To achieve a successful finance function transformation, you must assess your maturity. Let me explain why...

Not so long ago, I got a call from a CFO who started a project to upgrade the global financial ERP. The timeframe – 9 months – was challenging. But a technical team had already been appointed. She intended to use this ERP upgrading project to upgrade the finance function’s processes.

My advice to her was to start with a quick assessment of her finance function. I also advised her to include them in the project as soon as possible. But the timeframe was very tight.

So, she gave priority to designing the solution to give way to the implementation. 18 months and more than €1 million later, the project lacked traction, and change was rejected in many places globally.

Want to make sure this doesn't happen to you?

If so, make sure to follow the 3-step finance maturity assessment framework outlined in this article, where I discuss:

- Why knowing your finance function’s current state is vital before you transform it

- How to define your finance function’s current state

- How to conduct a 3-step maturity assessment for your finance function

Why knowing your finance function’s current state is vital

What does transformation look like for a finance function?

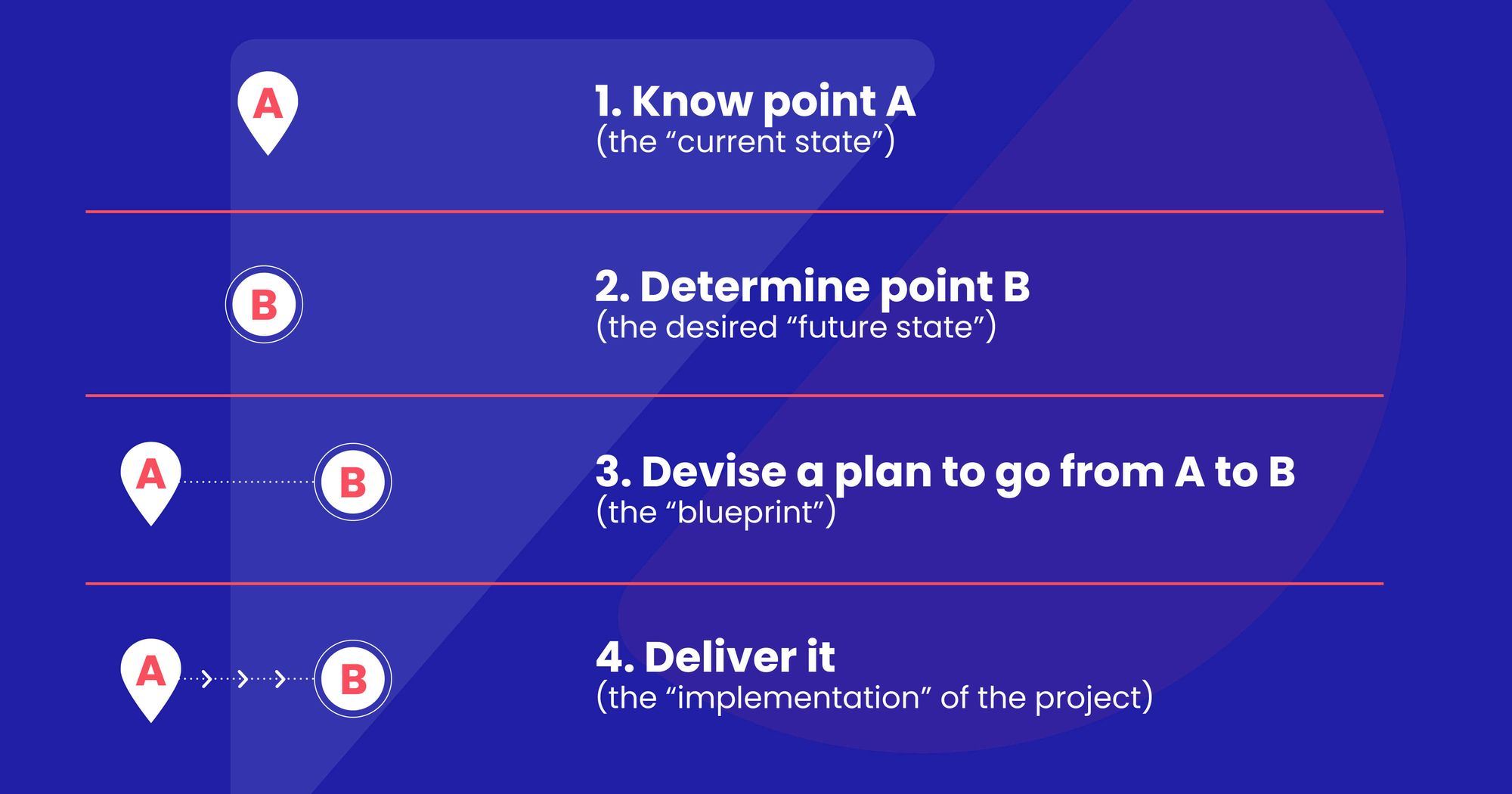

Simply put, a transformation project is taking an organization from point A (how it functions today) to point B (how it must function tomorrow).

To achieve a successful finance function transformation, you need to:

The typical shortcut

Regardless of an organization’s location, industry or size, the team appointed to transform its finance function (including the CFO) wants to quickly form a vision for the future...and for good reasons:

- Painting a brighter future boosts the morale of the staff

- It reinforces the need for a transformation

- It underpins the project team’s leadership qualities.

Documenting how the CFO and finance function currently operates is implicitly common knowledge and uninspiring. In other words, it's a waste of time and money.

The first step of your journey: knowing your current state

The problem is that, by shunting the current state analysis, the project team runs three risks:

The first is that the project team tends to make assumptions about where the problem the transformation needs to fix lies. Thus, they may throw time and money at the wrong problem.

The second is that, because the staff isn't offered the opportunity to voice their frustrations upfront, they may be reluctant to support a project that might not solve their daily issues.

The third is that because the project team doesn't identify how much change is needed where the staff could reject the solution. This inconveniently and frequently happens close to the deployment stage.

Sound familiar?

In other words: if you try to save time and/or money by not analyzing your current state, you'll pay an even higher price for it later. The solution is to take some initiative and spend the necessary time to identify the current state of your finance department.

How to define your finance function’s current state

A variety of tools

There are many tools to assess a finance function’s current state. Some examples include individual interviews, group workshops, “voice of customer” surveys, questionnaires, process mapping, organization road mapping, RACI analysis, advanced analytics, and consulting firms. Not to mention your favorite search engine will provide more than you can think of.

But if you're serious about transforming your finance function, use the maturity assessment framework. Although it'll not suffice by itself to build a current state analysis, we like it for the following reasons:

- It's based on quantitative data, data management, data governance, and metrics. You can have data-based conversations with the staff, the project team, finance executives, and anyone involved with decision-making

- It's customizable. You can tailor them to your organization

- It's scalable

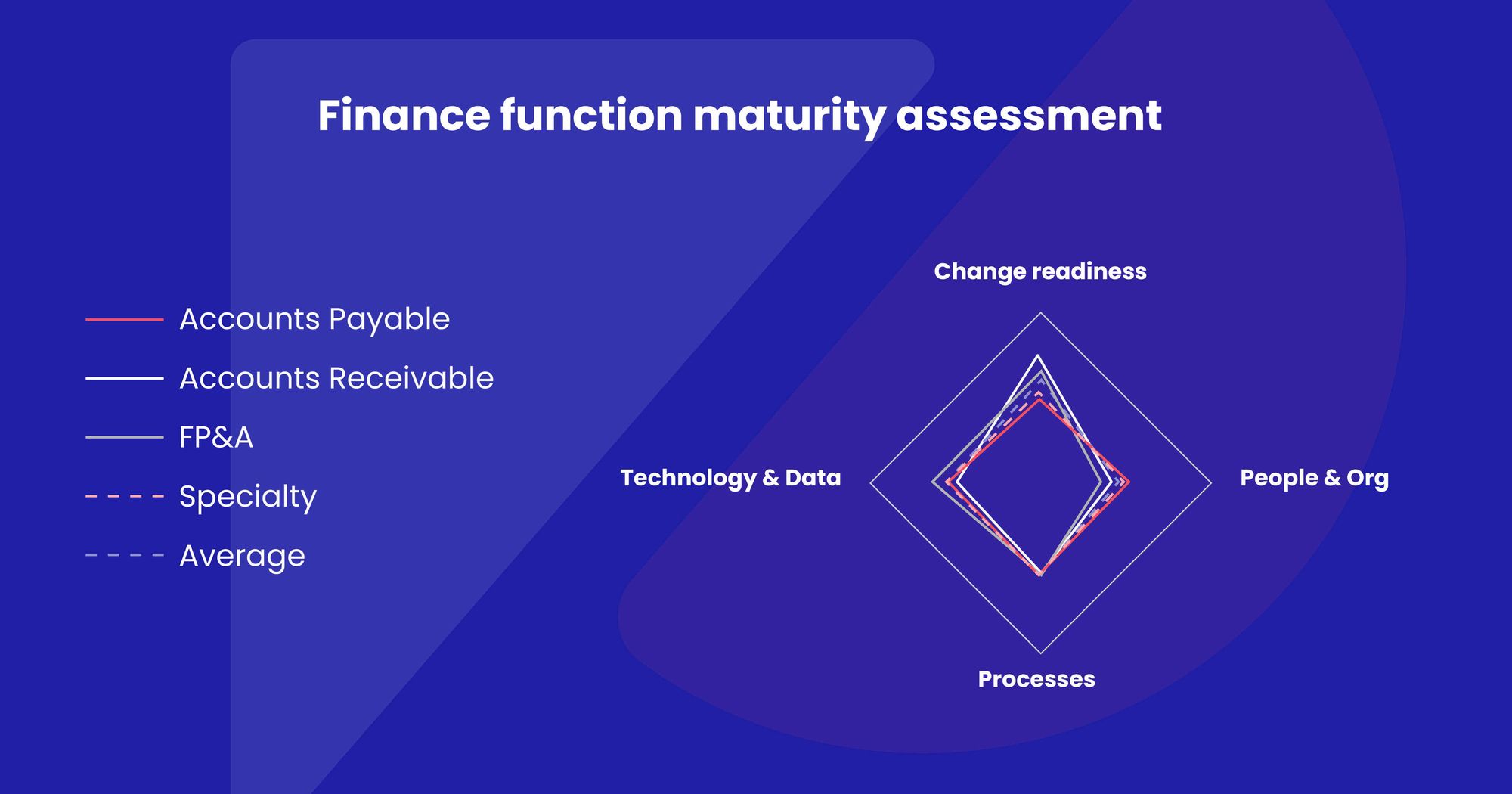

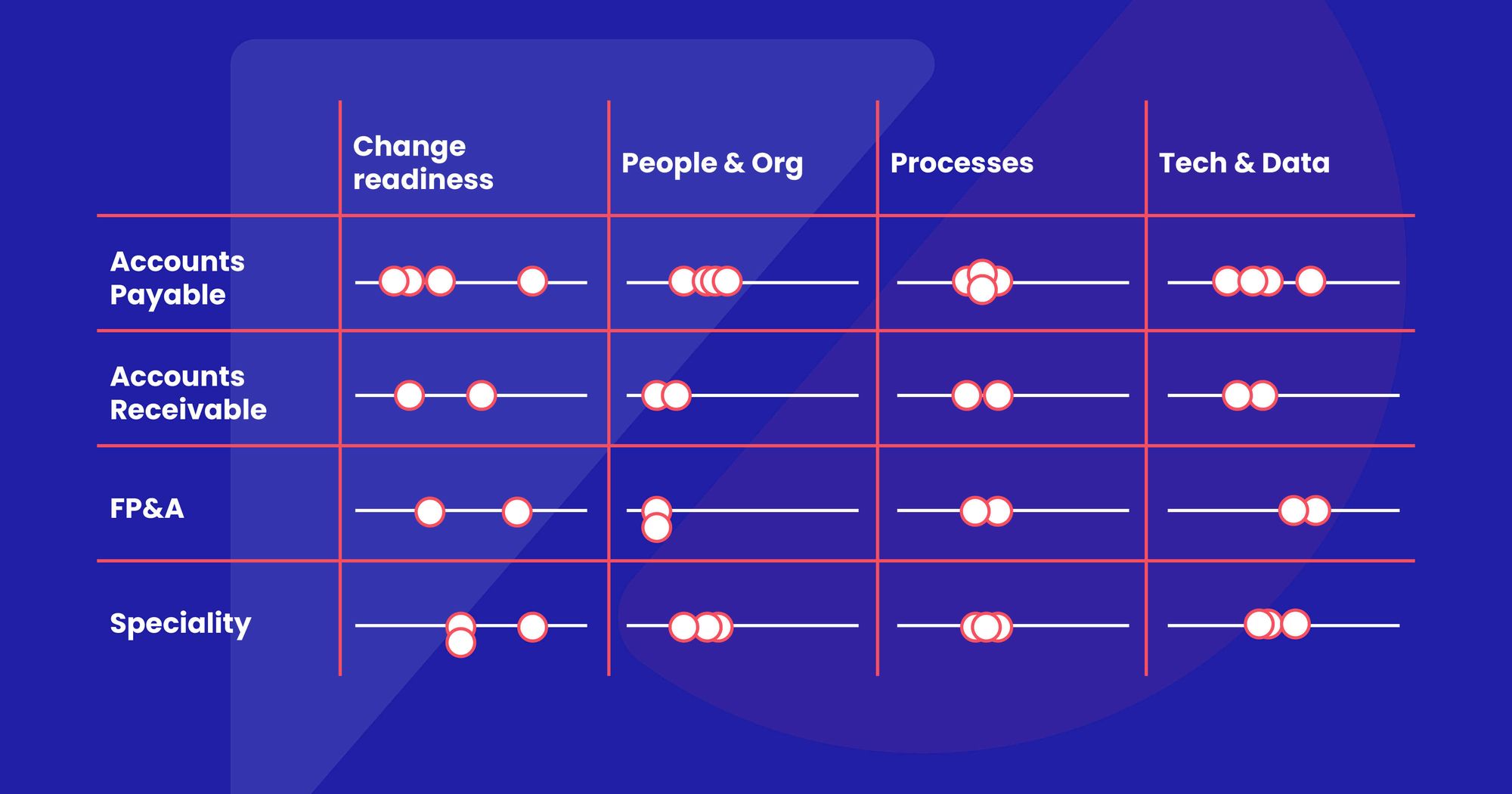

Example of an output of the data analysis:

The maturity assessment framework for finance functions

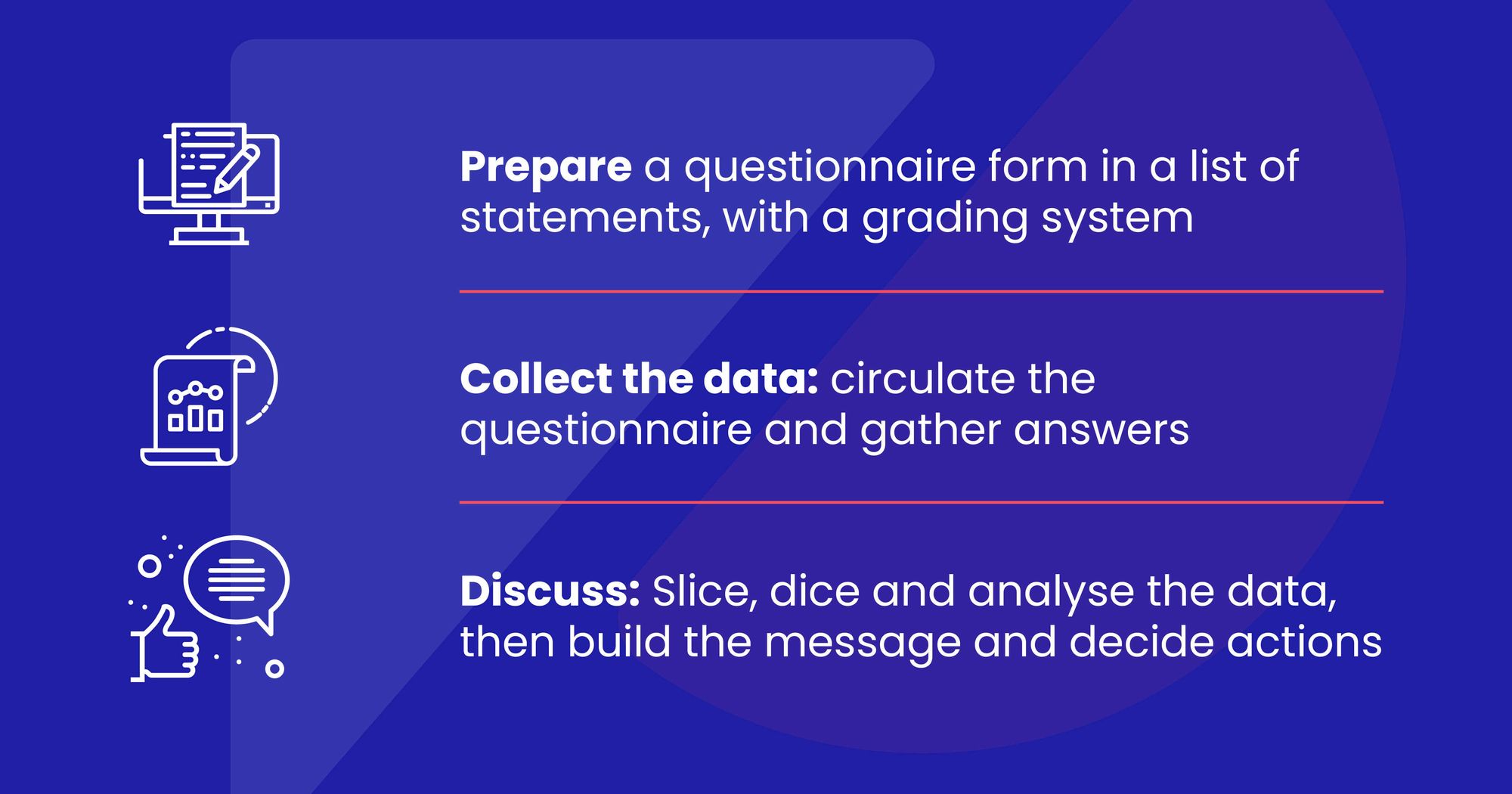

The maturity framework consists of 3 steps...

These steps are further detailed below.

1. Preparing your finance function maturity model

The maturity model consists of a questionnaire that you prepare in two parts.

The first is the list of questions you'll ask your finance team. This is followed by the corresponding statements that allow the grading of maturity. It's what we call the “operational excellence components” and it often focuses on your finance operating model.

The second is how you'll split the population to analyze the data, for example by the department.

The operational excellence components

Think about the transformation ahead. Do you reckon everything needs to change to the same amount: behaviors, skills, technology, processes…? Most likely not. So, structure your questions in components to facilitate your analysis of where difficulties lie.

A good starting point for these components is the 3-legged stool: people/process/technology.

For each of these 3 components, we've outlined a series of questions and some statements to give you a starting point. We've only outlined statements for levels 1 and 5. Use the following keywords in your favorite search engine to find loads of others. Some may include maturity models, maturity assessment, and finance function transformation.

Good sources also include white papers from consultancies like BCG, McKinsey, EY, PwC, Accenture, Cap Gemini, etc.

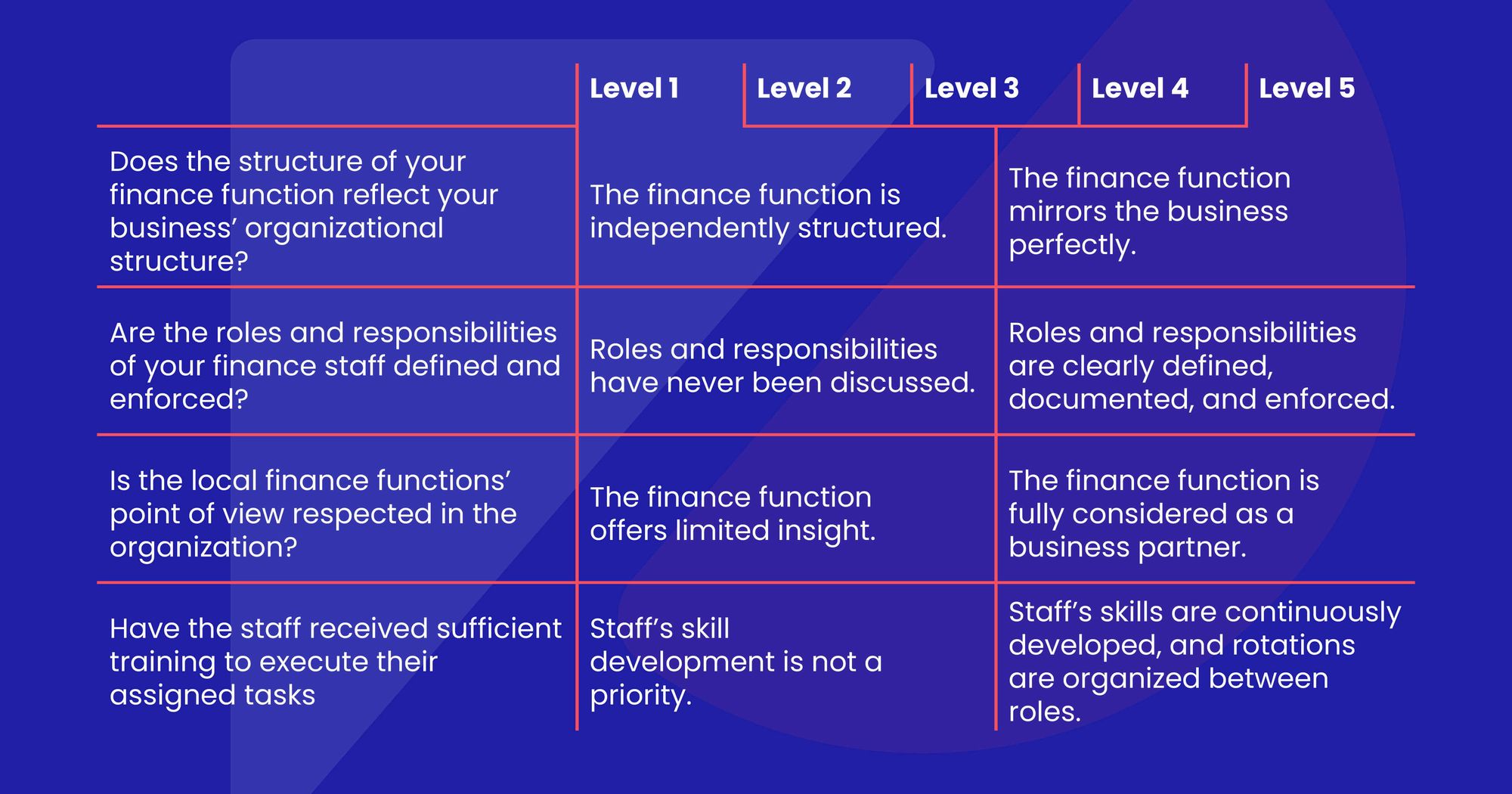

People within the finance function

This will help understand how well your finance organization corresponds to how core business processes are organized. This will also help clarify your team’s competency and how well your staff is skilled and trained to perform their duties.

It answers the question: does the way we are organized and staffed meet our business counterparts’ expectations?

Questions to grade include:

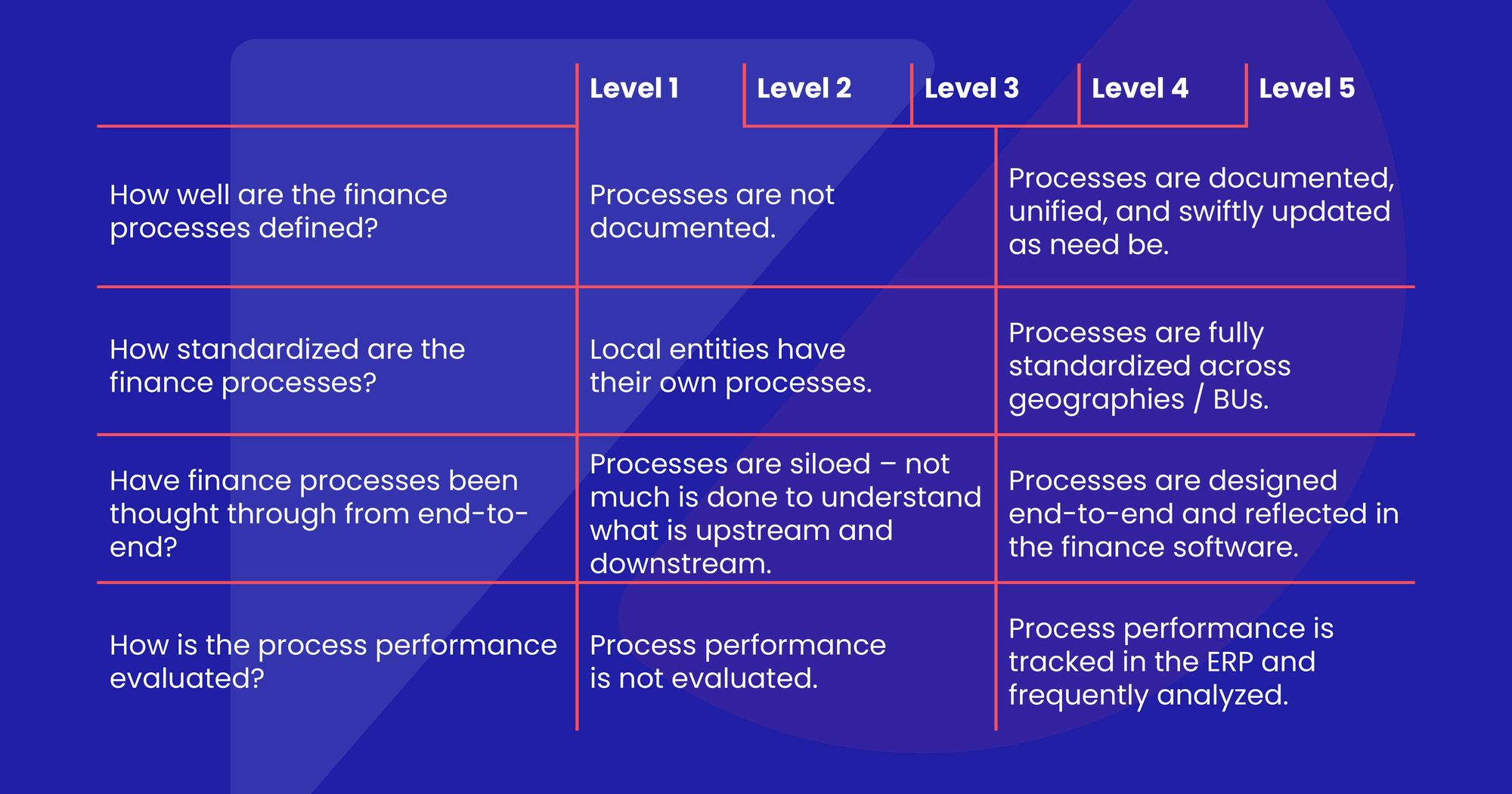

Processes within the finance function

This will help understand how effective and efficient your finance organization is. This answers the following questions: do our processes enable our function to perform outstandingly? Do they give us a competitive advantage? Do they optimize our risk management processes, strategic planning, etc.?

If not, what steps can we take to reach better financial management and improve our existing finance processes?

Questions to grade include:

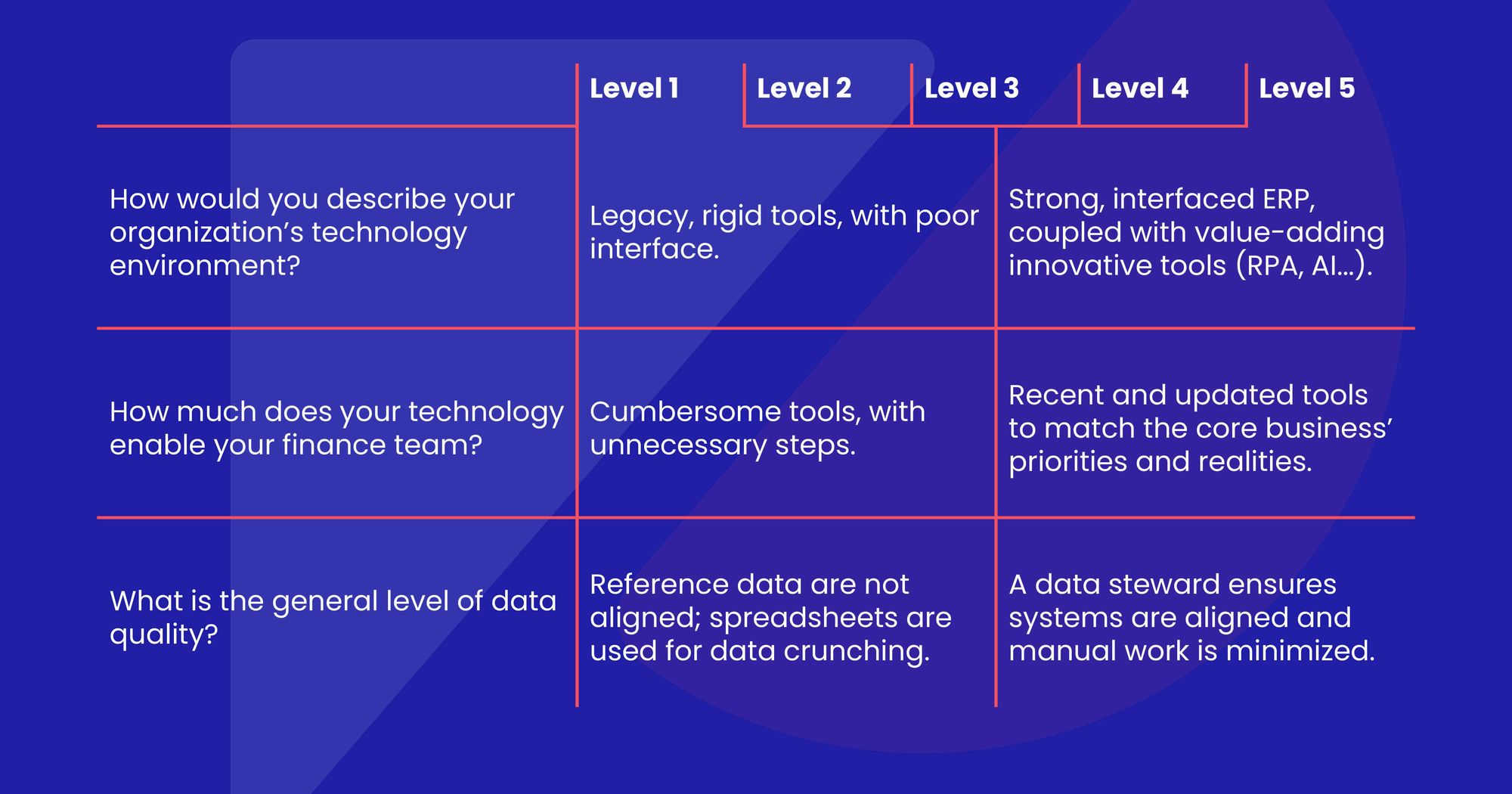

The technology used by the finance function

This will help understand how useful or painful your data and technology are for your entire organization. This answers the question: does our finance technology enable or hinder us from performing our tasks? and - Have we considered new technology to help with process automation and finance transformation, etc.?

Questions to grade include:

Other components

Depending on your organization, you may want to refine and optimize your analysis. You can do so by using some of these other dimensions:

- Finance function strategy

- Policy

- Performance measurement

- Split of organization vs. people

- Split of big data vs. technology

One interesting extra component is change readiness. Take advantage of the survey to understand how well the staff is equipped to endure a transformation in real-time. This will be particularly interesting for the change management team to craft their approach.

Analytical dimensions

In your “population” (the finance and accounting staff), it's likely all teams don't face the same issues. Prepare yourself to analyze the data by department, or by end-to-end process (purchase-to-pay, order-to-cash, record to report…) - whatever makes sense for your organization or project. For example, the Accounts Receivable team might be struggling with how they're organized, whereas the Accounts Payable team isn't.

2. Collecting your maturity data and actionable insights

Before you send the questionnaire to your team, make sure you introduce it properly.

Try to have a physical (or at least virtual) introduction to the process. Explain that you want to draw an objective picture of the current state to make a plan for continuous improvement.

Your team (and other stakeholders) must feel that their view matters. This is a leadership move.

“We are required to change, but we can prioritize what needs to change. To succeed, we must first understand where we should start and what matters the most”.

Then, send the questionnaire. This can take a variety of forms from a spreadsheet attached to an email to an internal professional, GDPR-compliant webform.

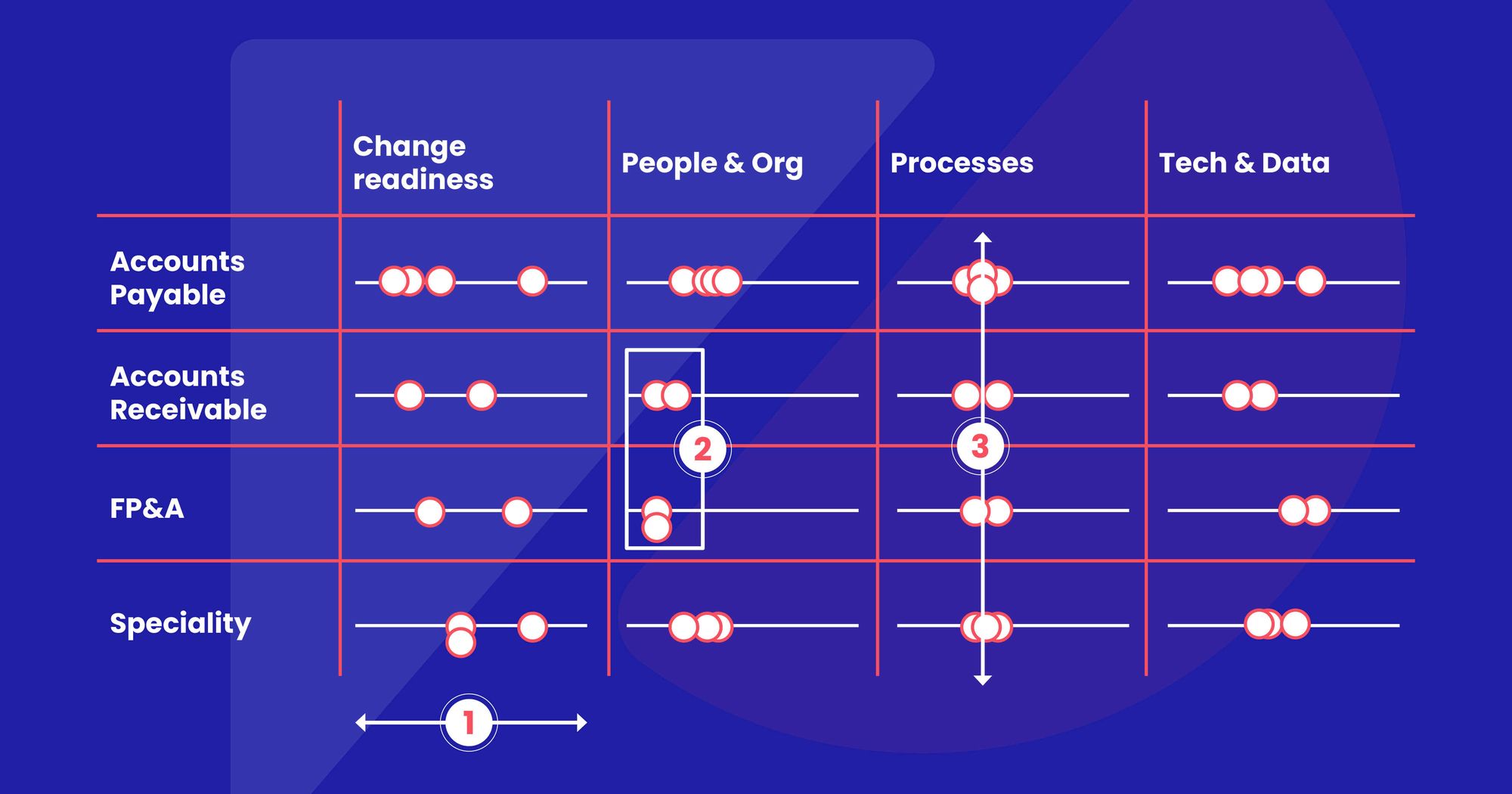

Finally, collect and organize the data. If you have the tech, you can use automation or an artificial intelligence tool to help sort the data. Essentially, it’s time to start slicing and dicing it by analytical dimension. In the figure below, the data is analyzed by department.

3. Enabling the transformation of a finance function

Analyze the results

Take a moment to look at what the data is telling you.

In the figure above, you can see the following:

1. The scores on the change readiness components are widely different. This indicates that the team members must have their needs addressed individually.

2. Two groups assessed themselves below others on the People & Organization component. This indicates they do not feel they are organized or that their skills and capabilities are at the level they need to be to perform well.

3. The team consistently estimates the level of maturity of your processes. This indicates that no team feels their outputs are subpar to others.

Clarify and calibrate

After analyzing the data, debrief with your teams. Ask for clarification. Allow them to review their grading. This conversation may help them to calibrate their understanding.

Both the CFO and finance team must be clear on where the challenges lie ahead.

Once the analysis is stabilized, it's good practice to formalize an opinion. The figure above could lead to the following statement:

“We must modernize our finance function to address the two key challenges we face. We must make sure that first our staff is upskilled and better aligned to our core business, and second processes are reviewed to reach industry standards. There'll be adjustments to our finance and accounting software in targeted areas such as machine learning, forecasting, budgeting, and others per ad hoc."

"Most importantly, we must make sure we put an appropriate change management process (and performance management) in place since there's disparate readiness for change in the team, as we want everyone to go through this journey successfully.”

Assessing your maturity level is a good way of defining your finance function’s current state, as it is simple to understand and drives data-based conversations. Furthermore, the framework can be further used to place where you would like your finance function (including the CFO and other finance leaders within the entire organization) to operate after the transformation.

Good luck in your transformation journey! Feel free to reach out to me on LinkedIn.

Follow us on LinkedIn

Follow us on LinkedIn