9 M&A best practices

Leading a successful M&A deal is a defining moment for any CFO… but that doesn’t make it easy.

Maximizing value while minimizing risks in these complex deals requires a delicate balance, strategic foresight, and careful planning.

To help you craft a winning deal, we’ve compiled some M&A best practices that can help you not only survive the ordeal but also thrive, turning potential pitfalls into opportunities for growth. 🚀

1. Setting the stage for M&A success

Once the decision has been made to pursue an M&A, one of the first tasks usually involves making sure everyone is on the same page. This means bringing management teams together to develop a cohesive game plan.

Brainstorming sessions with business heads, legal counsel, and your CEO can help build consensus on priorities and principles for evaluation. To help facilitate a productive discussion, try posing some strategic questions, such as:

What are our motivations for pursuing an acquisition or merger?

How can we deploy M&A to achieve our growth objectives?

What types of targets align with our strategic roadmap?

How will success be measured if a deal materializes?

Ensuring alignment on these questions not only clarifies the direction and objectives of the M&A process but also sets a solid foundation for any following steps.

2. Understanding components of value creation

Once the strategy is set, you’ll enter one of the most crucial phases - identifying and valuing potential M&A targets.

An M&A target refers to a company that has been identified as a potential candidate for acquisition or merger by another company. In the context of mergers and acquisitions, the target is the company that is to be bought or merged with.

So, how can you identify and value targets?

A good place to start is by leveraging market research and data analytics to pinpoint companies that align with your strategic objectives. Utilize industry reports, financial databases, and competitor analyses to create a shortlist of potential targets.

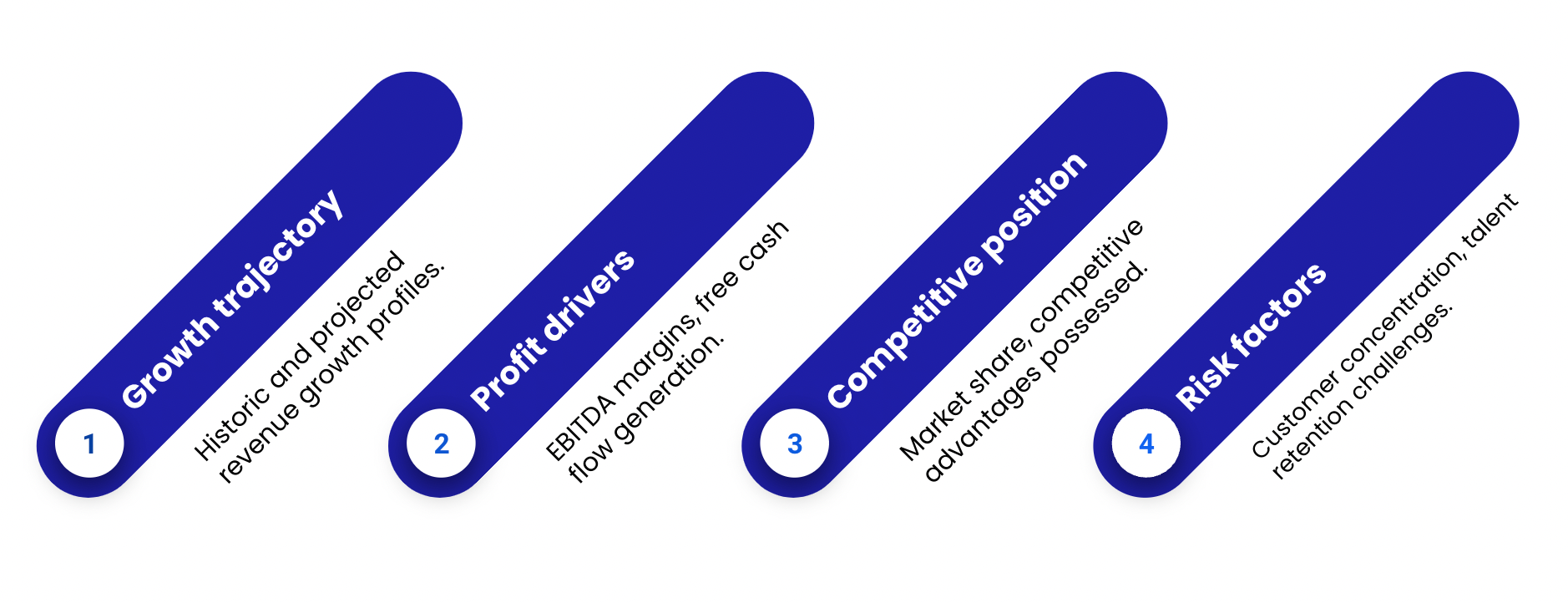

Key components to assess when valuing targets include:

Performing a thorough due diligence process will also uncover any financial, legal, or operational risks that could affect the valuation and eventual integration of the target company. This step is a cornerstone of M&A best practices, ensuring that potential pitfalls are identified and addressed early in the merging process.

3. Identifying opportunities for growth

Now it’s time to pinpoint key growth opportunities. Deploying proactive market intelligence and networking strategies will help you lock in deals with the best growth synergies.

Focusing on growth potential is important because it ensures each merger and acquisition isn’t just a financial investment, but a strategic move that can help the company grow. 📈

Here are some tips to help identify these opportunities:

Conduct market analysis

Keep a close eye on what’s going on in the market. Are there any emerging sectors? Declining industries? Areas in desperate need of innovation? Market analysis will help you pinpoint sectors where an acquisition could provide a competitive edge or fill gaps in the company's portfolio.

Evaluate strategic fit

Assess how potential targets align with your company’s long-term strategic goals. For example, you might want to think about how an acquisition can diversify offerings, enhance product lines, or expand geographic presence.

Leverage network and advisors

Utilize the knowledge and connections of industry experts, investment bankers, and M&A advisors who can provide insights into potential opportunities and facilitate introductions.

Monitor competitors

Pay attention to competitors' M&A activities, as these can reveal emerging opportunities or sectors worth exploring.

Innovate internally

Encourage internal teams to identify potential acquisition targets that can enhance or complement existing operations, products, or services.

4. Crafting compelling investment cases

Once high-potential M&A targets are identified, it’s time to transition into the role of deal champion. In other words, you need to craft compelling cases that justify the investment and outline the value creation roadmap.

To help with this, you can lay out frameworks that quantify each dimension of a proposed deal, including:

- Strategic rationale: Details on how target acquisition accelerates key priorities.

- Growth potential: Granular breakdowns of revenue and cost synergy opportunities.

- Risk factors: Analysis of integration challenges and mitigation plans.

- Financial returns: Models projecting IRR, NPV, and pro forma impacts across finance metrics.

- Exit options: Evaluation of divestment potential via future sale or IPO.

Ultimately, your aim is to create an objective risk-reward breakdown with evidence demonstrating how the deal powers strategic growth.

5. Determining returns on investment

One of the most important M&A best practices is to make sure the numbers make sense. This means backing investment cases with financial modeling and determining reliable ROI projections.

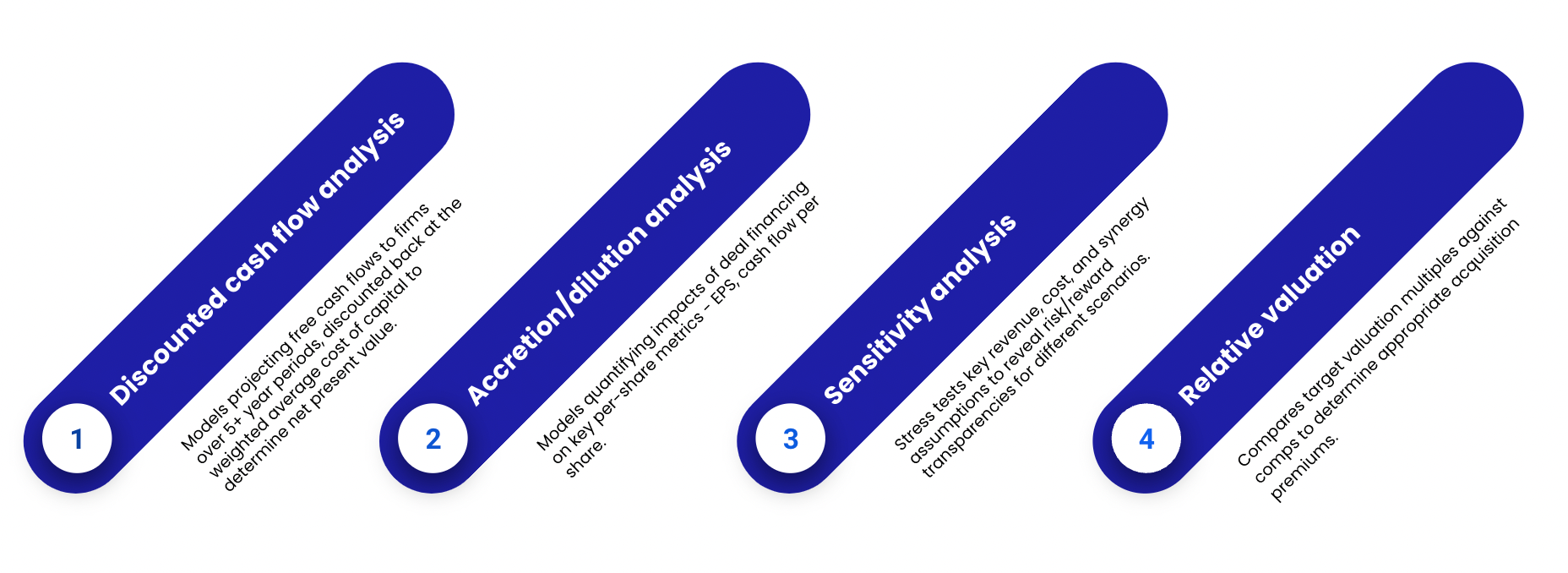

You’ll need to rely on models to assess the viability of any M&A deal and optimize structuring for maximum returns. Techniques used include:

6. De-risking M&A activities

M&As tend to come with execution risks that can erode value pretty quickly. From regulatory to integration challenges, it’s important to both monitor and mitigate common risk factors.

Some potential M&A risks to focus on include:

- Financial risks: Shortfalls in synergy capture, hidden liabilities, financing cost overruns, etc.

- Valuation risks: Overpayment due to forecast inaccuracies or optimism bias.

- Integration risks: Poor system consolidation, cost alignment delays, and culture clashes.

To help avoid risks, assemble cross-functional teams and processes to swiftly address hiccups. establishing regular sync cadences, and rapid intervention protocols.

It also helps to develop contingency plans to prepare for potential events like economic shifts or loss of leadership.

7. Engage in effective negotiation

Another important M&A best practice is to employ strategic negotiation tactics to achieve favorable deal terms while maintaining a good relationship with the target company.

Easier said than done, we know.

So, here are some useful tactics CFOs often deploy to help negotiate successfully:

- Anchoring: Establish reasonable valuation goal posts early, referencing detailed financial analyses.

- Active listening: Uncover the underlying interests of the target through empathy and inquiry.

- Bridging: Offer creative shared value solutions addressing both sides’ core concerns.

- Alternative option creation: Construct contingent structures providing flexibility as uncertainties develop.

8. Communicate transparently

With so much going on during a merger or acquisition, it’s easy for communication to fall by the wayside.

But here's the thing—keeping everyone in the loop, from your employees and shareholders to your customers, is not just good manners; it's a strategic move that can make or break the success of your deal.

By communicating transparently, you're not just sharing information; you're building trust, managing expectations, and laying the groundwork for a smoother transition.

Here are some tips to help keep stakeholders in the know:

Start early

As soon as an M&A deal is under serious consideration, start planning how and when you'll communicate key messages. Waiting too long can fuel rumors and anxiety.

Be consistent

Ensure your messaging is consistent across all channels and stakeholder groups. Mixed messages can lead to confusion and erode trust.

Use the right channels

Different stakeholders might require different communication methods. While employees might benefit from in-person meetings or internal newsletters, shareholders might prefer official press releases or regulatory filings.

Balance honesty with sensitivity

Be as open as you can about the reasons for the merger, the expected outcomes, and how it will affect various stakeholders. However, be mindful of the anxieties and concerns these changes might provoke. It's about finding the right tone that is honest yet reassuring.

Encourage feedback

Make it a two-way street by inviting questions and concerns. This not only helps in addressing specific issues but also makes stakeholders feel valued and heard.

9. Prioritize IT and systems integration

When merging companies, the integration of IT systems is critical to avoid operational disruptions. This step is crucial for ensuring that all technology platforms and infrastructure work seamlessly together from day one. This is where M&A tools come into play, offering essential support for a smooth transition.

Leveraging these tools is part of following M&A best practices, as they can significantly streamline the process of merging IT systems, ensuring a more efficient and less disruptive integration.

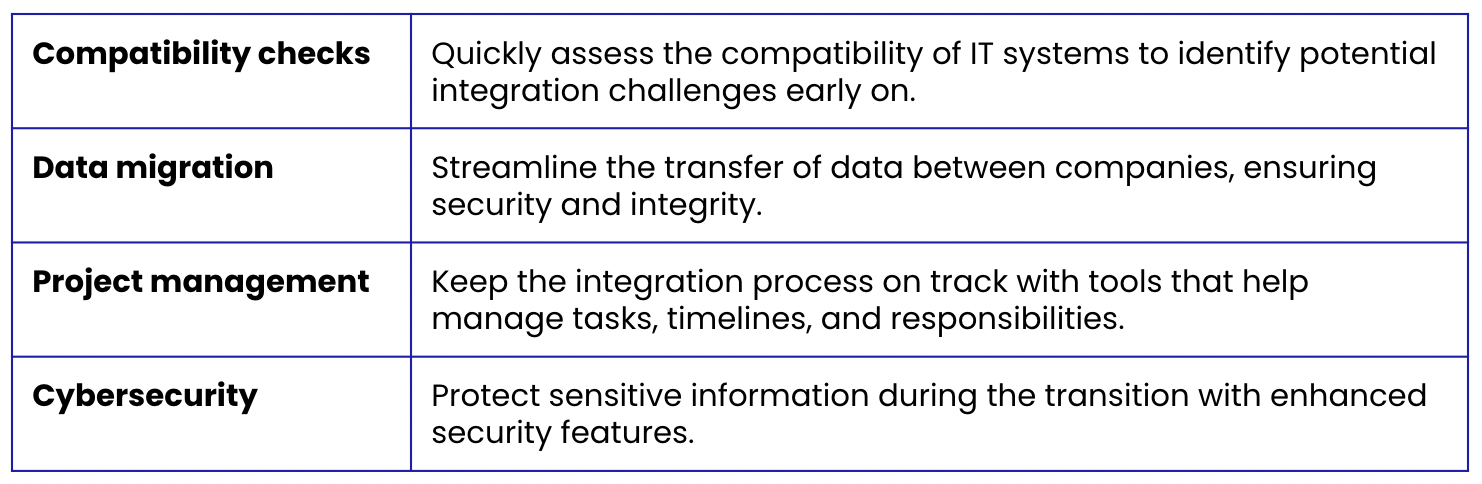

Key areas where M&A tools make a difference:

By prioritizing IT and systems integration and leveraging the right M&A tools, companies can minimize downtime and maintain productivity, setting the stage for a successful merger.

Follow us on LinkedIn

Follow us on LinkedIn