One of the hardest questions to answer about financial planning and analysis (FP&A) is ‘what is the typical FP&A team structure?’

This question is so hard to answer because there is no one-size-fits-all. Instead, it depends on numerous factors like company size, funding, revenue, profit, growth rate, public or private, complexity, locations, and subsidiaries, etc.

So, determining how big your FP&A team should be really comes down to capacity and budget.

Table of contents:

- Signs it's time to expand your FP&A team

- FP&A team structure at a startup

- FP&A team structure at a private company

- CFO role within FP&A

- Leader of FP&A team (role)

- How FP&A teams interact with other departments

When should you expand your FP&A team?

If the workload is becoming unmanageable for yourself or your existing team, it’s likely time to find either additional resources or solve the problem with software.

Of course, these decisions need to make sense from a budgetary perspective. Growing an FP&A team too large too quickly when revenue growth isn’t there to support it is usually a bad idea. Timing the growth of your team right so you aren’t in an urgent situation to get resources hired is critical to a healthy FP&A function.

So, let’s discuss some different company sizes and what an FP&A team would typically look like for each.

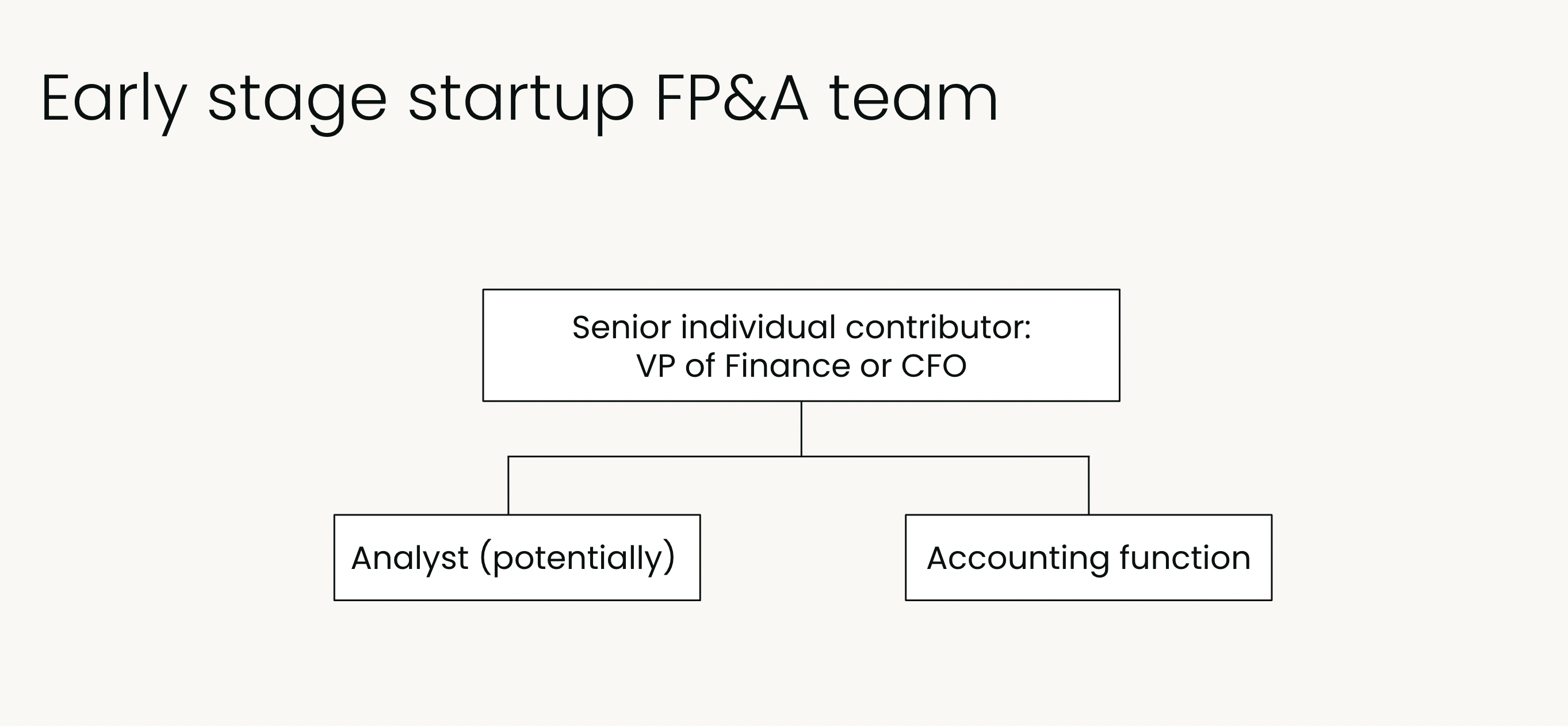

FP&A structure: Start-up company (small business)

Let’s assume we're discussing a start-up in the early stages of fundraising (Seed or Series A) with low revenue.

This type of company may require what's called a senior-level “individual contributor”. This person may join the company as a VP of Finance all the way up to a CFO, but would typically be handed the full workload of the finance team (maybe one analyst if they're lucky).

In this situation, this person would need to be highly skilled in modeling to establish a working budget, forecast, long-term plan, and other strategic modeling needed while also being a key decision-maker in how the company’s money is used.

They would also, in many situations, manage the accounting function with a resource there to close the books. This is a highly visible, heavy workload role that can have outsized benefits in terms of career growth or potential equity gains.

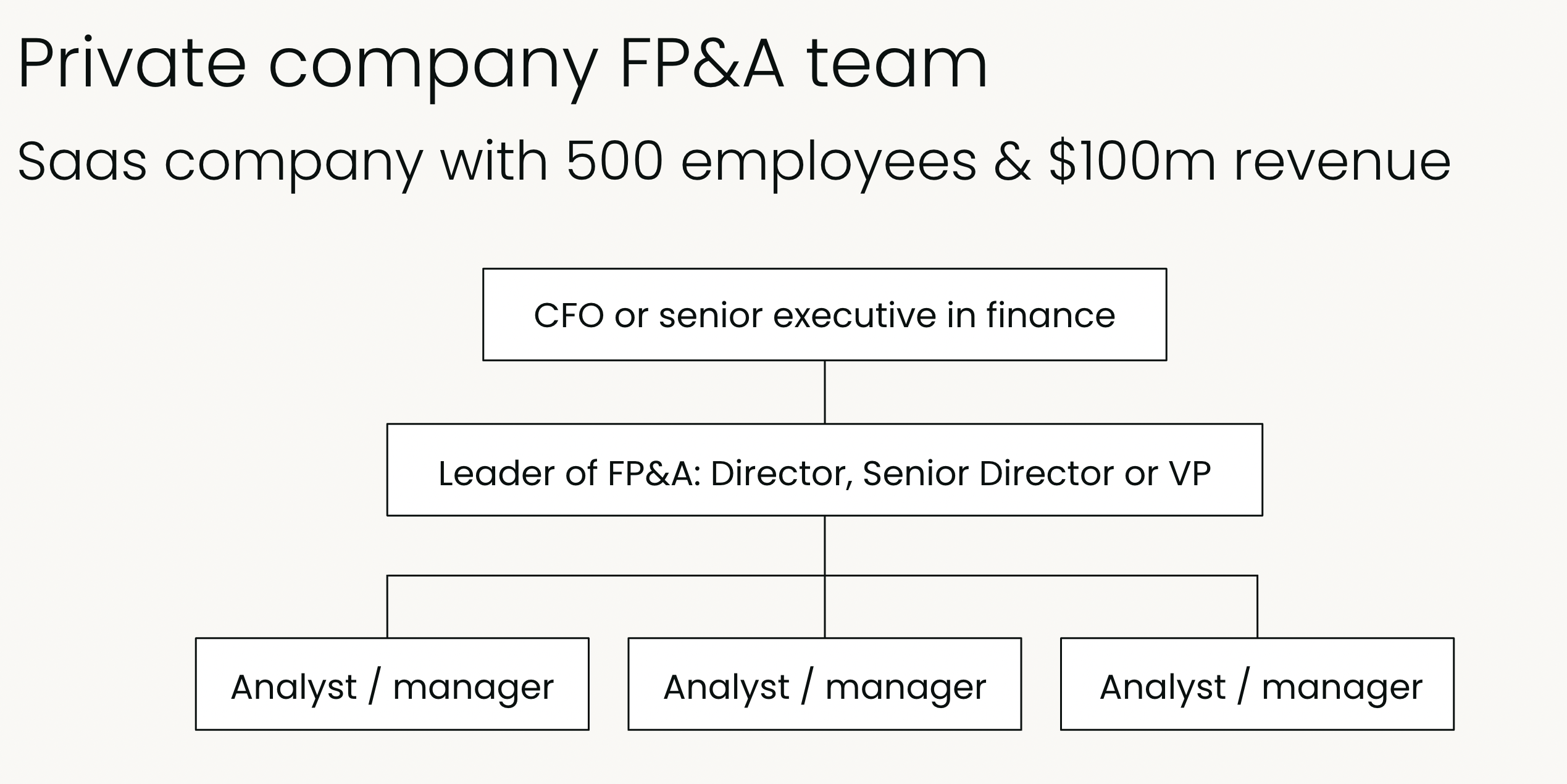

Private company FP&A team structure

Now, let’s look at this same company and assume they have grown to now be a private company with 500 employees and over $100M in revenue. Here's a visual for what the FP&A team structure might look like for this type of company:

This team would be expected to be far more robust. The top of the finance team would almost certainly be a Chief Financial Officer (CFO) or equivalent senior executive in finance.

Underneath the CFO would be a leader of FP&A, which could be a wide range of titles but typically a Director, Senior Director or Vice President level.

Depending on the complexity of the business (Software-as-a-Service (SaaS), manufacturing, consumer goods, etc.), there could be different needs so let’s assume this is a SaaS business.

You would expect anywhere from 2-3 workers underneath the FP&A leader at the analyst and/or manager levels. The necessity around this would be for FP&A business partnering (presenting monthly reporting to the department leaders and budgeting) and strategic FP&A (long-term modeling, planning, and forecasting).

The more the business expects to see in terms of reporting and the quicker they expect it, the more resources are needed to support this. So, your FP&A team structure may look larger or smaller depending on the demands of leadership, investors, and the Board.

CFO role within FP&A team

These levels within an FP&A function work in very different ways. The CFO will interact with the board, investors, and the C-level co-workers while delegating all major functions within the finance team to their direct reports.

The role is typically very hands-off in terms of work product (actually building or interacting with models) but instead, storytelling based on the information given and maintaining a critical eye at all times.

Leader of FP&A role

The VP or director level is the layer of protection between the analyst or manager level and the CFO. They're tasked with managing the whole FP&A function, ensuring all processes are carried out seamlessly and on time and any errors are caught before arriving with the CFO.

This person needs to be a master delegator, a hirer of people, and a great manager to be successful. The analysts and managers should drive the majority of the work product but the Director or VP should know the P&L better than anyone else in the company.

Each person within the FP&A team has a different level of involvement at each stage, but the role must shift the more senior you become.

How FP&A teams interact with other departments

You may be asking how this FP&A team interacts with the rest of the company. Well, the answer is they should be interacting with all departments across the company in some capacity.

FP&A team & accounting

First and foremost, FP&A should be joined at the hip with accounting. Understanding the close process, how things are booked into the general ledger (GL), how to find what you need within their accounting software, etc. are necessities to function well within FP&A.

FP&A team & leadership

Leadership interactions, both at the C-level and within each department, are what establishes a healthy business partnering model. You must do this to ensure you are relied on for decision-making and viewed as a valued thought partner.

FP&A team & corporate development

Depending on company size, you may have a corporate development team. If you do, you likely work on several long-term strategic models with them around growth opportunities for the company. These can sometimes be the most interesting part of the job.

FP&A team & sales

Interacting with sales is a must. Being on the same page with the sales forecast so you may better forecast revenue is one of the most important things in FP&A. These are just some of the countless interactions FP&A needs to maintain across a business.

In summary, FP&A is the glue that keeps the company together. The expectation is to support all functions and arm them with financial data to drive success, whatever form that comes in. That is why it is one of the most critical in any business.

FAQs

How are FP&A teams structured?

FP&A teams are usually structured with a hierarchy that includes roles such as analysts, senior analysts, managers, directors, and a vice president or head of FP&A. Each level has increasing responsibilities, from data gathering and basic analysis to strategic planning and decision-making support.

What does a good FP&A team look like?

A good FP&A team is well-rounded, combining strong analytical skills, business acumen, and effective communication. They are proactive, collaborative, and adept at leveraging technology to provide insightful financial forecasts and strategic recommendations.

What are the tasks of an FP&A team?

FP&A teams handle tasks such as budgeting, forecasting, financial analysis, variance analysis, and strategic planning. They also prepare reports for senior management, analyze financial trends, and provide insights to support decision-making processes.

How do I build an FP&A department?

Building an FP&A department involves hiring skilled professionals, implementing robust financial software, and establishing clear processes for budgeting, forecasting, and reporting. Training and continuous development are crucial to ensure the team stays updated with best practices and industry trends.

What is the group structure of FP&A?

The group structure of FP&A often includes specialized teams focusing on different areas such as corporate finance, business unit support, strategic planning, and reporting. This allows for a more focused approach to managing various aspects of financial planning and analysis.

Take your career to the next level with FP&A Certified: Core

Ready to improve your financial planning and analysis (FP&A) skills and skyrocket your career growth? Our FP&A course is your gateway to mastering the skills and know-how needed to drive strategic business growth with the power of FP&A.

Learn from FP&A experts like:

🎓 Patrick Dennehy - Senior Director, Finance at Kyruus Health.

🎓 Diego Carlesso - Head of Finance Integrated Supply Chain at Philips.

🎓 James Mannering - Owner & Operator at Lamson Consulting.

🎓 Jay Millstone - Director of Financial Planning & Analysis at Topa Insurance Company.

🎓 Bill Singh - Vice President of Financial Planning & Analysis at Genting Americas Inc.

🎓 Eric Rosen - Director of Finance at Ordergroove.

Find out more about this course including your coaches, the curriculum and what's included.👇🏼

Follow us on LinkedIn

Follow us on LinkedIn