can address them.

5. Questions for the Interviewers

- Prepare thoughtful questions: Remember, an interview is a two-way process. Prepare questions that show your interest in the role and the company.

6. Practical preparation

- Know the logistics: Double-check the interview time, location (or video call link), who you'll be meeting with, and any materials you should bring or prepare.

- Professional attire: Plan your outfit to present yourself professionally, matching the company's dress code.

CFO interview questions and answers (examples)

When you walk into that room (or log into that video call) for your CFO interview, it's important to understand the structure you're stepping into.

Typically, a CFO interview comprises a variety of question types designed to assess your aptitude from multiple angles.

Below, you'll find a selection of potential CFO interview questions that you might encounter, along with illustrative examples of how you could construct your responses.

Remember, these examples are meant to guide and inspire your own unique answers and shouldn't be taken as gospel! They are more generic answers whereas you can bring your unique experiences and personality to the table.

1. General interview questions for a CFO

Even senior executive roles have to answer the usual (and often mundane) questions asked in most job interviews. These are used to break the ice and help the interviewer get to know you better. You can expect the usual contenders, such as:

Q. Why are you looking for a new job opportunity?

Example response:

"I've had a rewarding journey at my current organization, overseeing financial strategy and contributing to the company's growth. However, I'm seeking new challenges and opportunities to leverage my financial expertise and leadership skills on a larger scale. Your company's vision resonates with me and I believe my experience aligns well with your strategic goals."

Q. What do you know about our company and why would you like to work here?

Example response:

"I've been following your company's growth and achievements in the market. Your commitment to innovation and customer-centric approach sets you apart. I'm particularly impressed by your recent initiatives in sustainability and digital transformation...

"As CFO, I'd love to contribute to this forward-thinking and progressive environment, driving financial strategy that aligns with your organizational values."

Q. Why are you capable of taking on the level of responsibility the role of CFO requires?

Example response:

"With over 15 years of progressive leadership experience in finance, I've successfully navigated through various financial scenarios and driven strategic growth in previous roles...

"I've built efficient teams, implemented robust financial processes, and helped steer companies towards their financial goals. I'm confident in my ability to bring this depth of experience to your company, guiding the financial strategy and contributing to your overall vision."

Other examples of general questions for a CFO interview include:

- Why do you think you're the right fit for this position?

- How have your previous experiences prepared you for the role of CFO in our company?

- How do you keep up-to-date with the latest industry trends and regulations?

- Do you have any questions about the job or our company?

- What do you consider to be your greatest professional accomplishment?

2. Strategic questions

These questions assess your ability to think big-picture and long-term. They gauge how well you can strategize, align business objectives with financial goals, and drive growth. Examples might include:

Q. How would you handle the financial planning for our company's expansion into a new market?

Example response:

"My approach would begin with a thorough market analysis to understand the potential opportunities and risks. I would closely examine customer behavior, competition, and local regulations. Concurrently, I'd work with the team to project realistic revenue targets and associated costs...

I'd also factor in initial setup costs, such as marketing to build brand awareness and any infrastructure or logistics expenses. These would form the backbone of our financial model. Once we've launched, it would be vital to monitor financial performance closely against our projections and adjust our plan as necessary."

Q. Can you describe a time when your financial strategy resulted in significant company growth?

Example response:

"In my previous role at XYZ Corp, I noticed we were sitting on substantial cash reserves earning minimal interest. I proposed an investment strategy to use a portion of those reserves to invest in growth initiatives and high-yield safe investments...

After gaining buy-in from the board, we were able to fund two new product lines without external funding. Both products performed exceptionally well in the market, increasing our revenue by 18% in the first year after launch. The remainder of the cash reserves invested saw a return rate of 8%, significantly higher than the interest it was initially earning."

Q. Can you tell me about a time when you initiated an organizational change?

Example response:

"At my previous company, I initiated a transition to a new, more advanced financial management system. I realized that our existing system was outdated and inefficient, which led to delays in financial reporting and analysis...

"After careful vendor evaluation and testing, I presented my proposal to the executive team and led the transition once approved. The new system improved our financial analysis capabilities, increased reporting speed by 40%, and ultimately led to better, data-driven decision-making across the organization."

Q. How do you apply financial strategies to solve business problems?

Example response:

"In my view, financial strategy is a powerful tool to address a range of business problems. For instance, if a company is struggling with cash flow, I'd first conduct a thorough analysis to identify the root cause. Maybe our receivables cycle is too slow, or there are inefficiencies in our inventory management.

"Once I've identified the issue, I'd develop a strategy to address it, whether that's implementing stricter payment terms, investing in inventory management software, or even renegotiating with suppliers. The key is to use financial data not just to identify the problem, but also to monitor the effectiveness of the solution implemented."

Other examples of strategic questions:

- How would you go about aligning the company's financial strategy with its overall business goals?

- What financial metrics do you consider most important for our company and why?

- Describe a strategic initiative you led that required significant cross-departmental collaboration. What were the outcomes?

- How do you balance short-term financial pressures with long-term strategic goals?

- How have you utilized technology or digital transformation in past roles to improve financial processes and strategy?

Tip: Focus on the future

Strategic questions are aimed at gauging your ability to think long-term and envision the future direction of the company from a financial perspective. When answering these questions, it's important to demonstrate that you understand not only the current financial situation but also how your strategic decisions will impact the future of the company.

Begin your answer by acknowledging the present situation or challenge and then shift your focus to future outcomes. Describe the steps you would take to achieve the desired state, how you would engage other stakeholders, and the metrics you would use to measure success.

For instance, if asked how you would support the company's growth, you might discuss investing in new technology to improve financial efficiency, adopting a more aggressive investment strategy, or optimizing the company's capital structure. Each of these strategies implies a future focus and a drive to move the company forward.

Remember to align your strategy with the broader business goals and the specific context of the company. Demonstrate your ability to balance risk and reward, and to adapt your strategy in response to changing circumstances.

Lastly, being able to articulate complex strategic ideas in clear, accessible language is a key skill for a CFO. Practice explaining your strategic approach in a way that non-financial stakeholders would understand, as this reflects your ability to lead and influence across the organization.

3. Operational questions

These delve into your ability to oversee the day-to-day financial operations and management of the company. Interviewers want to see how well you handle regular financial tasks, resource allocation, and efficiency improvements. Here are a few examples:

Q. How have you improved financial processes in your previous roles?

Example response:

"In my last role, I realized our month-end reporting was taking too long and creating bottlenecks. I led the implementation of a new financial reporting software that automated many manual steps, improving accuracy and reducing our reporting cycle by a week. This enabled more timely decision-making across the organization."

Q. How would you go about reducing operating costs for our company?

Example response:

"Reducing operating costs begins with a thorough understanding of where the money is going. I would start by conducting a cost analysis to identify any areas of inefficiency or waste. This could involve everything from renegotiating contracts with suppliers to investing in technology to improve productivity."

Q. What kinds of finance and accounting tools do you use on the job?

Example response:

"I'm well-versed in a range of finance and accounting tools. In terms of software, I've worked extensively with Oracle NetSuite for enterprise resource planning and QuickBooks for small business accounting. I also frequently use Tableau for data visualization to support financial analysis and decision-making. Additionally, I'm proficient in Excel and have used it for everything from budgeting to financial modeling."

Q. Can you tell us about a time when you faced a significant operational challenge and how you overcame it?

Example response:

"In a previous role, we were faced with a major customer's late payments, which was affecting our cash flow. I worked closely with the sales and customer service teams to understand the situation from the client's perspective.

"We decided to implement a more flexible payment plan for the client, which helped them to catch up on payments without disrupting our relationship. Concurrently, I introduced stricter credit policies and terms for new customers to prevent similar issues in the future."

Other examples of operational questions:

- Can you provide an example of a process you've improved in your current or previous role?

- How do you ensure financial reports are accurate and timely?

- Can you share your approach to cost control and how you've successfully managed operational costs in the past?

- How would you handle a situation where you identified significant inefficiencies in our operational processes?

- How have you used financial analysis to drive operational improvements?

4. Financial questions:

Here, your deep knowledge of finance is tested. These questions aim to understand your proficiency in financial analysis, budgeting, forecasting, and managing financial risks. These questions can often be quite technical. For instance:

Q. How do you approach creating a financial forecast for a company like ours?

Example response:

"I would first conduct a comprehensive analysis of your historical financial data, identifying patterns and trends...

"I would then collaborate with other departments to understand your sales forecasts, marketing plans, and operational costs. I also consider macroeconomic trends and industry factors. The result is a forecast that is not only based on numbers, but also on a holistic view of the business."

Q. Can you describe a time when you identified and mitigated a significant financial risk?

Example response:

"In my previous role, our company was considering a major investment in new technology. My analysis showed it could significantly drain our cash reserves and put us at risk if it didn't yield expected returns. I presented my findings to the executive team and proposed an alternative plan: a phased approach to the investment, which would allow us to test the technology's impact before fully committing. This approach was accepted and ended up saving the company from a potentially significant financial risk."

Q. What types of finance tools do you use on the job and/or have experience with?

Example response:

"Over the course of my career, I've become proficient in a range of finance tools. I've extensively used enterprise-level ERP systems such as SAP and Oracle for managing finances at a macro level...

For financial analysis and reporting, tools like Tableau and Power BI have been invaluable. I've also used specific financial modeling tools like Adaptive Insights. Of course, Excel remains a staple for various financial tasks."

Q. What steps would you take to improve our company's financial performance?

Example response:

"Improving financial performance is a multi-faceted process. Firstly, I would conduct a thorough review of your financial statements to understand the current performance and identify any areas of concern. Secondly, I would work closely with department heads to identify cost-saving opportunities and efficiency improvements...

"Additionally, I would review your investment strategy to ensure it's aligned with the company's risk tolerance and growth objectives. Lastly, I would ensure that we have robust financial controls and reporting in place to inform decision-making. Throughout this process, I would prioritize communication with stakeholders to ensure everyone understands the financial goals and their role in achieving them."

Other financial questions that could come up during your interview include:

- How would you approach creating a budget for a company of our size and industry?

- Can you discuss your experience with managing debt and capital structure?

- How have you leveraged financial data and analytics to drive business improvement?

- How would you handle a situation where there is a significant deviation from the financial forecast?

- Can you describe your approach to cash flow management, particularly during a downturn or a period of uncertainty?

5. Situational/behavioral questions:

These questions throw you into hypothetical situations or delve into your past experiences to understand how you'd behave in different scenarios. The aim is to evaluate your problem-solving, leadership, and interpersonal skills. Examples might be:

Q. Tell me about a time when you had to make a difficult financial decision. How did you handle it?

Example response:

"In my last role, a significant customer was consistently late with their payments, impacting our cash flow. After careful analysis, I had to make the difficult decision to suspend their credit terms until the arrears were cleared. I communicated this decisively yet diplomatically, maintaining the relationship while ensuring our financial health."

Q. Imagine our company is facing a significant budget cut. How would you decide what gets reduced?

Example response:

"In such a scenario, I'd conduct a thorough cost-benefit analysis of all departments and projects. Non-critical initiatives would be first for review. I would also seek to enhance operational efficiency and renegotiate contracts, aiming to make strategic cuts that minimize impact on our core services and employees."

Q. What steps will you take to help other senior executives make good financial decisions?

Example response:

"Open communication is key. I would ensure they have clear, accurate, and timely financial information. I'd also offer my strategic insight, translating financial data into actionable intelligence. My aim would be to foster a financially-aware culture where every decision is made with a clear understanding of its financial impact."

Q. If revenue projections suggest the possibility of the business incurring a loss, what measures would you implement to safeguard the business from this potential loss?

Example response:

"I would swiftly put in place a contingency plan focusing on cash preservation, including reviewing all expenses, deferring non-critical expenditures, accelerating incoming payments, and exploring additional funding options if needed. Throughout, I would ensure transparent communication with all stakeholders about the situation and our response strategy."

6. Personal/leadership questions:

These questions help interviewers understand who you are as a person and a leader. They might ask about your leadership style, your motivations, and your cultural fit with the company. For example:

Q. How would you describe your leadership style and how has it contributed to your success?

Example response:

"I would describe my leadership style as 'collaborative'. I believe in harnessing the collective intelligence of my team to make informed decisions. I encourage open communication, invite different perspectives, and value everyone's input...

"This approach not only fosters a motivated and cohesive team, but it also leads to more robust and well-rounded financial strategies. I've found that my ability to build and lead high-performing teams has been integral to my success as a CFO."

Q. What motivates you as a CFO?

Example response:

"What motivates me most as a CFO is the opportunity to drive strategic growth. I enjoy using financial data to uncover insights that can shape the direction of the company. There's something deeply satisfying about translating numbers into strategies, and then watching those strategies lead to tangible business outcomes...

"I'm also driven by the chance to mentor and develop my team, and to create a finance function that not only serves the company but empowers it."

Q. If someone in your direct-report finance team falls short of your expectations, how would you handle the situation?

Example response:

"I believe in addressing such issues promptly and constructively. First, I would have a private conversation with the individual to understand the root cause of the issue. It's possible they need further training, clearer instructions, or more feedback...

"Then, we'd work on a performance improvement plan together, setting clear, measurable objectives. I would follow up regularly to provide support and track their progress. My goal would be to empower them to improve while also ensuring the efficiency and effectiveness of the team as a whole."

Q. Can you describe how you promoted ethical conduct within your team in your last position?

Example response:

"Ethics have always been paramount to me, both personally and professionally. In my most recent role, I set clear expectations of ethical behavior and incorporated these principles into our team's goals and performance metrics. I led by example, ensuring my actions consistently mirrored the standards I set...

"To foster an open environment, I encouraged team members to voice concerns without fear of repercussions. We also conducted regular training sessions on ethical issues to keep everyone updated. Through these actions, I believe we built a culture where ethics were considered in every decision we made."

Other examples of leadership questions:

- How do you develop talent within your team? Can you share a specific example?

- How do you approach delegating tasks within your team?

- How do you ensure effective communication within your team and with other departments?

- What strategies do you use to manage your team's performance and keep everyone on track?

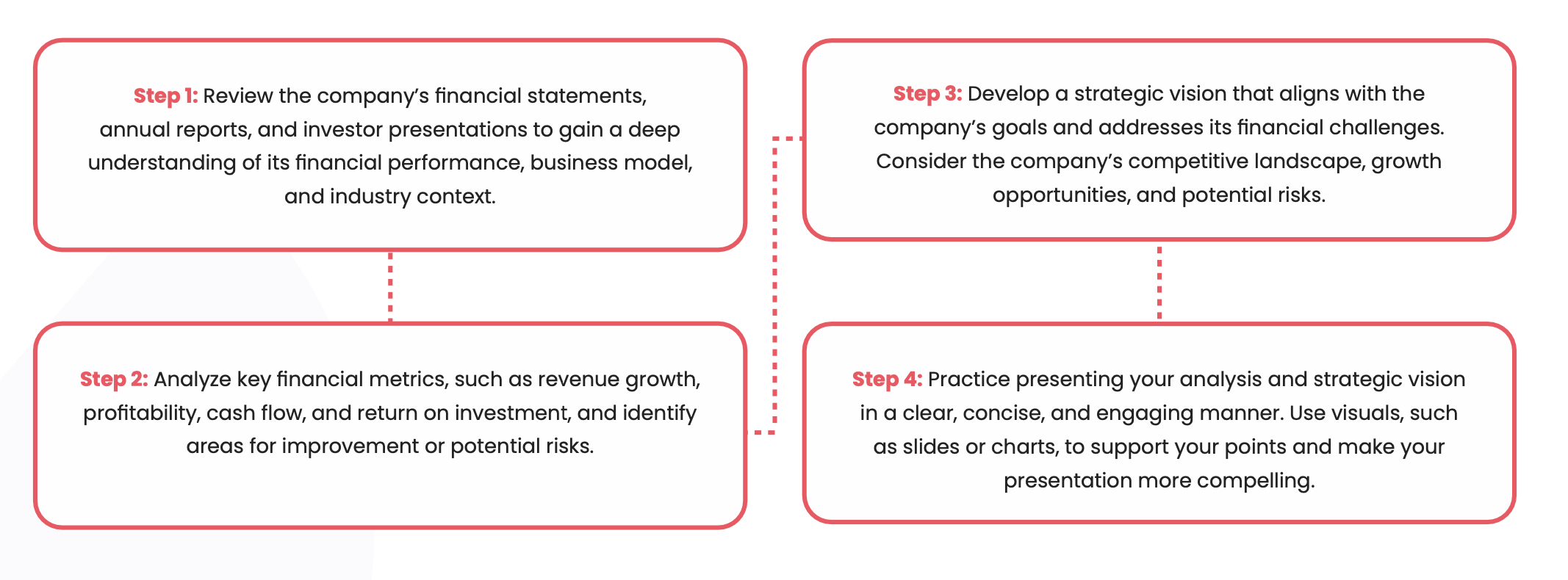

Presentation of financial analysis and strategic vision

In some CFO interviews, you may be asked to present a financial analysis or discuss your strategic vision for the organization. This is an opportunity to showcase your analytical skills, financial acumen, and ability to think strategically.

To prepare for this aspect of the interview, follow these steps:

Performance tips for your interview

From the moment you step into the interview room, every word you say, every gesture you make, and even the way you sit can send powerful messages about your suitability for the role.

So, how do you ensure you're ticking all the right boxes and leaving a lasting impression?

Here are some performance tips to help you ace your CFO interview:

1. Speak their language

Alright, first things first, you want to be clear, concise, and on point. Don't beat around the bush or get lost in financial jargon. Answer the question, use real-life stories to illustrate your points, and always tie it back to how you can add value to their company.

2. Radiate confidence

Confidence isn't just about knowing your stuff (though that's important), it's also about showing it. Stand tall, give a firm handshake, and maintain eye contact. Show them you're a financial whiz who can handle pressure with grace and charm.

3. Be an industry guru

You're not just a number cruncher; you're a strategic leader. That means knowing the financial landscape inside and out. Be ready to chat about industry trends, regulatory changes, and how you've navigated these in the past. Show them you're not just keeping up with the industry, but you're staying a step ahead.

4. Body language speaks volumes

You know as well as anyone that it's not just what you say, it's how you say it. Non-verbal cues can make or break an interview. Keep your posture open, use natural hand gestures when explaining your points, and keep your expressions friendly and attentive.

5. The art of listening

It's easy to get so caught up in what you're going to say next that you forget to really listen. But remember, good conversation is a two-way street. Show them you value their input and can communicate effectively.

6. Get your ducks in a row

Preparation is key. Know the company, rehearse your answers and get a good night's sleep. Walk into that room knowing you've done your homework and you're ready to impress.

7. Be creative

And finally, be creative. According to a Harvard Business Review interview with Disney’s CFO, Gary Wilson, a CFO creates value by being creative. When asked 'how can a CFO create value?', he answered:

"Just like all the great marketing and operating executives — by being creative. Creativity creates value. In finance that means structuring deals creatively."

The importance of reciprocal questions

Asking your own questions in an interview is an excellent way to show your genuine interest in the role and the company, and it's a valuable opportunity to determine whether the company is a good fit for you as well.

By asking thoughtful and informed questions, you demonstrate that you've done your homework and that you're looking at the opportunity from all angles, not just as a job, but as a partnership between you and the organization.

Here are some examples of insightful questions you might want to ask during your interview:

- Understanding the company's vision:

"Can you describe the company's growth plans for the next five years, and how the CFO will contribute to achieving those goals?"

- Learning about the team:

"Could you tell me more about the team I would be leading? What are their strengths, and where are the areas for improvement?"

- Gauging corporate culture:

"How would you describe the company culture here, particularly within the finance department?"

- Assessing the challenge:

"What are some of the most significant financial challenges the company is currently facing, and how can the CFO play a role in overcoming these?"

- Understanding expectations:

"What would you consider success for the CFO in the first six months on the job?"

- Future opportunities:

"What opportunities for professional development or advancement might be available to the CFO in the future?"

- Aligning with leadership:

"How does the executive leadership team work together to set strategy and make decisions?"

By asking questions, not only do you showcase your seriousness and dedication to the role, but you also gather crucial information that can help you determine whether this role and company are indeed a good fit for your career aspirations.

After the interview

You’ve completed the interview and can finally breathe a sigh of relief… but now what?

The post-interview phase is equally crucial in securing the job, as it involves effective follow-ups, critically evaluating the job offers you receive, and, of course, navigating the negotiation process for your compensation package.

Effective follow-ups

A well-timed, thoughtful follow-up message can leave a lasting impression. A thank you note expressing your continued interest in the role and appreciation for the interviewer's time is a great start. This is an opportunity to reiterate your key strengths, touch upon an engaging aspect of the interview, or clarify a point, if necessary.

Evaluating job offers

When you receive a job offer, it's not just about the salary. Evaluate the entire compensation package, including bonuses, stock options, retirement contributions, and other benefits. Consider the company culture, opportunities for professional growth, and the alignment of the company's vision with your career goals.

Handling the negotiation process

As a potential CFO, you bring immense value to the company, and your compensation should reflect this. Before entering negotiations, research the market rate for CFOs in your industry and region, identify your priorities (base salary, bonuses, stock options, benefits), and be prepared to discuss your achievements and value proposition.

Approach negotiations with professionalism and assertiveness, express your expectations and show a willingness to reach a mutually beneficial agreement.

According to research, 75% of recruiters have noticed an increase in salary negotiations from their candidates. So, don't be afraid to negotiate and if you're met with a counteroffer, consider it thoroughly before responding.

FAQs: CFO interview questions

How do I prepare for a CFO round interview?

Preparation should involve understanding the company's financial landscape, industry trends, and potential challenges. This includes analyzing the company's financial reports, understanding its strategic plans, and familiarizing yourself with its market and competitors. Additionally, brush up on your leadership examples and successes, as well as potential answers to common CFO interview questions.

How can I express my understanding of the company's industry during the interview?

Refer to industry trends and challenges when discussing your strategic plans. Show that you understand the company's market position, competitors, and industry regulations. This will demonstrate that you're not just financially savvy, but also business-oriented.

How can I handle situational or behavioral questions in a CFO interview?

Structure your responses using the STAR (Situation, Task, Action, Result) method. This involves describing a situation you faced, the task you needed to accomplish, the action you took, and the result of your action.

What are some red flags I should look out for in a CFO interview?

Red flags could include lack of clarity about the company's financial situation, unrealistic expectations for the CFO role, a high CFO turnover rate, or a company culture that doesn't align with your values.

How can I deal with interview nerves?

Preparation is key to overcoming nerves. Practice your responses, research the company thoroughly, and get a good night's sleep before the interview. On the day, take deep breaths, maintain eye contact, and remember that it's not just about them assessing you, but also about you assessing if the company is a good fit for you.

Join our Slack community

It's an empowering platform for finance professionals like you, offering an exclusive space to connect, learn, and grow. We bring together diverse minds from the finance world, facilitating knowledge sharing and fostering innovation.

From topical discussions and expert insights to collaborative projects, you'll find value in every interaction. Join us to stay updated with the latest in finance, network with peers, and contribute to shaping the future of our industry.

Follow us on LinkedIn

Follow us on LinkedIn