A CFO's involvement in investor communications is crucial for narrating a company's financial story. As the top financial executive, you understand the past, present, and future of the organization better than anyone.

Leveraging your financial acumen and leadership to shape investor messaging allows you to build credibility, trust, and transparency with investors.

Read on as we explore the unique role of the CFO in investor communications and best practices.

Table of contents:

- What is investor communications?

- The importance of investor communication

- Investor relations in private equity

- The role of a CFO in investor relations

- Challenges faced by CFOs in investor communications

- Tips for better investor relations communications

- Examples of poor vs excellent investor relations

What is investor communications?

Investor communications refers to how a company communicates financial and operational information to current and potential investors in the company.

As a CFO, you're tasked with not just handling the numbers, but also sharing your company's financial story clearly and engagingly.

Here's what it involves:

Financial reporting

This isn't just about sharing numbers. It's about clearly showing your company's financial health through balance sheets and income statements.

Earnings calls and presentations

Imagine these as regular check-ins where you discuss how the company has performed, throw light on operational updates, and share glimpses of what lies ahead.

Annual reports

More than a document, it's a yearly recap that tells the story of your company’s activities and financial performance, offering both hindsight and foresight.

Press releases

These are timely news bulletins that keep everyone in the loop about major happenings like mergers or leadership changes.

Investor meetings and conferences

These are your face-to-face or virtual interactions where you engage directly with those who have a stake in your company's success.

Regulatory filings

Critical for compliance, these filings ensure you're keeping things transparent and above board with regulatory bodies.

Corporate governance communications

Here, you're conveying how the company is managed and governed, keeping investors informed about policies and practices.

Crisis communication

When things get rocky, this is about being upfront and guiding investors through the storm with clear and prompt communication.

The ultimate aim? To ensure investors are well-informed and confident in their decisions, fostering a sense of trust and reliability. Well-executed investor communications can lead to a more positive perception and potentially a stronger financial standing in the market.

Why is investor communication important?

Investor communications is important to build a solid, trust-filled relationship between a company and the people who invest in it.

You’ve got to keep the investors in the loop. This involves making sure they really get what's happening with the company's finances, where it's heading, and the strategy behind it all.

This kind of clear and open chat helps investors feel confident about their decisions, knowing they're on the same page with the company's leadership.

But don’t forget – good investor communications can boost how a company is seen in the market.

When a company talks openly and regularly with its investors, it clears up any confusion, keeps everyone's expectations in check, and can even attract new investors while keeping the current ones happy.

What is investor relations in private equity?

Investor relations in private equity refers to the ongoing communication and relationship management between private equity firms and their investors, who are typically institutional investors, like pension funds or endowments, and high-net-worth individuals.

Since private equity involves investments in companies that are not publicly traded, the dynamics of these relationships can be quite unique compared to public markets.

What is the role of a CFO in investor relations?

Essentially, the CFO is like the main storyteller for a company when it comes to chatting with investors. Their job is to make sure investors are kept in the loop and feel good about where their money is going. This usually involves:

Telling the financial story

The CFO breaks down the complex financial stuff into a story that makes sense. They explain how the company is doing, where it's making money, and what the challenges are. It's like translating number-crunching into a clear narrative.

Earnings calls and meetings

Think of these as the big stage moments for the CFO. They're presenting the company's financial results and answering all sorts of questions from investors. It's their chance to shine and reassure everyone that they've got things under control.

Strategy and forecasting

The CFO doesn't just talk about the here and now. They also lay out the roadmap for where the company is headed. This is about giving investors a peek into the future, like what investments the company is making and what the growth prospects look like.

Building trust

This is a big one. The CFO's job is to build and keep trust with investors. This means being honest, even when things aren't going great, and being clear about how they're handling risks and opportunities.

Crisis management

When things get rocky, the CFO is often the one who has to calm the waters. They need to communicate effectively during tough times, showing that they have a plan to navigate through any storms.

Regulatory compliance

They also need to make sure all this communication is on the up and up, following all the rules and regulations about financial reporting and disclosures.

The CFO is the go-to person for investors when they want the real scoop on the company's financial health and future. They're part therapist, part storyteller, and part strategist, all rolled into one.

Challenges faced by CFOs in investor communications

CFOs face several challenges in investor communications, but there are practical ways to navigate these issues effectively:

1. Balancing transparency with confidentiality

Challenge: CFOs must share enough information to keep investors informed without disclosing sensitive details that could harm the company's competitive position.

Solution: Establish clear guidelines on what constitutes confidential information. Use generalized statements about strategy and performance without revealing specifics that could be leveraged by competitors.

2. Managing diverse investor expectations

Challenge: Investors have varying expectations and demands, from short-term gains to long-term strategies.

Solution: Regularly engage with investors to understand their perspectives and priorities. Tailor your communication to address different investor groups while maintaining a consistent overall message.

3. Navigating market volatility

Challenge: Market fluctuations can lead to nervous investors and a demand for immediate information.

Solution: Prepare contingency plans for different market scenarios. Communicate proactively during volatile times, even if it's to say that you are monitoring the situation and will provide more information when available.

4. Compliance with regulatory requirements

Challenge: Ensuring that all communications comply with the increasingly complex regulatory environment.

Solution: Stay updated on regulatory changes and have a robust compliance framework. Regularly review communication materials with legal advisors to ensure compliance.

5. Addressing negative performance or bad news

Challenge: Communicating negative financial results or company setbacks in a way that maintains investor confidence.

Solution: Be upfront and honest about the challenges while highlighting the steps being taken to address them. Focus on the long-term vision and strategy of the company.

By tackling these challenges head-on with clear strategies and proactive communication, you can maintain strong and trusting relationships with your investors, even in the face of obstacles.

8 Tips for better investor relations communications

Alright, let's talk about some real-world, practical tips for CFOs when it comes to nailing investor communications:

1. Keep it clear and simple

Financial data can be complex, but your job is to make it understandable. Don't get lost in jargon or overly complicated explanations. Think about explaining your financials to a friend who's not a finance whiz.

2. Consistency is key

Whether it's good news or bad, keep your communication style consistent. Investors should know what to expect from you in terms of tone and clarity, regardless of the situation.

3. Be proactive, not reactive

Don't wait for the rumors to start flying. If there's news, especially if it's not great, be the first to communicate it. This shows that you're in control and trustworthy.

4. Tell the whole story

Numbers don't exist in a vacuum. Give context. How do these financial results tie into the bigger picture of where the company is headed? What's the strategy behind the numbers?

5. Listen and engage

Communication is a two-way street. Listen to what your investors are saying and asking. Their concerns and questions can give you valuable insights into what matters to them.

6. Stay updated on regulations

The last thing you want is a compliance issue. Make sure you're up to date on any legal changes that affect how and what you can communicate.

7. Practice makes perfect

Before those big earnings calls, practice your presentation. Know your stuff so well that even if you're thrown a curveball question, you can handle it with confidence.

8. Use different channels

Some investors love detailed reports, others prefer a quick update call or an infographic. Mix up how you deliver information to cater to different preferences.

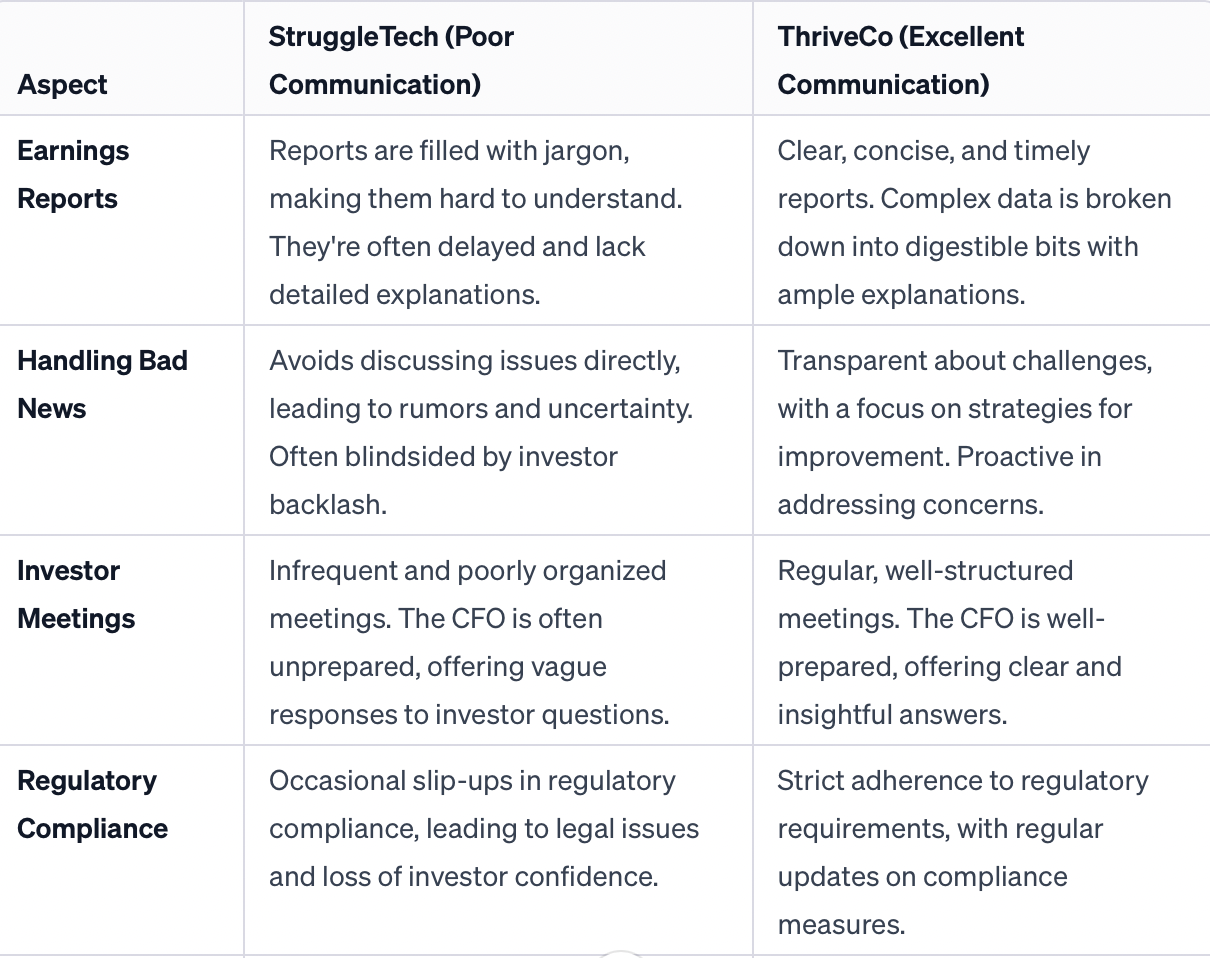

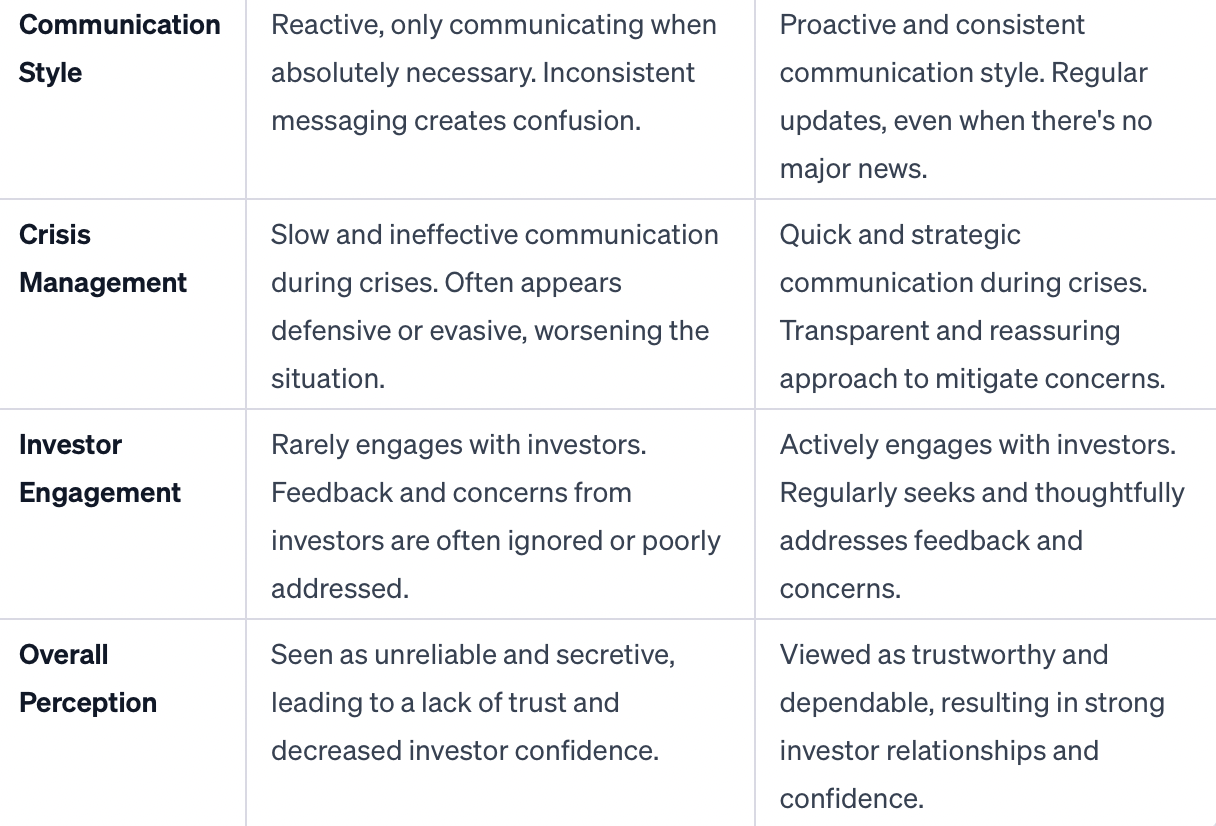

Poor vs excellent investor communications

The best way to understand the differences between poor investor communications vs excellent investor communications is by looking at them both in action.

So, let’s imagine we're looking at two (fictional) companies – let's call them "StruggleTech" and "ThriveCo."

Here's how their investor communications might stack up:

In these case studies, StruggleTech's approach to investor communications is riddled with vagueness and a reactive stance, which damages investor trust. On the other hand, ThriveCo demonstrates how clarity, proactive engagement, and transparency can create a positive and trustworthy relationship with investors.

Finance Alliance Pro Membership

Take control and unlock your true potential with the Finance Alliance Pro Membership - an exclusive community that connects you with elite finance professionals and equips you with the cutting-edge tools and resources you need to dominate the field.

Fuel your growth:

- Engage in high-level discussions

- Sharpen your skills

- Unlock exclusive career opportunities

Join Finance Alliance Pro Membership today! 🎓

Follow us on LinkedIn

Follow us on LinkedIn