In the current economic crisis, business leaders from early-stage startups to large multinational corporations, have to make difficult decisions. The financial implication of these decisions is critical. The CFO helps the CEO navigate these decisions.

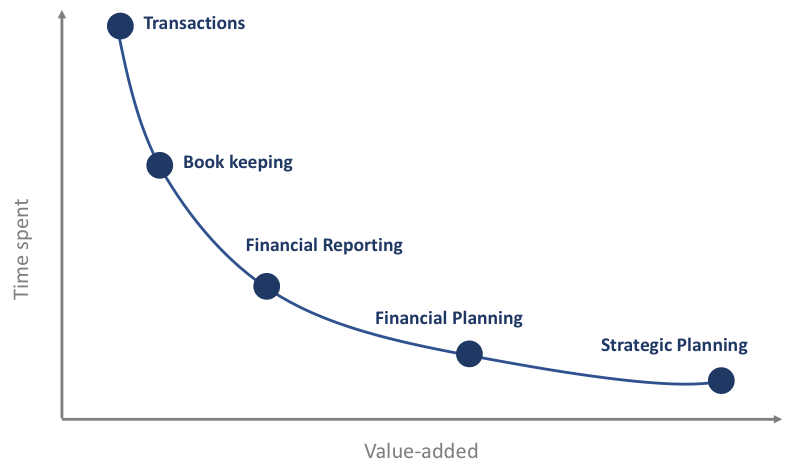

Historically, the CFO role focused on backward-looking information. This involved ensuring on-time and accurate financial reporting. The CFO role has evolved into a highly strategic role. It needs a robust system to handle the day-to-day reporting of tasks and generate accurate financial information.

I wanted to further understand the responsibility of the CFO suite, the process of billing to accounting, and the software tools available to run an effective finance office. So, I interviewed 50 people that held CFO, finance manager, and financial analyst type roles. The companies represented include venture-backed startups, mid-sized businesses, and large multinationals.

The findings are geared towards software-as-a-service (SaaS) technology startups.

In the following, you'll find a synthesis of the key findings on the following topics:

- How do you view the responsibility of the CFO suite?

- System for a high functioning finance office

- Integrating disparate finance tools

- Getting full visibility of subscription revenue

- Financial planning of the CFO suite

How do you view the responsibility of the CFO suite?

The following are select responses from the finance leaders I interviewed. Their titles include CEO, CTO, COO, CFO, and VP of Finance of venture-backed startups.

“Pre Series B, it’s a part-time role to track past financial numbers. Post Series B, it becomes a full-time job to support strategic planning. This includes segmenting where revenue is coming from, how to best allocate capital, setting equity financing strategy, and identifying other sources of financing.”

“Building strategic goals with the CEO and Board of Directors, then making sure the functional organizations get the information they need to execute on the strategy.”

“In the startup world, unit economics is the new product-market fit. Especially in times like these, unit economics needs to be strong. This task falls to the finance leader.”

"The CFO suite doesn’t want to be the “Department of No.” Rather, our job is to provide a framework for the department managers to think about their budget.”

“It evolves with stage. In the early stages, it is cash flow management. As a growth-stage startup, the question is how to achieve profitability while continuing to invest in growth.”

“There are three primary components to the CFO position. One is accounting: you need this done to inform the next two. The second is financial planning: how things will develop in the future. Third is financing and cash management.”

System for a high functioning finance office

Traditionally, the chief financial officer (CFO) handles tracking the company’s past and present financial situation and ensuring on-time and accurate financial reporting. Today, the CFO informs strategic decisions that drive the success of the company. Yet, a significant amount of time is spent on tedious tasks.

It is critical to get the repetitive tasks correct. After all, those deliverables feed into financial planning and strategic planning. If the bookkeeping is incorrect, then the CFO runs financial analyses based on incorrect information. To cut errors and increase efficiency, these are the popular software solutions.

Accounting is a driver for software selection

For accounting software, the industry standard for startups and SMBs is QuickBooks. It connects with bank accounts and corporate credit cards to track financial information. Forward-looking financials are tabulated elsewhere, typically in Excel. For companies with heavy inventory, using QuickBooks needs more manual intervention. QuickBooks is sufficient for small businesses. But, as the business becomes larger and more complex, limitations arise. These limitations are key drivers for growth-stage startups to transition to enterprise-level accounting tools.

For enterprise-level accounting tools, there were a few mentions of Sage Intacct but the popular choice is NetSuite. NetSuite is an integrated business platform that eliminates the need for separate software applications. It can process the data of sales, customer relations, marketing, and human resources. Other features include:

- Loading and Backup - NetSuite loads quickly. Backup happens behind the scenes without any downtime or need to get off the system.

- Multiple User Performance - NetSuite can be used by multiple users at the same time. Plus, it doesn’t show any performance issues.

- Application Access - NetSuite loads in any modern browser from any location. The client is free to be mobile.

- Security and Audit - NetSuite role-based permission can be very granular. It includes audit trails, which illustrate who made field level changes including before and after data element changes.

When to switch: When a company reaches ~50 employees, the management begins thinking about switching to NetSuite. However, it can be difficult to justify a 10x price increase from QuickBooks. Between 50 to 150 employees, many startups transition from QuickBooks to NetSuite.

Rounding out the finance software stack

- Expense report software: Expensify & Brex - Both are sufficient for expense reporting and reimbursement. Brex offers a corporate credit card.

- Customer relationship management: Salesforce - The favorite CRM tool for SMBs and enterprise companies. A few respondents noted using HubSpot but almost all are switching over to Salesforce.

- Billing and invoicing software: Bill.com - Cloud-based platform to pay vendors through direct bank transfer or sending a check. SMBs often use multiple billing platforms. This is because their customer may use a different billing service.

- Payroll & HR software: Zenefits & Rippling - Zenefits is the leader for SMBs and Rippling is rapidly growing. Rippling offers an end-to-end software solution from sending an electronic offer letter to a seamless onboarding experience.

Integrating disparate finance tools

Many startups use at least 5 unique software tools to manage the finance office. Each tool houses different data and serves a different purpose. As a result, there is high touch to ensure data moves around the company on time and correctly. While it may be appealing to integrate all the systems, there is a trade-off between integration and flexibility.

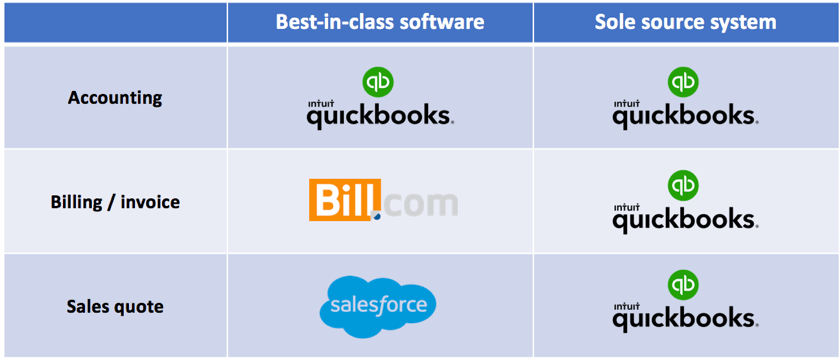

One solution is to use one tool for many applications. For example, QuickBooks is known for its accounting capability. But, it also offers limited functionality for generating quotes and invoicing.

Using best-in-class software may require more manual touch. Yet, it unlocks more functionality to help accurately track the business. Whereas when you apply a sole source system, it integrates data across the financial process, but there is less functionality. Of the finance leaders interviewed, only a few companies chose the sole source approach. The vast majority of companies prefer to have more functionality.

In-house hire vs third-party firm

Outsourcing to third-party firms is a necessary option when scaling. Not every task will need a full-time or even part-time employee. The benefit of bringing on a third party is getting a specialized worker who's trained, experienced, and works at a reasonable cost.

Choosing what to outsource to third-party companies can be challenging. Tasks that slow down individual team members are a good place to start. There are some tasks that everyone dreads. These are often time-consuming and repetitive tasks that must be done regularly. These tasks are usually easy to delegate to others to help boost productivity. A few examples:

- Answering service to take customer service phone calls.

- Payroll services to handle payday tasks.

- Analytics reports and campaign monitoring.

Rather than hire someone in-house, companies often choose to outsource accounting and recruiting roles.

- Accounting - Most companies responded that they outsource accounting firms for general bookkeeping. This was even more evident in the early days of company life. Example accounting firms include Attivo Partners and Keating Consulting. This is paired with QuickBooks. After hiring a finance leader, the accounting firm is usually retained to handle bookkeeping. Meanwhile, the finance leader focuses on financial forecasting and strategic planning.

- Recruiting - Startups in the hypergrowth phase must decide between hiring a full-time recruiter vs retaining a recruiting firm. The latter option is expensive with the company likely paying a substantial premium compared to an in-house hire. The premium is to pay for the flexibility. The company can turn off the service anytime.

Getting full visibility to subscription revenue

The majority of the companies interviewed are venture-backed SaaS companies. At the growth stage (roughly post Series B), the customer base often gets large enough that tracking revenue becomes a challenging task.

- Each month, how much of our ARR is from new contracts? Existing customers expanding? How much ARR churned?

- What is our revenue split between subscription vs professional services?

- What is our gross revenue retention rate last month? How much is attributable to one customer success team vs another?

- How much revenue are we recognizing? What does the revenue waterfall chart look like?

These are complex questions to answer. Only a few companies have an in-house expert on this subject, especially in light of the new accounting rule for revenue recognition.

GAAP Revenue Recognition Rules

Effective December 2018, FASB changed the guidelines to recognizing revenue under ASC 606. The new accounting standards aim for international alignment on how companies recognize revenue from contracts with customers.

For software, there are two forms of deployment but three forms of payment schedules. The software can be deployed on-premise or by cloud.

- On-premise: This is the perpetual maintenance model. The vendor sells a perpetual license to the customer. The software is installed on the client-server. The pricing structure is a high initial set-up fee plus an annual maintenance fee. The upgrade process is difficult. The customer must migrate the data to the new software and then redeploy each update.

- Cloud: This is the software-as-a-service business model. The vendor hosts the software on its cloud server. The client pays a monthly or annual subscription fee to use the software. The benefit of hosting on the cloud is the simplicity to push updates. Each software update is automatically pushed to the customer.

From the perspective of a financial statement, the SaaS model is preferred because the revenue model is more predictable. The perpetual maintenance model fluctuates more as a substantial piece of revenue. Many on-premise providers have transitioned to the cloud. For those that haven’t yet, they may charge a subscription fee similar to cloud solutions. This is called Turn License.

- Turn License: The vendor provides the software solution on-premise. However, there is also a subscription fee, identical to a SaaS business model.

ASC 606 Restriction: While the turn license model creates a more attractive financial statement, per ASC 606, companies must recognize revenue per their revenue model. In other words, the vendor may charge a subscription model but it must recognize revenue per the perpetual maintenance model.

Software solutions for revenue visibility

For companies seeking clarity and visibility in their revenue, these were primary solutions:

- ChartMogul

- ProfitWell

- Baremetrics

- SaaSOptics

All four solutions serve SaaS businesses by providing all subscription reporting and analytics - in one place.

- ChartMogul, Baremetrics, and ProfitWell are great options for businesses lacking variation in subscription business models. Netflix and Spotify are examples of companies with limited variation.

If your business sells software subscription services to an enterprise and you deal with complex revenue subscriptions, SaaSOptics is a strong solution. While the platform does not have the best user interface, the feature set is comprehensive.

Pricing also varies significantly. Their pricing model is a function of the customers’ MRR. Assuming a company has $250K MRR:

- ChartMogul charges $725 per month

- Baremetrics charges $300 per month

- ProfitWell is free (pay for add-ons)

- SaaSOptics charges $900 per month

Financial planning of the CFO suite

There will always be a need for someone to balance the books and perform critical routine tasks.

The CFO role is much more dynamic today. Their value is in strategic planning, which includes:

- Designating resource allocation

- Using financial information to inform product planning

- Identifying M&A opportunities.

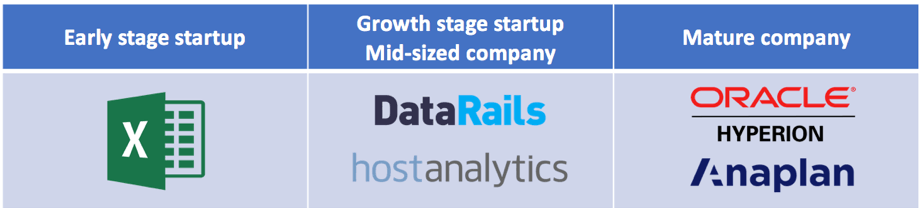

There are several tools at your disposal to elevate the financial planning function. These tools will inform strategic planning. The right tool for you depends on the size and stage of your company.

For early-stage companies, there is little to no financial planning involved due to limited financial information. As a company matures, there are several mid-tier FP&A tools on the market, including DataRails and HostAnalytics. Due to the limitations of these tools, the majority of financial planning work still occurs on Microsoft Excel.

When companies switch to Oracle NetSuite, they can get access to an add-on called Hyperion. Hyperion is Oracle’s financial planning and analysis tool that sits on top of the ERP, making it a popular FP&A tool. However, its interface is described as “clunky.” Several mature enterprises have opted for Anaplan over Hyperion for its comprehensive financial planning suite. For a large enterprise to set budgets and forecasts across dozens of departments, it’s near impossible to keep the information consistent on a spreadsheet. Anaplan handles this problem well. Be prepared to pay up for Anaplan, it is an expensive software tool.

Strategic planning - Many startup finance leaders noted the same strategic challenges that they have to solve:

- Cash spread: Companies are paying their vendors net of 30 days. But enterprise customers are negotiating for net 60-75 days payment terms. The mismatch between accounts receivable and accounts payable results in an unpleasant cash spread.

- Data challenge: Each month, the CFO suite has to match cash receipt with billing. The data from Salesforce may not match the invoicing data. It’s often due to the timing of recording; nonetheless, it’s a manual process every finance leader has to deal with.

- Incomplete information: The financial information is only as good as the data from the source. For example, if the sales team is not updating its CRM, the finance team is working with incomplete data. This problem seems to reside mostly with sales.

Want to read more insightful articles by Alex Lee? Visit Alex's author page for more great articles like this one!

Searching for more resources and advice?

Sign up to our free Finance Alliance Slack community and start networking with other CFOs and finance leaders today!

Follow us on LinkedIn

Follow us on LinkedIn