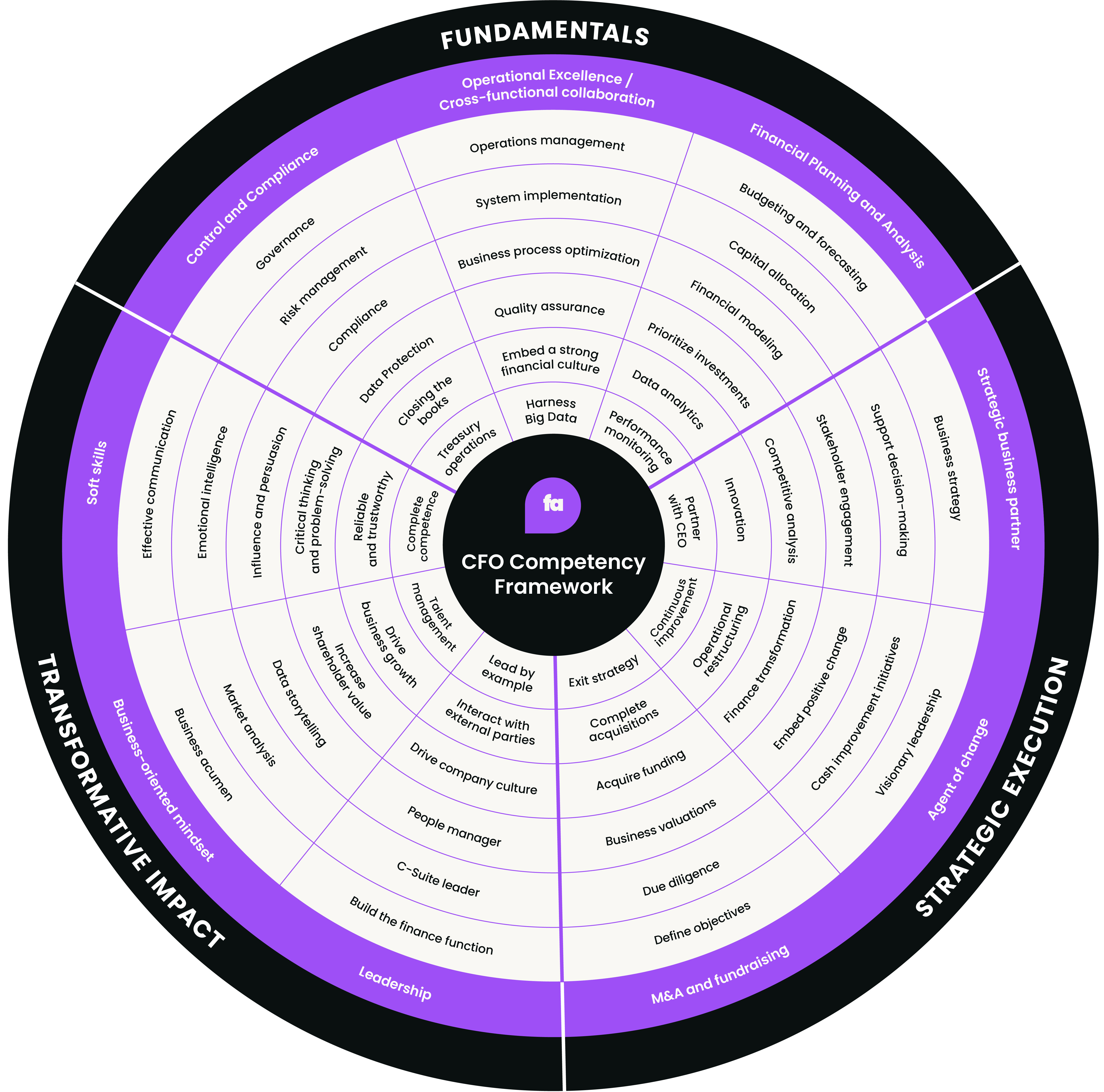

The Chief Financial Officer Competency Framework

Our CFO Competency Framework is more than just an assessment tool - it's your personalized roadmap to career success.

There are a lot of moving parts to the CFO role and it can often feel impossible to master each one. This is why we’ve curated a comprehensive collection of resources that'll help you gain a deeper understanding of each area of your role and close any skill gaps with laser focus.

Each level of our framework is dedicated to mastering a specific facet of the CFO role from fundamentals through strategic execution and transformative impact.

Part 1: Fundamentals

A strong foundation in core areas like financial control, compliance, FP&A, and operations is essential for CFOs. Mastering these fundamentals will help you to make informed decisions, ensure financial health, and ultimately guide the company towards long-term success.

Control and compliance

Don't underestimate the power of control and compliance. As CFO, you can leverage them to manage risks, build trust with key stakeholders and guide the company towards financial stability and sustainable growth.

Operational excellence

By driving operational efficiencies and fostering cross-functional collaboration, the CFO can optimize business processes, align resources, and deliver insights that fuel enterprise-wide decision-making and growth strategies.

Financial planning and analysis

Sharp financial planning and analysis (FP&A) helps the CFO to make data-driven forecasts, create efficient budgets, and monitor performance in real-time. This translates into strategic decisions, optimized resource allocation, and measurable progress towards achieving organizational goals.

Part 2: Strategic Execution

CFOs must master strategic execution to create value. This includes providing financial insights for shaping strategies, driving change initiatives, and identifying growth opportunities through deals like mergers and acquisitions. Excelling in these areas helps CFOs to become true business partners and agents of change.

Strategic business partner

A CFO should function as a trusted strategic advisor, delivering essential financial insights that are vital to shaping business strategies and creating value for the company. They play a pivotal role in guiding the company's financial direction and ensuring that strategic decisions are informed by robust financial data.

Change agent

Mastering change management enables CFOs to navigate disruptions, drive transformation initiatives, and foster a culture of continuous improvement.

M&A and fundraising

A CFO's skills in mergers, acquisitions, and fundraising come into play when spotting opportunities for growth, closing deals, and getting the funds needed for strategic expansion. This know-how is crucial because it helps the company not just grow, but do so smartly and sustainably.

Part 3: Transformative impact

Transformative impact requires CFOs to be exceptional leaders inspiring teams and aligning stakeholders with a common vision.

Leadership

Strong leadership is key to motivating teams, getting everyone on the same page, and guiding the company toward long-term success. When CFOs lead effectively, they not only inspire their teams to aim high but also help align different stakeholders with the company's goals.

Business-oriented mindset

By seeing how different parts of the business interconnect, a CFO can offer valuable insights and strategies that help improve efficiency and boost results across the board. This broader perspective allows them to contribute significantly to the overall performance of the company.

Soft skills

Soft skills are just as crucial for a CFO as their financial expertise. Honing interpersonal, communication, and influencing abilities allows CFOs to build effective relationships, collaborate across functions, and drive organizational alignment.

Want access to even more resources?

Our CFO Competency Framework is your baseline roadmap to career success. If you find any gaps you'd like to fill, Pro+ membership offers exclusive resources to enhance your progress.

Advance through each level, from foundational principles to strategic execution, with tailored content that ensures impactful leadership. Tap into this L&D subscription today and take the next step on your journey to becoming a CFO.