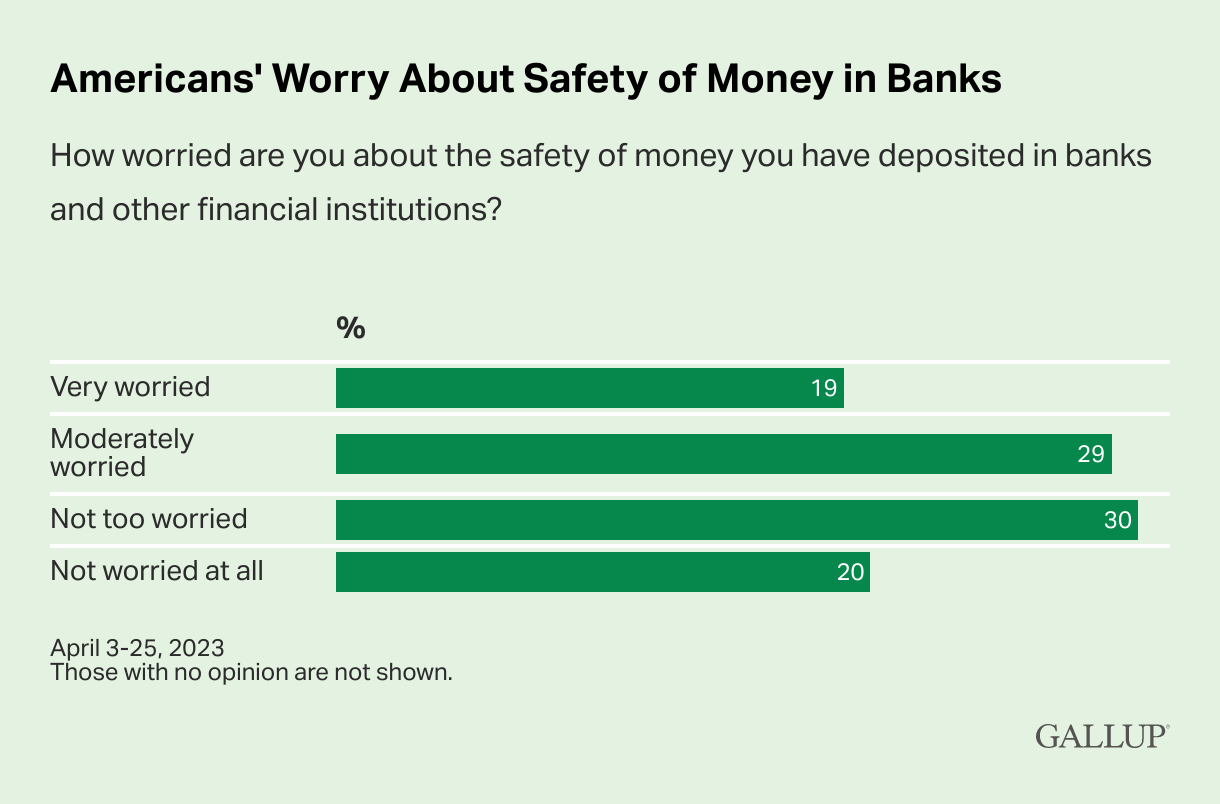

Recent events are stirring concerns over a potential recession with many Americans becoming increasingly worried about the safety of their money in banks.

Findings of a recent Gallup survey revealed almost half of the 1,013 adults polled expressed concern regarding the security of their money in banks or other financial institutions. The survey also showed that 30% of the participants were "not too worried", while 20% had no worries at all.

As CFOs, understanding the sentiment and apprehensions surrounding the banking system is crucial to make informed decisions and guiding the company through uncertain times.

This article will explore the growing fears of a potential banking crisis and how they compare to previous financial crises while offering insights on how CFOs can navigate these challenges.

Concerns about the U.S. financial system

Since the recent failures of Signature Bank and Silicon Valley Bank, First Republic lost $100 billion in deposits. A fortunate deal meant regulators took possession of the bank and sold its assets to JPMorgan Chase in hopes of stabilizing the industry and calming the increasing worry expressed by the public.

These events have drawn comparisons to the aftermath of the Lehman Brothers collapse in 2008, which similarly led to increased concerns over the security of financial institutions.

Although the 2008 financial crisis had a significant impact on the banking system, Gallup's survey revealed concerns had subsided by December of the same year, following the implementation of measures to alleviate the crisis's effects. This suggests the current level of worry among Americans may not be the norm during more stable times.

FDIC insurance and its implications

One factor contributing to Americans' heightened concern over their deposits may be a lack of awareness of federal deposit insurance or fear of a snowball effect that could impact federal insurance.

The Federal Deposit Insurance Corporation (FDIC) insures up to $250,000 per depositor per insured bank for each account ownership category. The Gallup survey found that lower-income adults, those without a college degree, and Republicans were more worried than their counterparts. This worry may stem from a lack of knowledge about FDIC insurance or dissatisfaction with the current economic situation.

The underlying factors behind the banking crisis

As the U.S. banking system faces increasing turbulence, regional banks such as PacWest and Western Alliance have been significantly affected, with share prices plummeting and trading being suspended.

The unfolding crisis, which originated with the collapse of Silicon Valley Bank in March, has intensified, raising apprehensions about the stability of financial institutions.

A combination of elements has contributed to the present predicament, such as:

- The accelerated hike in interest rates by the Federal Reserve

- Business models employed by the impacted banks

- The prevalence of small and mid-sized banks in the U.S.

- Shortcomings in regulatory oversight

For example, Silicon Valley Bank wasn't seen as crucial to the financial system, resulting in fewer strict rules compared to bigger banks. Many of its customers didn't have deposit insurance, leaving them at risk of losses due to increasing interest rates on U.S. Treasury bonds. Likewise, other banks that faced difficulties later had similar traits, like being regionally focused and sensitive to growing borrowing expenses.

For CFOs, understanding the underlying factors behind the banking crisis is crucial to make informed decisions and adapt to the changing financial landscape. This knowledge can help CFOs anticipate potential risks, adjust strategies, and ensure the stability of their business operations during turbulent times.

Addressing concerns as a CFO

Given the growing concerns about the safety of financial institutions, CFOs must take proactive measures to address these issues within their organizations. Here are a few steps to consider:

Educate employees and stakeholders about FDIC insurance

Make sure your employees, especially those responsible for managing accounts and finances, understand the protections offered by the FDIC. This knowledge can help alleviate concerns and foster confidence in the banking system.

Diversify banking relationships

To mitigate risks associated with any single financial institution, consider diversifying your company's banking relationships. This approach can help protect your company's assets and reduce dependence on any one bank.

Monitor the financial health of banking partners

Keep a close eye on the financial health of the banks your company works with. Stay informed about news and developments related to your banking partners, and be prepared to make changes if necessary.

Develop contingency plans

Prepare for the possibility of a recession or financial crisis by developing contingency plans. These plans should outline how your company will respond to potential challenges, such as reduced cash flow, tighter credit markets, or currency fluctuations.

Communicate with stakeholders

Maintain open lines of communication with stakeholders, including investors, employees, and customers. Inform them of the steps your company is taking to protect its financial health and address any concerns they may have.

On the bright side...

While the current situation in the banking sector may seem worrisome, history has shown us that financial systems can recover and adapt. As CFOs and other financial professionals work to address these challenges, the resilience and innovation that often emerges during times of crisis can pave the way for a brighter future.

In the meantime, let's keep our spirits up and remind ourselves that with every challenge comes an opportunity to learn, grow, and ultimately, come back stronger.

FAQs

What are the main concerns regarding the U.S. banking system?

The recent failures of several regional banks, such as Silicon Valley Bank and Signature Bank, have raised concerns over the stability of financial institutions and the safety of money deposited in these banks.

How can CFOs address concerns about the banking system?

CFOs can take several steps, such as educating employees about FDIC insurance, diversifying banking relationships, monitoring the financial health of banking partners, developing contingency plans, and maintaining open communication with stakeholders.