Financial planning and analysis (FP&A) is the 13th fastest-growing role in the United States and plays a critical part in driving profitable growth.

Data analysis, budgeting, and forecasting are all top priorities for anyone in this role. The central objective, though, is using financial expertise to drive profitable business decisions.

To do this properly, you must develop some key FP&A skills.

So… what are they?

Good question.

There are quite a lot of them, and most can be broadly categorized into two main areas: hard skills and soft skills. Below, we’ve curated a list of the top 10 FP&A skills in each category that are required for success.

10 hard FP&A skills

These hard skills are the technical competencies and knowledge needed to analyze data, build financial models, and translate complex information into actionable insights.

1. Attention to detail

Reading data and spotting trends or patterns in that data requires some serious attention to detail.

A single error can lead to chaos and inaccuracy in models, budgets and forecasts, which can negatively impact business decisions. That's why attention to detail is so important. It ensures:

- Reliable insights - Accurate data leads to sound financial analysis.

- Credibility - Consistent accuracy builds trust with stakeholders.

- Proactive problem-solving - Catching data issues early prevent bigger problems later.

2. Data storytelling

80% of CFOs agree that data storytelling is an essential skill for modern finance professionals. And, it’s not just about presenting data, you have to weave financial data into a compelling narrative with visuals like financial graphs and charts.

Remember - not everyone in the company understands finance the way you do. So, a huge part of your role as an FP&A professional is to be a translator. You bridge the gap between complex financial data and actionable insights for a wider audience - this is where data storytelling comes in.

3. Converting data into insights

Converting data into insights is a critical skill in FP&A because it transforms raw numbers into actionable intelligence.

When people are faced with data alone, it can be overwhelming and extremely difficult to interpret. But, when FP&A can analyze and contextualize that data, they reveal patterns, trends, and potential anomalies that might have been missed.

Practice summarizing complex data into key takeaways and actionable recommendations. This approach will help you consistently translate raw data into meaningful insights.

4. Tech-savvy

The most successful FP&A professionals tend to be very tech-savvy. This is an important FP&A skill because financial analysis relies on advanced software and tools to manage, analyze, and visualize data efficiently.

Proficiency with tools like Excel, for example, allows for complex data modeling, advanced financial forecasting, and intricate data manipulation.

It’s also worth getting familiar with enterprise resource planning (ERP) systems and specialized FP&A software to help:

- Streamline processes

- Automate routine tasks

- Ensure accuracy in financial reporting

You should also try to keep up with cutting-edge tech associated with AI and machine learning. For example, GPT-4o (the latest version of OpenAI’s ChatGPT) is already changing how finance professionals work since it can create charts and graphs with your data and even analyze data sets.

New technologies can be intimidating at first, but if you take the time to learn how to use them properly, they can benefit both you and your organization.

5. Financial modeling and forecasting

If you want to succeed in FP&A, you need to be proficient in not only financial modeling, but also forecasting, scenario planning, and sensitivity analysis.

Companies rely on the FP&A team to build accurate scenarios and forecasts that help them make smarter decisions.

With a solid model, you can see how different situations, like a sales slump or an unexpected expense, might play out. This lets you create contingency plans and adapt quickly to changing circumstances.

Need help identifying key drivers in your company? Check out our ‘How to create a driver-based planning framework’ guide for tips:

6. Data analysis

By effectively analyzing data, you can identify trends, uncover patterns, and make informed decisions. This FP&A skill is crucial for creating accurate forecasts, budgeting, and strategic planning - all of which are vital for steering the company toward its financial goals.

Here are some quick-fire tips to help you get better at data analysis:

- Use visualization tools - Excel, Power BI, and Tableau are excellent for creating visual representations of your data, which might make it easier for you to spot patterns.

- Look for outliers - Outliers can indicate inconsistencies or errors in data. Use scatter plots to visualize and identify data points that fall significantly outside the normal range.

- Trend analysis - Perform moving average calculations to smooth out short-term fluctuations and highlight longer-term trends.

- Segmentation - Break down data into different segments (e.g., by product, region, or customer demographic) to identify trends and inconsistencies within specific areas. This can reveal insights that might be hidden in aggregated data.

- Benchmarking - Compare your data against industry benchmarks or historical performance to identify anomalies and trends.

7. Budgeting

A well-crafted budget sets financial targets for every department, acting as a roadmap for the entire company. It helps everyone understand where the money's coming from and where it's going.

As the year progresses, FP&A compares actual performance against the budget. This lets them identify areas that are exceeding expectations or falling short. This tracking allows for course correction and ensures the company stays on track to achieve its goals.

You might find it helpful to practice zero-based budgeting (ZBB) to help build your budgeting skills. This method starts the budgeting process from a "zero base," analyzing every expense for each new period as if it were brand new, rather than simply adjusting previous budgets.

8. Capital planning

Capital planning helps ensure that capital expenditures are aligned with the company's overall strategy, growth plans, and financial targets.

By developing strong capital planning skills, FP&A professionals can support the creation of long-term shareholder value.

However, this is a skill that you might not develop right away. In fact, you might find that the best way to get better at capital planning is on the job.

By working closely with experienced FP&A professionals and participating in capital planning processes within the company, you can gain a lot of hands-on experience and practical knowledge.

9. Reporting

One of the most important FP&A skills to help you thrive in your role is reporting skills. This is because FP&A professionals are often responsible for collecting, analyzing, and presenting financial data clearly and insightfully. This is key because accurate reports mean smarter decisions, happy regulators, and trust from everyone (including investors and lenders).

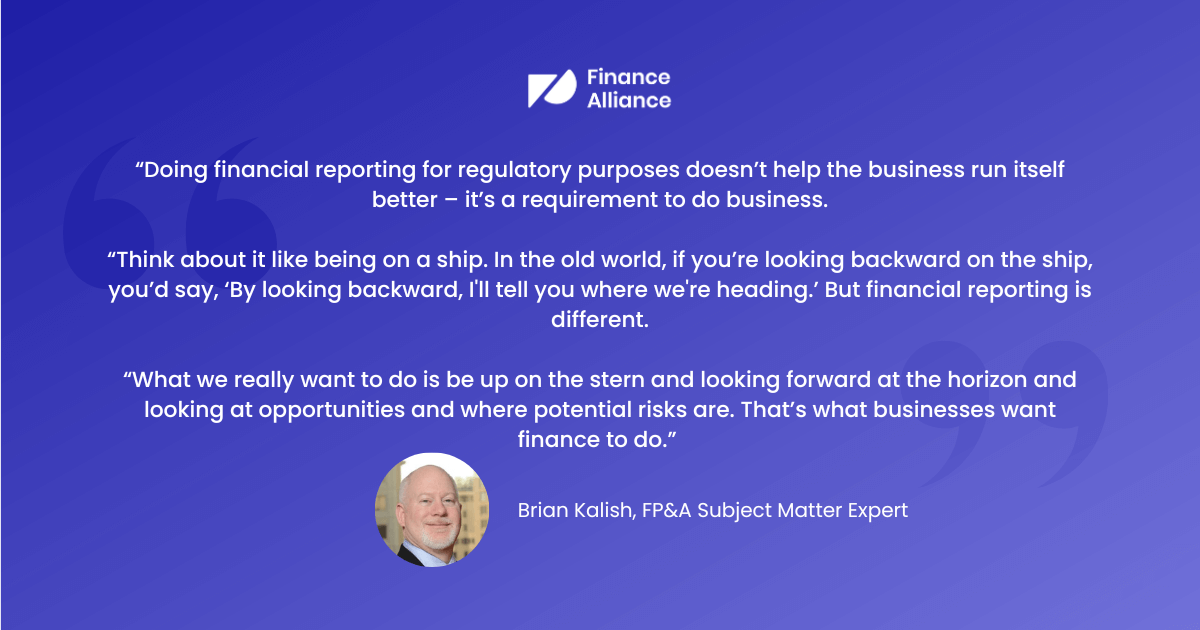

Below is a quote from an episode of the Two Cents: Finance Talk podcast, where Brian Kalish shared an interesting analogy for financial reporting, and how modern FP&A professionals should approach it:

10. Variance analysis

Variance analysis is the process of comparing actual financial performance to budgeted or planned figures to identify and understand the reasons for any differences.

When you dive deep into why the actual numbers ended up different than what was planned, that's where you uncover truly valuable insights.

Was it higher costs that threw things off? Weaker sales than projected?

Understanding the root causes behind the variances is what separates great FP&A analysts from the rest.

Fast-track your FP&A skills with Pro+

With the Finance Alliance Pro+ membership, you’ll possess all the tools and knowledge needed to overcome any challenge and excel in your financial career - including exclusive soft skills workshops led by finance experts. You'll also enjoy:

- Financial templates & frameworks

- 100+ hours of OnDemand insights

- Free in-person Summit ticket annually

- Mentor program

- Access all areas to virtual events

- Exclusive articles

... and more

Sharpen your FP&A skills and take your career to the next level.

10 soft skills for FP&A

These skills enhance interpersonal interactions and are essential for effectively navigating the workplace.

1. Ownership & accountability

Taking ownership and accountability for your work is one of the most underestimated FP&A skills. You need to stand behind your analysis and recommendations, be ready to defend them when you need to, and take accountability for them.

Doing this openly will help create a sense of trust and collaboration, breaking down those department silos that can slow things down. It also creates a safe space to take calculated risks and learn from mistakes, which ultimately leads to better results and a stronger FP&A function as a whole.

With true ownership and accountability, FP&A isn't just seen as a support function, but as leadership's eyes and ears into the company’s financials.

2. Business acumen

Do you understand how the business model(s) of your organization work? To do your job to the best of your ability, and to provide the most value possible, you must understand the various business models of the organization and how those models tie in with overall business strategies.

The best FP&A professionals understand how all the different parts of the business fit together as a whole. So, take time to familiarize yourself with each of the different departments within the organization and learn how they all work together. And don’t stop there, you should also ensure you’re always up to date with your industry, including competitors, latest news, and market trends.

Need some help building your business acumen skills?

Here are a few ways you can improve:

- Step out of your silo – too many FP&A teams are siloed away. You can often learn so much more about the business when you step out of your department and see how other parts of the business work.

- Pick the brains of department leaders – the more you understand about how these people work (and their goals, challenges, etc.) the better equipped you are to provide tailored financial support.

- Get data directly from source systems - don't just take the data you receive at face value. Trace operational metrics back to their origin to develop a deeper understanding - knowing which data is noise versus signal is huge.

3. Communication skills

Asking questions and listening objectively to others is a vital part of the FP&A role. Since you’re working with other people and often from different departments, polished communication skills are a must.

Learning how to communicate effectively will help you to get better at presenting ideas to board members and delivering relevant insights in a way that people without a background in finance can understand.

4. Collaboration

Collaboration is a massively important part of the role because you’ve got to work with others not just in the finance department, but across the organization.

Working effectively with others and being open to collaboration is key.

You must be willing to learn from all areas and departments within the business because their insights could prove critical to your ability to assess risk, create accurate forecasts, and help leadership make vital business decisions.

5. Business partnering

If you have your eyes set on bigger things (and roles), you might want to focus your efforts on developing FP&A skills that will help you become a strategic business partner to the company.

If you’re in FP&A, it’s safe to assume you have the insights and foresight to guide strategic decisions. But unless you can translate complex financial data into actionable insights, work alongside different departments to navigate challenges and seize opportunities – you’ll be stuck in the backseat.

6. Strategic thinking

The way your mind works has a greater impact on your success as an FP&A professional than you might think.

With finance transformation on the rise, there’s a good chance that many of the tedious and mundane tasks that take up your time will be automated. This is good news for finance professionals because it frees them from the burden of being tied to manual work and gives them more time to think critically and strategically.

Your ability to think strategically will serve you well as you’ll find it a lot easier to spot trends and come up with solutions to help the business mitigate risk, budget appropriately, increase cash flow, etc.

7. Project management

FP&A teams often manage a variety of tasks simultaneously, from budgeting and forecasting to ad-hoc analyses. As you can imagine, having good project management skills comes in handy for FP&A pros because it helps them stay organized, prioritize tasks, and meet deadlines.

To improve your project management skills in FP&A, you could start by breaking down large FP&A projects. This involves viewing large-scale FP&A initiatives, like budgeting or implementing a new financial system, as a series of smaller, manageable projects. This helps you to practice planning, resource allocation, and milestone tracking within the larger FP&A scope.

8. Problem solving

Did you know that 68% of financial analysts consider problem-solving the most crucial skill for a finance leader? It’s perhaps not a surprise considering problem-solving is one of the most useful FP&A skills to have.

Think about it - the finance data and reports themselves don't drive any value. It's the ability to analyze that information, identify issues and opportunities, and then develop strategies to course-correct or capitalize on them. That's where the real impact comes from.

The problems FP&A tackles range from short-term fires like cash crunches and supply/demand imbalances, all the way up to big-swing strategic plays like M&A, new market entries, and funding major growth initiatives.

Each situation requires creative problem-solving skills to stabilize issues, capitalize on opportunities, and ultimately drive better performance.

9. Leadership

Leadership is important for FP&A professionals because it helps you spearhead new financial initiatives (like budget planning), influence key decisions, and inspire other team members to work together.

If you want to develop your leadership skills, you could try to:

- Connect with experienced leaders within your company or industry to gain insights and advice on effective leadership practices.

- Volunteer for leadership roles or projects that require cross-functional collaboration and strategic planning to gain hands-on experience.

- Pursue leadership training programs, workshops, and courses to develop your leadership competencies and stay updated on best practices.

Don't just support from the sidelines - step up and take ownership of driving important initiatives across the finish line. When you deliver successful outcomes, it helps to build serious credibility in the process.

10. Adaptability

As an FP&A professional, you spend a lot of time forecasting, identifying possible scenarios, and deciding what action to take. However, you’ve also got to be highly adaptable.

This means you must adapt to the changing needs of the business as and when they occur.

Being proactive and recognizing that the company’s needs have evolved is a vital skill. It’ll not only help you to anticipate the evolving needs of the business, but it’ll also help you identify how you can better serve the company to bring as much value as possible.

FAQs:

What are FP&A skills?

FP&A skills include financial modeling, data analysis, forecasting, budgeting, strategic planning, and proficiency with financial software and tools. Strong communication, problem-solving, and presentation abilities are also useful skills to have.

What accounting knowledge is needed for FP&A?

FP&A professionals need a solid understanding of financial statements, general ledgers, cost accounting, and financial reporting. Plus, understanding accounting rules (GAAP or IFRS) is key for getting the numbers right and staying on the legal side of things.

What does it take to be a great FP&A analyst?

To be a great FP&A analyst, you need to develop strong analytical skills, attention to detail, and the ability to interpret complex data. Some other areas that can help you improve in your role is proficiency in financial software, excellent communication skills, and a strategic mindset.

What makes a great FP&A leader?

A great FP&A leader combines deep financial expertise with strong leadership skills. They are adept at strategic thinking, effective communication, and team management.

What role does emotional intelligence play in effective FP&A?

High emotional intelligence helps FP&A professionals build stronger partnerships, have more collaborative/persuasive conversations, navigate organizational politics adeptly, and lead change management successfully.

Why are negotiation skills useful for FP&A?

From securing budgets to working through trade-offs during planning cycles, negotiation capabilities allow FP&A to advocate for optimal solutions while maintaining stakeholder alignment.

What technology skills are becoming more vital for FP&A?

Expertise in data visualization/BI tools, programming/scripting for automation and advanced modeling, cloud FP&A solutions, big data techniques, AI/machine learning for smart forecasting.

Improve your skills with our FP&A Certified: Core course

Ready to take your FP&A journey to the next level?

Our FP&A Certified: Core course offers a comprehensive and practical approach to mastering these essential skills. Through a structured curriculum, real-world case studies, and expert instruction, you'll gain valuable experience and build a strong foundation for FP&A success.

This course is designed to empower you and help you grow in your career. It focuses on providing informative and engaging learning experiences to help you develop your skills naturally and confidently.

Follow us on LinkedIn

Follow us on LinkedIn