Are you curious about the distinction between a CFO vs Controller?

These titles are often thrown around in the business and finance world, but understanding exactly what each role does can be challenging.

In this article, we're going to try to clear up the confusion. We'll look at how CFOs and Controllers contribute to a company's financial health, what their day-to-day responsibilities look like, and why both roles are crucial for businesses of all sizes.

Whether you're a business owner, a finance professional, or just curious about corporate structures, understanding these roles can give you valuable insights into how companies manage their finances.

So, let's dive in and explore the difference between a controller and a CFO...

Table of contents:

- Controller vs CFO: 7 key differences

- Role and responsibilities of a CFO

- Role and responsibilities of a Financial Controller

Controller vs CFO: 7 key differences

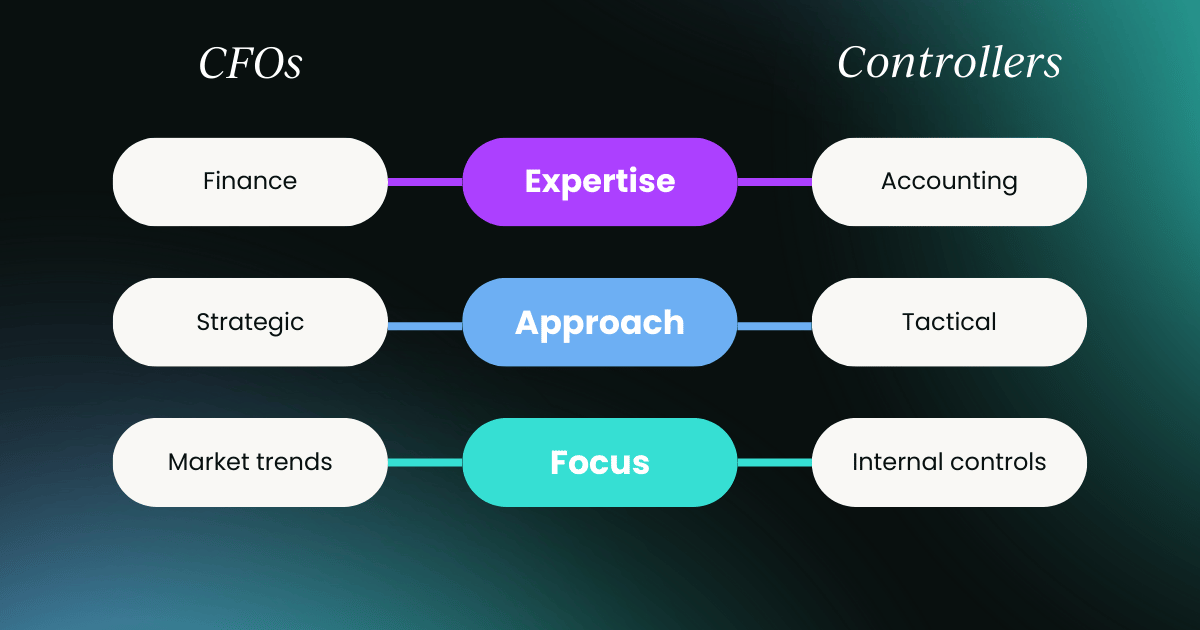

While CFOs and Controllers play crucial roles in a company's financial management, they have distinct responsibilities and focuses. Let's break some of these down:

1. Scope of vision

💸 CFO: Think of the CFO as the financial pilot, soaring high above the business landscape. They take a broad, strategic view of the company's finances.

⚖️ Controller: That makes the Controller more like a skilled navigator, expertly guiding the financial ship through day-to-day operations.

2. Focus areas

💸 CFO: Finance in its broader sense - financial planning, capital markets, and investments.

⚖️ Controller: Accounting specifics - ensuring compliance with GAAP, managing tax regulations, and maintaining precise financial records.

3. Strategic vs. tactical

💸 CFO: Develops long-term financial strategies and advises on major business decisions.

⚖️ Controller: Executes financial plans and ensures smooth daily financial operations.

4. External vs. internal

💸 CFO: Often the face of the company to external stakeholders, handling investor relations and major partnerships.

⚖️ Controller: Primarily focused on internal processes, collaborating with other departments to implement financial policies.

5. Future vs. present

💸 CFO: Forward-looking, analyzing market trends, and forecasting financial scenarios.

⚖️ Controller: Present-focused, ensuring current financial data is accurate and up-to-date.

6. Decision-making level

💸 CFO: Makes high-level financial decisions that impact the entire organization.

⚖️ Controller: Makes operational decisions within the finance department and provides data for higher-level decision-making.

7. Required skills

💸 CFO: Needs a mix of financial acumen, strategic thinking, and leadership skills.

⚖️ Controller: Requires deep technical accounting knowledge and attention to detail.

Understanding the difference between a CFO and Controller helps clarify why both roles are essential in a well-functioning finance department.

While there may be some overlap, each position brings unique value to an organization's financial health and growth. Let’s dive a little further into each role…

Role and responsibilities of a CFO

When you think of a CFO, you might picture someone buried in spreadsheets all day. But the reality is far more dynamic.

The Chief Financial Officer is like the financial architect of a company, designing and overseeing the big picture of the organization's fiscal health.

So, what exactly does a CFO do? Let's break it down:

Strategic financial leadership

At its core, the CFO's role is about big-picture thinking. They're not just number crunchers – they're strategic visionaries who use financial insights to guide the entire organization.

A CFO spends a good chunk of their time advising the CEO and board of directors on financial matters, developing long-term financial strategies, and identifying opportunities for revenue growth and cost optimization.

CFOs are always thinking about how to move the company forward financially.

Financial planning and analysis

CFOs spend a lot of time looking ahead. They're constantly analyzing market trends, predicting potential scenarios, and planning for the company's financial future. This involves:

- Creating and analyzing financial models

- Conducting scenario planning for various economic conditions

- Evaluating the financial impact of major business decisions

Capital management

Managing a company's money is no small task. CFOs oversee the capital structure, balancing debt and equity to ensure the company has the funds it needs to operate and grow.

They're also often involved in big financial moves like mergers, acquisitions, or taking a company public. Alongside all this, they’re also managing the company’s relationships with investors and financial institutions.

Risk management and compliance

Today, managing risk has never been more complex, nor more crucial, and CFOs play a key role in protecting the company from financial risks. They're responsible for:

- Ensuring compliance with financial regulations

- Overseeing internal controls to prevent fraud

- Managing financial aspects of cybersecurity and other business risks

Team leadership

A great CFO doesn't work alone. They lead the entire finance department, setting the tone for the team's culture and ensuring everyone works together effectively.

This leadership extends beyond just the finance department, as CFOs often collaborate with other departments to drive financial awareness across the entire organization.

External relations

When it comes to financial matters, CFOs often serve as the face of the company's financial health to the outside world. They might find themselves:

- Presenting financial results to investors and analysts

- Negotiating with banks and other financial partners

- Representing the company in financial matters with the media and public

Technology and innovation

CFOs are increasingly involved today in leveraging technology to improve financial operations.

This could mean implementing new financial software, driving automation initiatives, or exploring cutting-edge fintech solutions to give their company a competitive edge.

Remember, the exact responsibilities of a CFO can vary depending on the company's size, industry, and specific needs. But one thing's for sure – it's a dynamic, challenging role that requires a unique blend of financial expertise, strategic thinking, and leadership skills.

Role and responsibilities of a Financial Controller

While the CFO might be charting the course, the Financial Controller is making sure the ship stays on course day-to-day.

Think of them as the guardian of a company's financial present, ensuring everything adds up (quite literally).

So, what does a financial controller actually do? Let's dive in:

Master of accounting

At their core, Controllers are accounting experts. They're the go-to people for all things related to the company's financial records.

This means overseeing the entire accounting department, making sure every number is accurate and every financial i is dotted and t is crossed.

Financial reporting

Controllers are the conductors of financial reporting, responsible for:

- Preparing regular financial statements (monthly, quarterly, and annual)

- Ensuring compliance with Generally Accepted Accounting Principles (GAAP)

- Managing external audits and liaising with auditors

Internal control

A key part of the Controller's job is to keep the company's financial house in order. They develop and implement internal control systems that keep the company's finances secure and running smoothly, such as:

- Developing and implementing internal control systems

- Monitoring for potential accounting errors or fraud

- Ensuring compliance with financial regulations and tax laws

Operational efficiency

Beyond just keeping the books, Controllers are often tasked with finding ways to make financial operations more efficient.

This might involve streamlining processes, implementing new accounting software, or identifying areas where the company can save money.

Financial analysis and support

While CFOs focus on the big picture, controllers dive into the details like:

- Conducting variance analysis

- Providing financial insights to support management decisions

- Assisting with budgeting and forecasting processes

Team leader and mentor

Controllers typically lead the accounting team. This means they're not just number crunchers – they're also mentors and managers, responsible for ret, training, and guiding their staff.

Compliance and risk management

Controllers play a crucial role in keeping the company on the right side of regulations:

- Ensuring timely and accurate tax filings

- Managing financial aspects of legal compliance

- Overseeing proper documentation for all financial transactions

Bridge between departments

While primarily focused on accounting, Controllers often serve as a link between finance and other departments.

They might collaborate with various teams to gather financial data, explain financial concepts to non-finance colleagues, or support the CFO in company-wide financial initiatives.

Remember, the exact duties of a Controller can vary depending on the size and structure of the company. In smaller organizations, they might take on some CFO-like responsibilities, while in larger firms, they might specialize more deeply in specific areas of accounting and financial management.

Regardless of the specifics, the Controller plays a crucial role in maintaining the financial health and integrity of any organization.

Conclusion

So, there you have it - a clear picture of how CFOs and Controllers shape a company's financial landscape. While both roles are crucial, they each bring unique skills and perspectives.

Understanding these roles isn't just about knowing who does what. It's about appreciating how different financial professionals work together to keep a business financially healthy and successful.

Whether you're building a finance team, considering a career in finance, or just want to understand your company better, recognizing the distinct value of a Chief Financial Officer vs Controller is key.

In the end, it's the synergy between these roles that helps drive a company's financial success.

FAQs

Can a company have a Controller without a CFO?

Yes, especially in smaller companies. In such cases, the Controller might report directly to the CEO and take on some CFO-like responsibilities.

As companies grow, they often add a CFO position to focus more on strategic financial planning.

What qualifications are typically required for CFO and Controller positions?

Controllers usually have a strong accounting background, often with CPA certification.

CFOs may come from various backgrounds, including accounting, finance, or business management.

Though it’s not always required, many CFOs hold MBA degrees or other advanced financial certifications.

How do CFOs and Controllers work together in larger organizations?

In companies with both roles, the Controller typically reports to the CFO.

The Controller focuses on managing day-to-day accounting operations and producing accurate financial reports.

The CFO then uses this information to make strategic financial decisions and guide the company's direction.

Is it common for Controllers to be promoted to CFO positions?

Yes, it's not uncommon for Controllers to move into CFO roles, especially if they develop strong strategic and leadership skills.

Follow us on LinkedIn

Follow us on LinkedIn