Finance transformation is a crucial business strategy gaining traction across industries worldwide. Gone are the days when you spent most of your time manually inputting data into spreadsheets (yawn!).

Now, with the help of automation, you can free up valuable time and offer your unique expertise to influence key decisions and drive the business forward.

But, as with any transformative business strategy, it's essential to get buy-in from the top. So, how can you convince stakeholders to invest in finance transformation? And perhaps more importantly, how can you leverage technology to drive positive change?

In this guide, we'll delve into the exciting world of finance transformation and explore how you can harness its power to take your business (and your career) to the next level.

In this guide, you’ll learn:

- The definition of finance transformation

- Why it’s so important

- Benefits of digital transformation in finance functions

- Challenges of implementing new technologies

- How to overcome challenges

- Automation and machine learning in finance

- Building a finance transformation roadmap

What is finance transformation?

Have you ever heard the saying, "out with the old, in with the new"? Well, finance transformation takes that mantra to a whole new level.

At its core, finance transformation is a strategic initiative that aims to revamp financial systems, processes, and capabilities to enhance business performance and drive sustainable growth.

The main drivers of finance transformation are to:

- Streamline financial operations

- Improve decision-making

- Enhance the efficiency and effectiveness of financial processes

But it's not just about implementing new software and tools. Finance transformation is a holistic approach involving everything from financial planning and analysis (FP&A) to accounting, reporting, and risk management.

To succeed in finance transformation, you must have a deep understanding of your company's goals, customer needs, and market dynamics. Once you're clear on those things, you can create a roadmap that aligns with your overall strategy.

Now, we won't sugar-coat it - finance transformation can be a complex and timely process. But, when executed successfully, it can help improve your financial processes, and business decisions, and position your business for sustainable growth.

Why is a financial transformation so important?

In today's fast-paced business landscape, companies must continually evolve to stay competitive. And, as finance professionals, we must adapt to this new reality by embracing financial transformation.

Gone are the days when digital transformation was considered an optional extra. Today, it's a necessity if you want to keep up with the competition and achieve your company's goals.

CFOs have a critical role to play in the digitalization of organizations. They must focus on enabling their finance function to deliver faster and more accurate data to support critical decision-making processes. This data must be reliable and timely to ensure effective decision-making. Failure to do so can result in falling behind competitors and missing out on valuable opportunities.

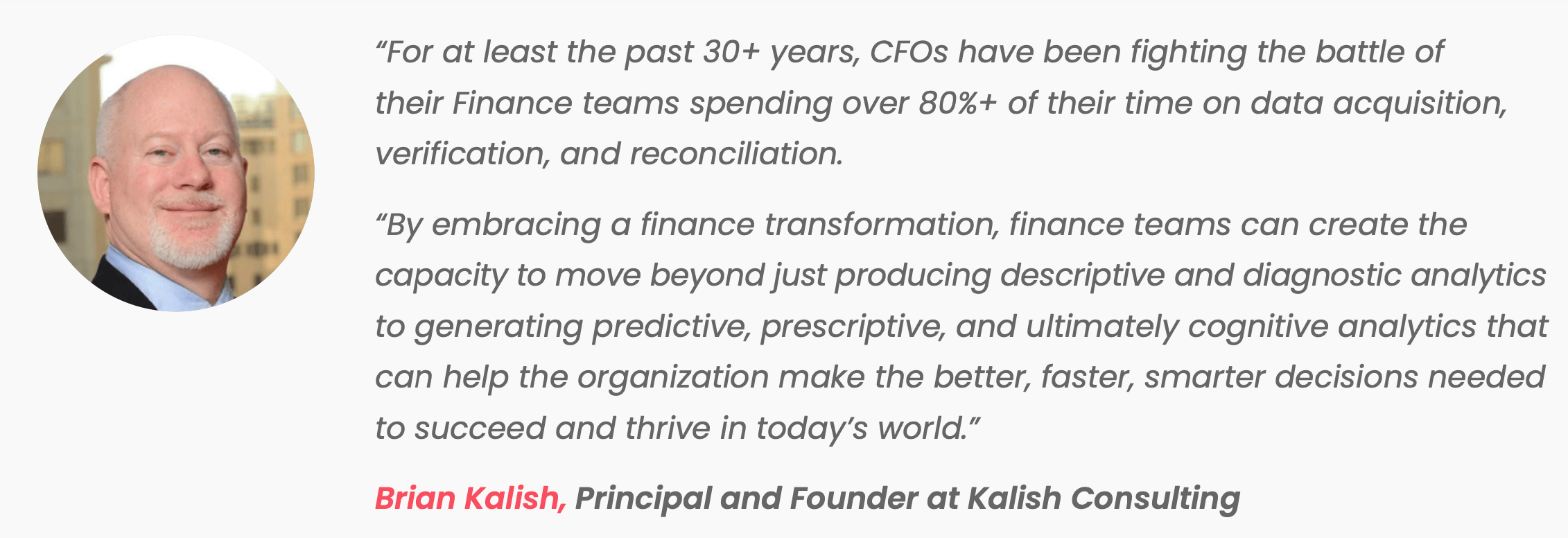

We reached out to some finance experts to get their take on why finance transformation is so important. Here's what they had to say:

“Finance transformation is a journey and not a destination. Finance Transformation is not just about implementing changes to the finance organization and operating model, re-platforming the finance processes and systems, or upgrading the existing digital technologies to increase the overall value of the finance function; it is more about reimagining the finance vision and strategy that is fully aligned with the overall enterprise-wide strategy and ambition to deliver sustainable and profitable growth story.” - Tjendra Halima, Chief Financial Officer & Management Consultant at Digital CFO Advisory Services

“Technological progress happens exponentially. Most of the tasks we do today are digital, so we also need to bring that progress to our industry. Take advantage of the best in technologies to deliver more assertive and efficient analysis.” - Paula Mota, FP&A Analyst at BRZ Insurance

“Given all the stresses and strains organizations have experienced over the past 2+ years, the need to modernize the finance function has never been more acute. We are operating in a world of ultra-high VUCA (Volatility, Uncertainty, Complexity, Ambiguity) hopefully, the highest level we will ever experience.

“CFOs need a Finance function that enables the strategic ambitions of the enterprise in this volatile environment. For most organizations, those ambitions feature transformation.” - Brian Kalish, Principal and Founder at Kalish Consulting

Benefits of digital transformation in finance

Finance transformation is a game-changing process that can help companies take their financial management practices to the next level.

But what exactly are the benefits of finance transformation, and how do they impact the finance function? Here are just a few:

1. Real-time access to financial data across the organization

By having up-to-date data on hand, finance teams can quickly:

- Identify potential issues and opportunities

- Monitor financial performance

- Measure progress against KPIs

With a comprehensive view of financial data, you'll be able to communicate better with stakeholders. This includes investors, customers, and business partners, which can help build trust and enhance an organization's reputation.

2. More streamlined business processes and financial operations

By creating a more efficient workflow, finance teams can reduce manual errors and improve accuracy, which saves time and resources.

This streamlined approach also creates a better experience for customers and suppliers. One of the main reasons being the elimination of bottlenecks in the financial process and the acceleration of the order-to-cash cycle.

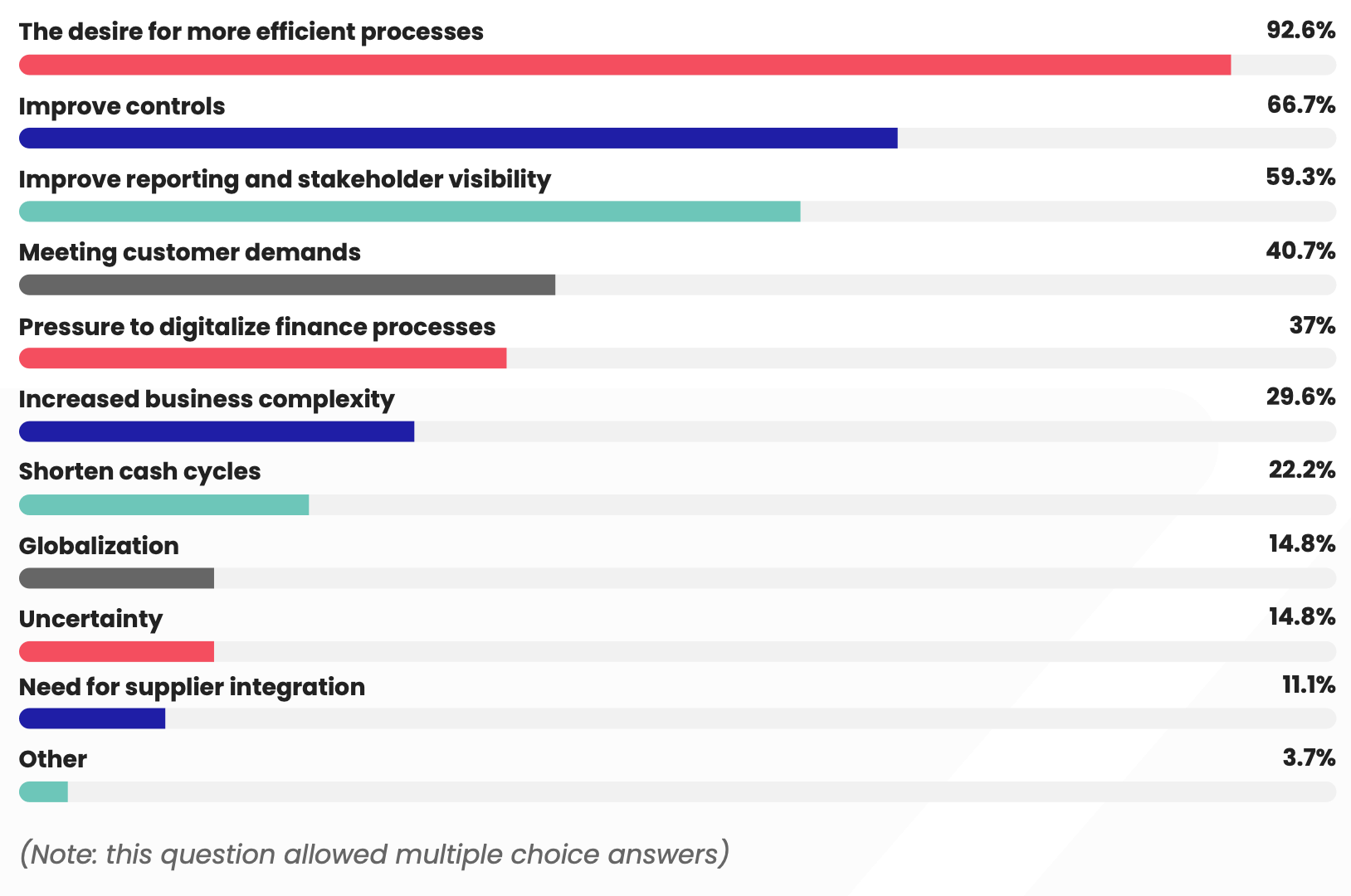

When we asked participants of our State of Finance Transformation Report what drives the need to adopt new technologies, a desire for more efficient processes came out on top with 92.6% of respondents in agreement.

Here are some more drivers of finance transformation within organizations:

3. A single source of truth for financial data

Having a single source of truth for financial data reduces confusion and errors. All stakeholders have access to the same data, which means you don’t have to worry about discrepancies, conflicting information, or manual reconciliations.

The result?

A more accurate and reliable view of financial data makes decision-making easier and more efficient.

Another reason why having a single source of truth is so beneficial is that it helps reduce the risk of data breaches or other security issues, as all financial data is stored in a centralized, secure location.

4. The automation of time-consuming, manual finance tasks

By automating tasks like invoice processing and account reconciliation, finance teams can improve accuracy and reduce the risk of errors.

Automation also frees up time, allowing finance teams to focus on higher-value activities, such as strategic planning, financial analysis, and risk management.

5. Improved collaboration and communication across the organization

Finance transformation projects improve collaboration and communication across the organization by providing better access to financial data and streamlining financial processes.

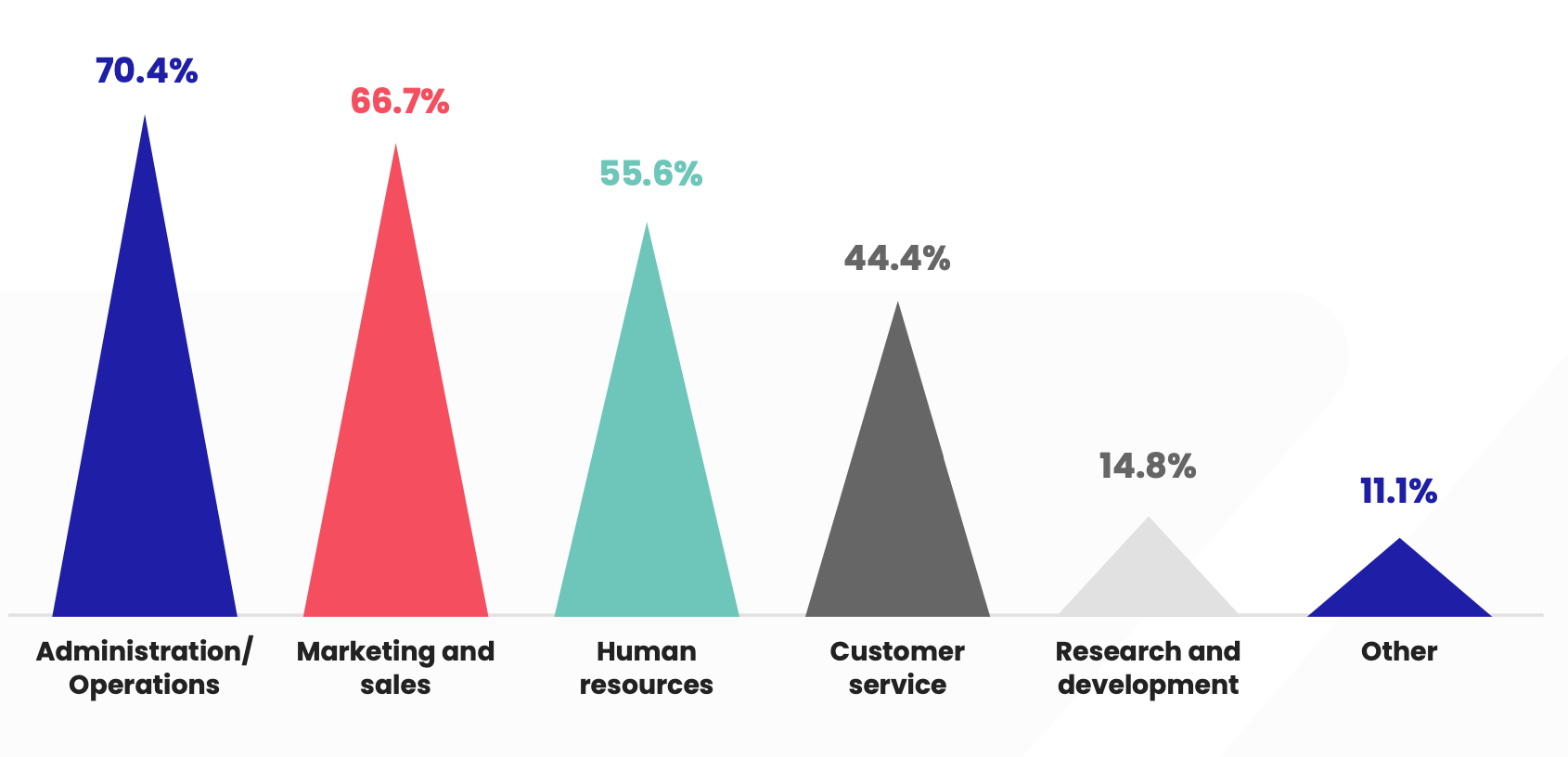

96.3% of the respondents of our report agreed that technology helps to provide more opportunities to collaborate with other departments including administration/operations, marketing and sales, human resources, customer service, and more.

Ultimately, improved collaboration can help the organization achieve strategic goals and enhance its competitive advantage.

We asked a few finance leaders to share their thoughts on how they believed finance transformation positively impacts the roles of finance professionals, from FP&A Managers to CFOs.

Let’s see what they had to say:

Challenges of implementing new technologies

Embarking on a journey towards a better financial future can be a thrilling adventure, but it's not without its fair share of challenges. The path to finance function transformation can be a bumpy one, and businesses must be prepared to navigate through some obstacles along the way.

Here are some of the key hurdles companies often face during the finance function transformation process:

Resistance to change: Finance professionals may be accustomed to the way things have always been done and may be reluctant to embrace new methods. However, with the right approach and communication, organizations can win over the hearts and minds of their finance teams and get them on board with the change.

Integration issues: Integrating new systems and processes with existing ones can be like fitting a square peg in a round hole. There may be unforeseen complications, leading to delays and additional costs. However, by taking a proactive approach and planning ahead, businesses can reduce the risk of integration issues.

Data quality issues: Accurate and reliable financial data is crucial to success, and any issues in this area can have severe consequences. To mitigate this risk, organizations must prioritize data quality and ensure that they have the right tools and processes in place to maintain it.

Lack of expertise: Finance transformation requires specialized knowledge in both IT and financial processes and systems. Organizations may not have the necessary expertise in-house, leading to additional costs and delays. In such cases, outsourcing or partnering with a specialist can be an effective solution.

Budget constraints: Transforming your finance function can be a costly endeavor. Limited funds can be a significant challenge, and organizations must find ways to invest wisely and make the most of their resources.

Time constraints: Finance transformation is a time-consuming process, and companies may find it challenging to balance the need for transformation with day-to-day operations.

Lack of a digital transformation strategy: Without a clear digital transformation strategy, digital transformation efforts can lack direction and may not align with overall business goals. This can lead to a lack of focus and wasted resources.

Security concerns: The implementation of new financial systems and processes can pose security risks, such as data breaches or cyber-attacks. It is essential to ensure that appropriate data security measures are in place to mitigate these risks and protect sensitive financial data.

By understanding the challenges and taking steps to address them, organizations can increase their chances of a successful transformation.

How to overcome these challenges

| Challenge | Solution |

|---|---|

| Resistance to change | Involve employees in the transformation process from the outset. Communicate the benefits of the transformation and provide training and support to help employees adapt to new ways of working. |

| Integration issues | Assess the compatibility of new systems and processes with existing ones before implementation. Pilot testing and phased implementation can help identify and address integration issues before they become major problems. |

| Data quality issues | Establish clear data governance policies and procedures. Regular data quality checks and audits can help identify and address any issues. |

| Lack of expertise | Hire external consultants or partner with vendors who specialize in finance transformation. This can help ensure that the transformation is implemented effectively and efficiently. |

| Budget limitations | Explore different financing options such as leasing or financing arrangements. It's also important to prioritize investments based on the expected ROI and to seek out cost-effective solutions where possible. |

| Time constraints | Create a realistic timeline and allocate sufficient resources to the transformation project. Prioritizing tasks and breaking the project down into smaller, manageable components can also help ensure that the transformation stays on track. |

| Lack of a digital transformation strategy | Develop a clear and comprehensive strategy that aligns with their overall business goals. This strategy should include a roadmap for finance transformation that outlines key milestones and timelines. |

| Security concerns | Implement robust security measures and protocols to protect sensitive financial data. This may include encryption, access controls, and regular security audits and testing. |

Automation and digital transformation

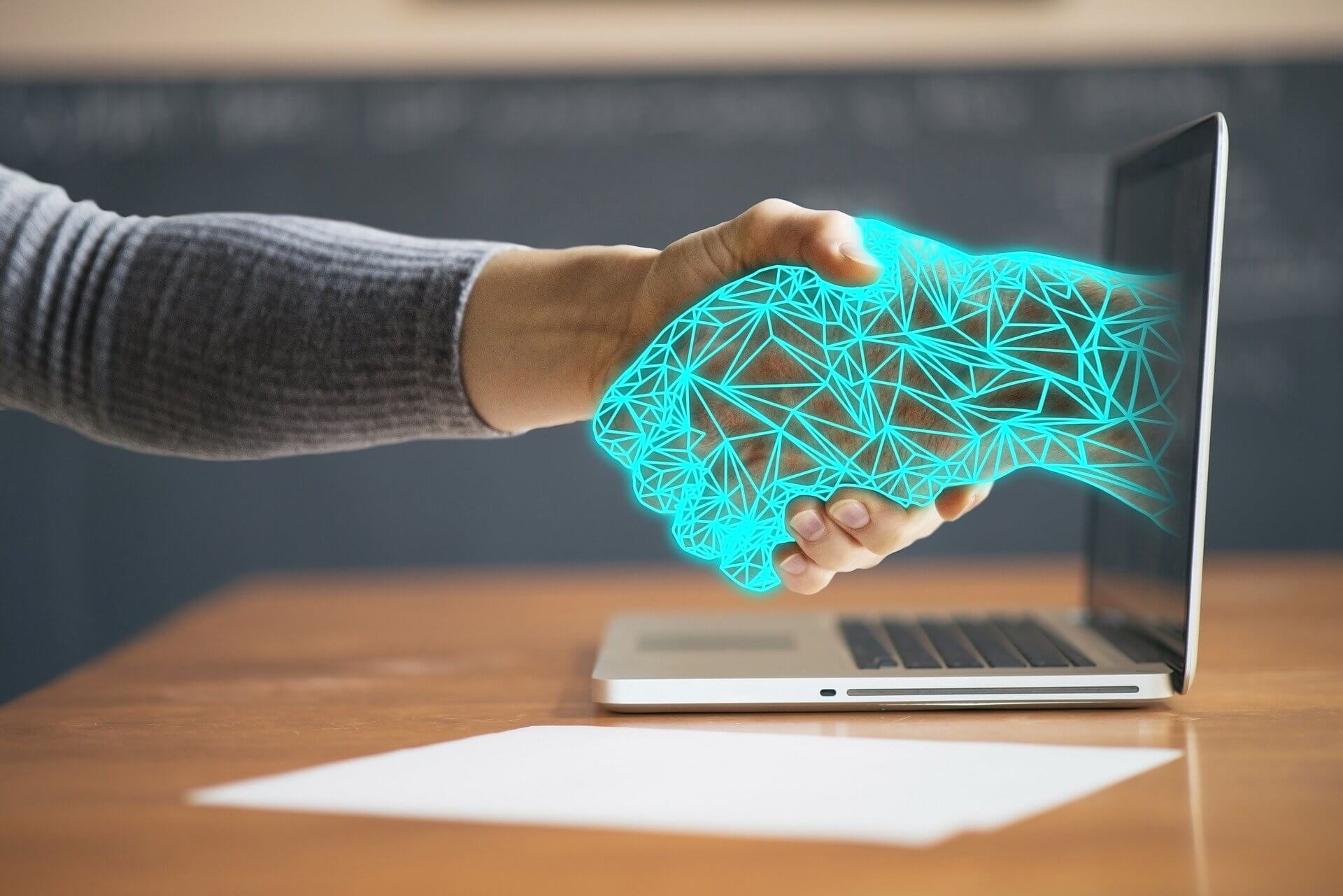

The use of automation and machine learning in the finance function has truly revolutionized the way CFOs approach financial data analysis. With these cutting-edge technologies, finance teams can make better decisions faster, which can ultimately drive business growth.

By automating manual finance tasks, such as accounts payable and receivable, finance teams can eliminate time-consuming and error-prone manual processes. This not only frees up time for more strategic tasks, but it also reduces the risk of human error, ultimately leading to increased accuracy.

Machine learning takes this a step further, allowing CFOs to improve financial forecasting and risk management. By analyzing historical financial data, machine learning algorithms can identify patterns and trends that may not be visible to the human eye. These insights can be used to make more accurate predictions about future financial performance, as well as identify potential financial risks and provide recommendations to mitigate those risks.

As more and more companies adopt these technologies, we can expect to see even greater improvements in financial performance and decision-making. However, it is important to note that automation and machine learning are not a silver bullet. CFOs must still exercise sound judgment and use these tools to augment, rather than replace, their financial expertise.

How to build a finance transformation roadmap

To create a successful finance transformation, you need to understand how it aligns with business strategy, allocate resources to initiatives that'll deliver the most business value, manage expectations and monitor/measure the overall success of the transformation.

Ready to build your finance transformation roadmap? Let's dive into the four stages of the process in more detail:

1. Assess

To assess your current state, start by identifying the pain points and areas of opportunity for improvement within your finance function. This includes evaluating your current financial systems and processes, as well as the skills and capabilities of your finance team.

You may also want to conduct a gap analysis to compare your current state to where you want to be in the future. This will help you define your vision for the finance function and determine the key initiatives that will drive transformation.

2. Design

The design stage involves creating a blueprint for the future state of your finance function. This includes defining the new financial processes, selecting the new financial systems, and defining new roles and responsibilities for the finance team.

To design the new processes, consider best practices and benchmarking against industry standards. When selecting the systems, ensure they align with your vision and can integrate with other systems you use. Finally, define new roles and responsibilities for your finance team that align with the new processes and systems.

3. Build

With the blueprint in place, it's time to start building. This stage involves implementing the new financial processes and systems defined in the design stage.

Your main tasks will include configuring the new financial systems, migrating data from old systems to new ones, and training the finance team on new processes and systems. This is also a good time to communicate the changes to the broader organization and prepare for any potential impacts on other departments.

4. Operate

The final stage is all about running the new financial processes and systems, monitoring performance, and continuously improving the function.

Establish performance metrics and monitor the performance of the transformation initiatives against those metrics. Make adjustments as needed and continuously improve the function. This stage is also a good time to review your progress and celebrate your successes.

By following these four stages, you can build a successful finance transformation roadmap that aligns with your business strategy and delivers the most business value.

Remember to allocate resources to the initiatives that will deliver the most impact and manage expectations throughout the process. With a well-designed roadmap, you can achieve a more efficient and effective finance function that drives better financial performance.

Finance transformation is a critical process that can help organizations improve their financial performance and achieve strategic goals. By leveraging automation, machine learning, and data analytics, CFOs can make better-informed decisions, reduce manual workloads, and increase efficiency.

Download The State of Finance Transformation Report!

Key topics discussed in this report include:

💡 Where finance transformation is now.

🔑 Key drivers of finance transformation.

💰 The positive impact of automation in finance.

🤔 Common challenges and how to overcome them.

⚒️ How to develop a culture of change.

🔮 What a successful adoption of finance transformation looks like.

….and so much more.

Ready to get stuck in?

Grab your copy today and discover the real impact of finance transformation on not just organizations, but the everyday life of finance pros like you! 👇

Follow us on LinkedIn

Follow us on LinkedIn