Account maintenance, wire transfers, check processing...they all add up. And the more you use bank services like this, the higher the charges.

But what if you could recoup some of those costs?

Thankfully, there’s a way to offset these types of costs and that’s with the earnings credit rate (ECR).

In this blog post, we'll explain what the ECR is, how it works, and how businesses use it to their advantage.

Topics covered:

- Earnings credit rate definition

- How it works

- Earnings credit rate formula

- ECR vs. hard interest

- How ECR can positively impact your business

- Limitations of ECR

- Common FAQs

What is the earnings credit rate?

The earnings credit rate is an interest rate the bank applies to your average daily balance.

However, it’s not the same as a traditional savings account where you may see some interest accumulate each month. Instead, your bank uses that calculated ‘interest’ to offset the service charges you incur for things like check processing, wire transfers, and account maintenance.

How does it work?

The earnings credit rate is used to reward businesses for keeping money in the bank. It’s an internal calculation that translates to a credit applied to your account.

Here’s how it works:

1. The bank applies the ECR to your average daily balance over a specific period (often monthly).

2. They take that balance and multiply it by the ECR percentage to get an earnings credit dollar amount.

3. This credit is then used to offset service charges like maintenance fees, transaction fees, or other account-related expenses.

Let’s bring this into the real world for a moment.

Say that a company maintains an average balance of $1 million for the month. Now, let’s assume the earnings credit rate is 0.5%. In this case, the earnings credit would be $5,000 (0.5% of $1 million).

If the earnings credit covers all the fees, great!

If not, you (as in the company) must pay the remaining amount owed to the bank. In some cases, any excess credits may carry over to the following month.

Earnings credit rate calculation (formula)

The basic earnings credit rate formula is:

Earnings Credit = Average Daily Balance × Earnings Credit Rate × Number of Days in the Period / 365

This formula gives the total earnings credit in monetary terms for that month, which can then be used to offset the fees.

For example, if your business:

- Has an average balance of $10,000 in its account

- Owes $50 in service charges

...and your bank’s ECR is 0.5% per year, here's how you’d calculate the earnings credit:

Monthly earnings credit = $10,000 × 0.005 × (30/365) ≈ $4.11

As you can see, it’s not a huge amount of savings. And since the earnings credit of $4.11 is less than the service charges of $50, you’d still owe $45.89 in fees after the credit is applied.

ECR rewards businesses that keep higher balances with reduced banking costs. Essentially, you get a discount on services by keeping your own funds on hand.

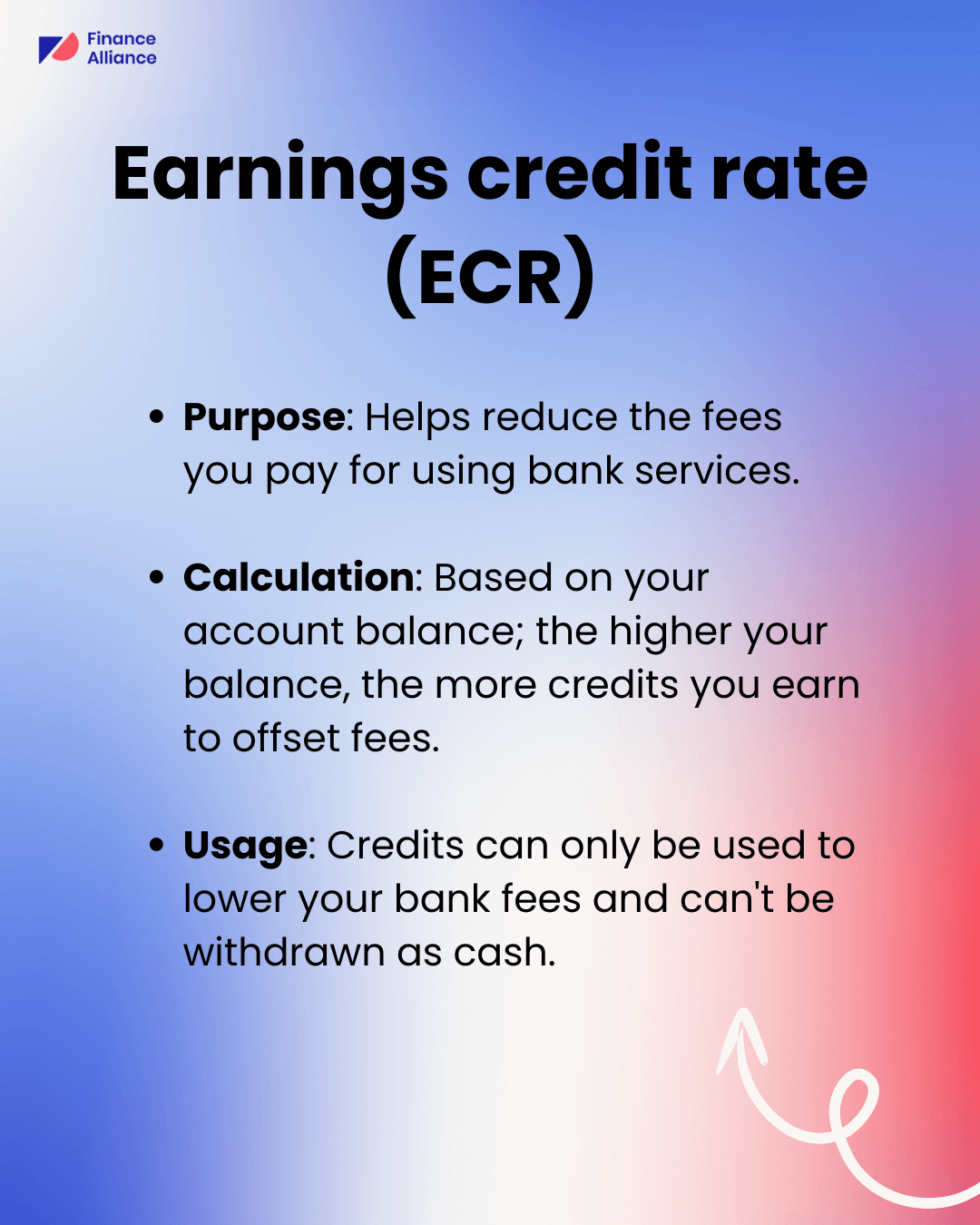

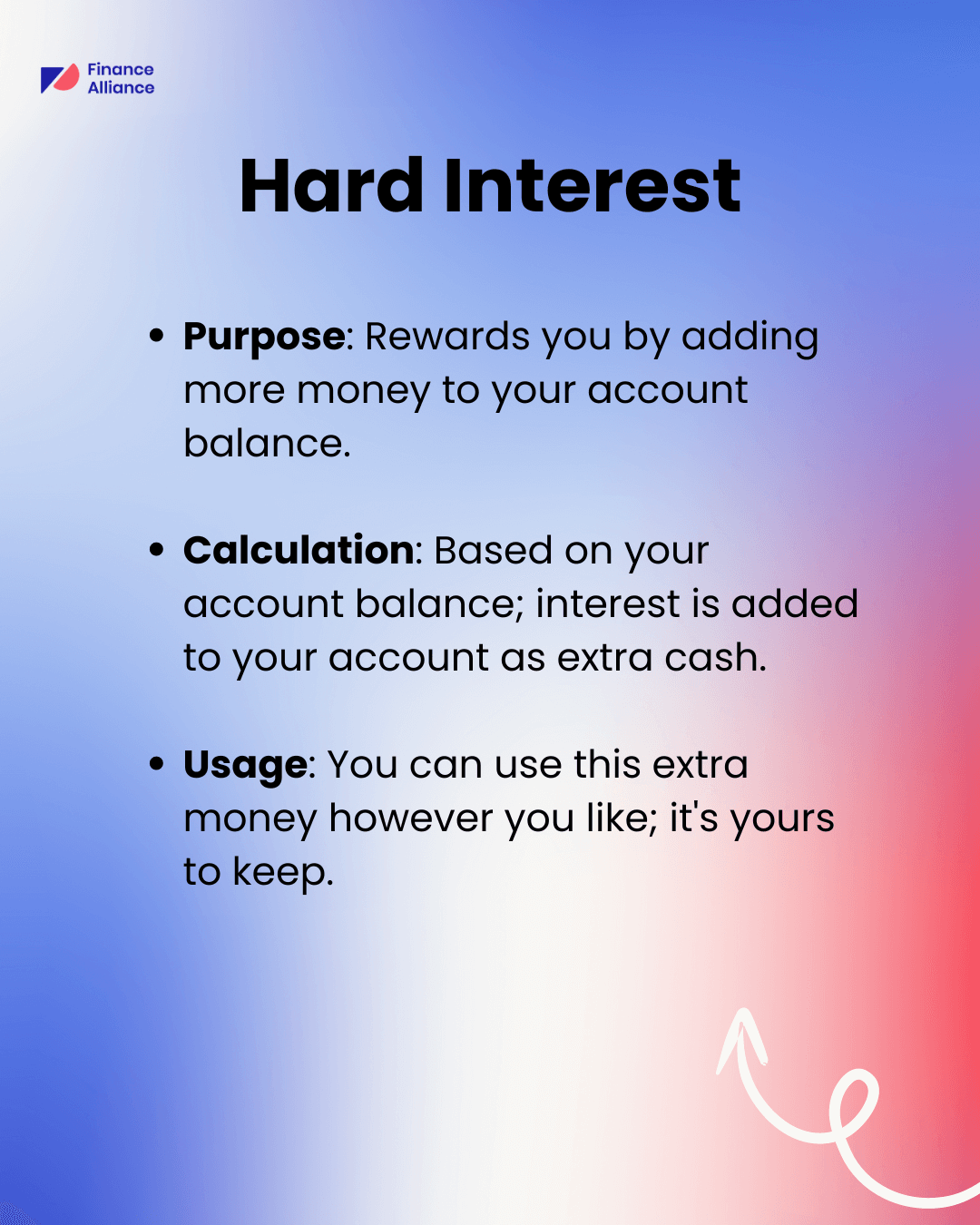

ECR vs. hard interest

There’s often a lot of confusion and mix up between the earnings credit rate and hard interest. The main difference between the two comes down to where the benefit of each goes.

Below, we look at the main difference between ECR vs interest by looking at their purpose, calculation, and usage.

Earnings credit rate (ECR):

Hard Interest:

In a nutshell:

ECR saves you money on fees.

Interest earns you money.

How ECR can positively impact your business

Now that we’ve covered the concept of ECR, let's get into the best ways it can help boost your company’s bottom line:

1. Reduces banking costs

The main benefit of ECR is that it helps reduce the monthly fees your business pays for its banking services like:

- Account maintenance

- Transaction fees

- Returned check fees

- Minimum balance fees

The credits earned are used to offset these fees, helping you to save money (even if it’s not always a huge amount).

2. Encourages larger balances

Think of ECR like a rewards program, but instead of points for buying stuff, you get rewarded for keeping more money in your business account. The more you typically keep on hand (average daily balance), the more "credits" you earn.

By keeping a higher balance, you make sure you have enough funds for daily operations without getting hit with those service fees.

3. Flexibility in cash flow management

With reduced or offset fees, businesses can have more predictable banking costs, which helps in budgeting and financial planning.

Not to mention, it helps to free up cash that would otherwise go towards fees. You can then reinvest this cash flow back into your business, whether it's for strategic growth initiatives, new equipment purchases, or simply building a healthier financial cushion.

4. Improved financial efficiency

With the savings from reduced fees, you can allocate funds more efficiently across your business operations. This might mean more resources for marketing, inventory, hiring, or other strategic investments.

By leveraging ECR to reduce fees, you can gain more control over your financial resources. With this newfound flexibility, you can be a lot more strategic with your investments and focus on areas that align with your company's growth goals.

5. Increased transparency

Another key benefit of ECR is that it gives you a clear picture of your business finances. The Corporate Finance Institute noted the increased transparency you can gain when combining “demand deposit accounts (DDAs) with the applicable ECR provide transparency in managing cash.”

This is because things like the balance information plus all transaction and fee details are readily accessible and included in your monthly account statements.

Limitations of ECR

While ECR can offer several benefits for businesses, there are also some limitations to keep in mind:

Different ECR rates

The calculation of ECR varies from bank to bank. Big players like money center banks often target businesses with lower average balances by offering them more attractive ECR rates. This strategy aims to attract a wider pool of customers.

On the other hand, regional banks tend to focus on businesses that maintain higher average balances. They reward these loyal customers with more generous ECR rates. With so much variation, it can be difficult and time-consuming to compare options and plan accordingly.

Limited to certain fees

Depending on your bank, ECR typically applies only to transactional and maintenance fees. This means that feed like overdraft charges, loan interest rates, or fees for special services, may not be covered by the earnings credits.

Non-cash benefit

Think of ECR credits like coupons you earn for keeping a higher balance. These coupons help reduce your bank fees, but they don't turn into actual cash.

If your fees are lower than the credits you earn in a month, those extra credits usually can't be carried over or withdrawn. It's all about using them to get the most out of your banking services.

Requires high balances

As we’ve mentioned, the higher your balance, the most you’ll gain from ECR. This might not be realistic for every business, especially smaller companies with limited cash flow or those with seasonal fluctuations in their income.

Smaller businesses might struggle to keep a consistently high balance due to operational needs and limited resources. And if you’re a business with fluctuating cash flow, you might also find it difficult to maintain a high average balance throughout the year.

FAQs: ECR

What are ECR payments?

ECR payments are not direct payments but rather credits applied to an account to offset monthly service charges. They are calculated based on the average balance in the account and the agreed-upon ECR rate.

How does the earnings credit rate work?

The earnings credit rate works by providing credits based on the average balance maintained in a commercial account. These credits can then be used to offset or reduce the service charges associated with the account, effectively lowering banking costs for businesses.

What is the earnings credit rating?

The Earnings Credit Rate (ECR) isn't quite a rating, but rather a percentage rate used by banks to calculate a kind of discount on your business banking fees.

What is an example of earnings credit rate?

An example of an earnings credit rate in action would be a business account with an average monthly balance of $50,000 and an ECR of 0.5% annually. If the bank charges $200 in monthly fees, the earnings credit for that month would be approximately $20.83, reducing the fees payable to $179.17.

What is the average ECR rate?

The average ECR rate can vary significantly between banks and is influenced by factors such as market interest rates and the bank's policies. Generally, ECR rates range from 0.10% to 1.00% per year, depending on the bank and the economic conditions.

What is the ECR ratio?

The ECR ratio refers to the ratio of the earnings credit given to the fees generated by the account. It is a measure of how effectively the earnings credit offsets the account's monthly fees.

Unlock your potential with Pro Membership

Streamline your processes, expand your knowledge, and elevate your finance career to unprecedented heights with our Pro Membership.

Join a community of driven professionals who share your passion for excellence, and gain access to a wealth of resources, including:

- Cutting-edge templates and tools to optimize your daily workflows

- Trustworthy, up-to-date insights from industry experts

- A supportive network of peers to share ideas and best practices

Don't settle for anything less than the best. Invest in your future today and experience the transformative power of Pro Membership.